Pharmacy Inventory Management Software Solutions And Cabinets Market Size and Growths

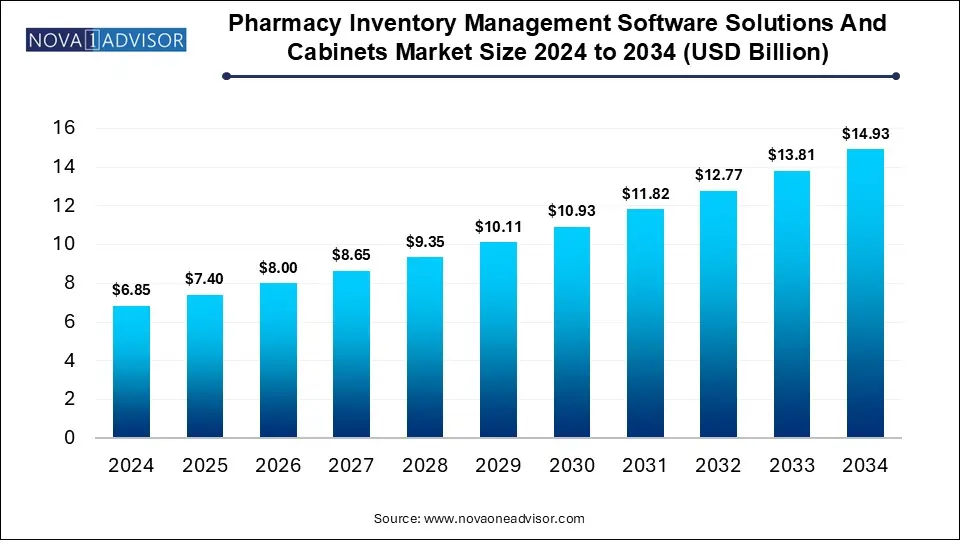

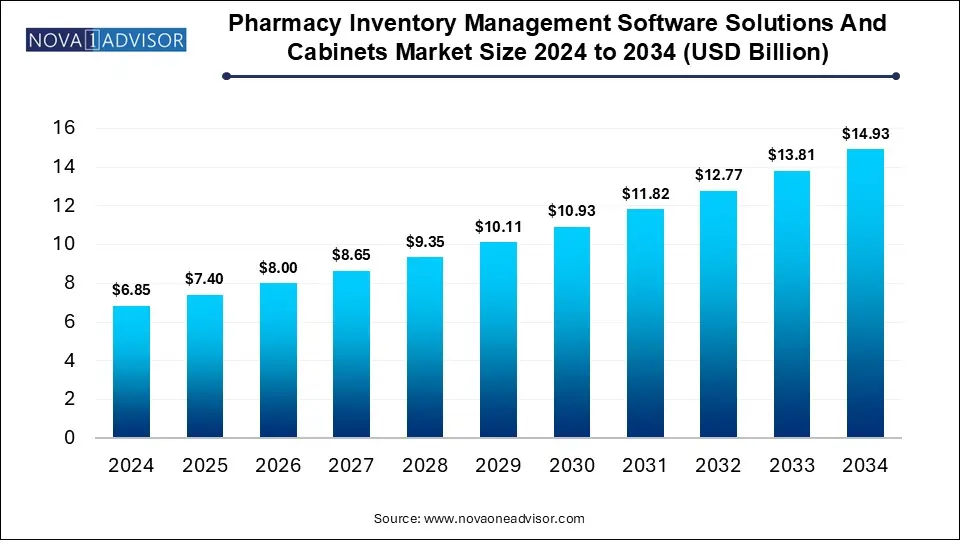

The Pharmacy inventory management software solutions and cabinets market size was exhibited at USD 6.85 billion in 2024 and is projected to hit around USD 14.93 billion by 2034, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

Key Takeaways:

-

In 2024, the cabinets/systems category led the market, accounting for a commanding 78% of the total share.

-

Decentralized operations emerged as the leading segment in 2024, capturing the largest portion of the market.

-

Independent pharmacies held the top position in the market in 2024, representing 41% of the overall share.

-

North America dominated the pharmacy inventory management software solutions and cabinets market in 2024, securing 54% of the total market share.

Market Overview

The Pharmacy Inventory Management Software Solutions and Cabinets Market is evolving rapidly as pharmacies, hospitals, and long-term care (LTC) facilities continue to modernize their inventory systems for improved accuracy, efficiency, and regulatory compliance. This market encompasses a wide range of digital solutions and automated storage systems designed to streamline pharmacy operations, reduce medication errors, and optimize supply chain logistics.

Growing medication complexity, increasing patient volumes, rising healthcare expenditure, and the need for stringent drug inventory control are propelling the demand for advanced inventory management systems. These systems integrate features like real-time tracking, expiration alerts, reordering automation, and analytics dashboards to improve overall operational efficiency.

The convergence of smart automation, artificial intelligence (AI), and Internet of Things (IoT) technologies within inventory management tools is reshaping how pharmacies operate. Cabinets are now equipped with biometric access, weight sensors, RFID tagging, and cloud connectivity. Meanwhile, software solutions are becoming more intelligent—integrating with EHRs (electronic health records), pharmacy management platforms, and centralized supply networks.

The adoption is particularly prominent in hospital and retail chain pharmacies, where drug volume, complexity, and patient safety standards are highest. Independent pharmacies and long-term care settings are also increasingly integrating these systems to reduce wastage and human error.

According to industry estimates, the market is poised for significant growth from 2025 to 2034, driven by a shift towards digital healthcare infrastructure and the global emphasis on automation in healthcare logistics.

Major Trends in the Market

-

Rising adoption of RFID-enabled smart cabinets for real-time medication tracking

-

Integration of AI and predictive analytics in software solutions for demand forecasting

-

Increased shift towards cloud-based inventory systems with mobile access

-

Growing emphasis on regulatory compliance with automated documentation features

-

Expansion of pharmacy automation in long-term care facilities

-

Software customization for specialty drugs and compounding pharmacies

-

Partnerships between tech providers and hospital networks to build integrated ecosystems

-

Introduction of robotic dispensing cabinets in high-volume hospital pharmacies

Report Scope of Pharmacy Inventory Management Software Solutions And Cabinets Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.4 Billion |

| Market Size by 2034 |

USD 14.93 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.1% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Mode of Operations, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

ARxIUM; BD; Clanwilliam IRL; Datascan, DCS INFOWAY; Epicor Software Corporation; GlobeMed Ltd.; Health Business Systems Inc.; JVM Co., Ltd.; LIBERTY SOFTWARE; Logic ERP Solutions Pvt Ltd.; McKesson Corporation; Omnicell Inc.; Oracle; Supplylogix LLC; Swisslog Healthcare |

Market Driver: Need for Operational Efficiency and Error Reduction

The primary driver accelerating the pharmacy inventory management software solutions and cabinets market is the urgent need for operational efficiency and medication error reduction in pharmacy settings. In high-volume environments such as hospital and chain pharmacies, manual tracking of drug stock often leads to inaccuracies, expired medication usage, and inventory mismatch, jeopardizing patient safety and incurring financial losses.

Advanced inventory management solutions mitigate these risks by providing real-time visibility into drug usage patterns, automating reordering processes, and offering predictive insights. For instance, when a hospital pharmacy uses RFID-based cabinets integrated with AI-driven inventory software, it can reduce stockouts by up to 80% and medication errors by 90%, while optimizing workforce utilization.

Moreover, regulatory agencies like the FDA and WHO mandate strict drug storage and tracking standards. Automation not only ensures compliance with such guidelines but also simplifies audit trails and reporting. As a result, healthcare providers are prioritizing investments in pharmacy inventory solutions to meet safety benchmarks and enhance care quality.

Market Restraint: High Initial Cost and Technical Complexity

Despite strong growth prospects, the high initial investment and technical complexity involved in deploying these systems serve as a key restraint. Implementing a pharmacy inventory management infrastructure requires substantial capital outlay for hardware (such as smart cabinets and dispensing machines), software licensing, integration with existing hospital/pharmacy information systems, and staff training.

Smaller or rural healthcare facilities often struggle with limited budgets and IT expertise, making adoption of sophisticated solutions more challenging. In certain cases, especially among independent pharmacies, cost-benefit analysis may not favor the immediate shift to digital platforms. Additionally, the learning curve associated with transitioning from legacy systems to digital platforms can disrupt daily operations if not managed properly.

For instance, in smaller long-term care facilities, a decentralized inventory approach using manual logs still prevails due to budgetary and resource constraints, despite known inefficiencies. This underscores the need for scalable, modular solutions that can cater to both high- and low-resource settings.

Market Opportunity: Expansion in Emerging Markets

An exciting opportunity lies in the expansion of pharmacy inventory solutions across emerging markets, particularly in Asia Pacific and Latin America. These regions are witnessing rapid urbanization, healthcare infrastructure development, and digital transformation initiatives, creating fertile ground for modern pharmacy technologies.

Governments in countries like India, Brazil, and Thailand are investing in hospital digitization and universal health coverage. This fuels the need for inventory systems that can handle large-scale medication distribution, ensure traceability, and prevent wastage in public sector facilities.

For example, India’s National Digital Health Mission (NDHM) and initiatives like Ayushman Bharat are promoting digital tools in healthcare management. Smart cabinets and software solutions tailored to these frameworks can bridge inventory gaps in government-run pharmacies. Companies that offer affordable, language-localized, and mobile-friendly inventory management systems stand to gain significant traction in these markets.

Segmental Analysis

Type Outlook

Software Solutions dominated the market in 2024 and continue to lead due to their scalability and integration flexibility.

Software solutions accounted for the largest share in the market by revenue, given their pivotal role in streamlining pharmacy workflows, managing inventory lifecycles, and reducing manual errors. These platforms offer dynamic modules for inventory tracking, demand forecasting, real-time alerts, and even integration with billing and EHR platforms. Cloud-based platforms further offer scalability and remote access, which is particularly valuable in multi-site pharmacy chains. For example, software systems like McKesson’s EnterpriseRx and BD’s Pyxis ES platform offer comprehensive inventory control across thousands of pharmacy locations.

Moreover, the ability to customize software solutions to suit different pharmacy formats retail, hospital, compounding, and LTC makes them indispensable. Vendors are increasingly adopting subscription-based SaaS models, making them more accessible to smaller players without massive upfront costs. This is further encouraging wide-scale adoption.

Cabinets/Systems, however, are the fastest growing segment due to rising automation trends and demand for secure medication storage.

Cabinets equipped with smart sensors, biometric access, and cloud sync are witnessing a surge in demand, especially in high-volume hospital and long-term care settings. These systems help reduce pilferage, ensure temperature-sensitive storage, and automate dispensing. They are also instrumental in regulatory audits, as each transaction is recorded digitally. Solutions like Omnicell’s XT cabinets and BD’s MedStation are increasingly being deployed across hospital networks to manage narcotics and high-risk drugs. The trend is being catalyzed by a global emphasis on drug safety and traceability.

Mode of Operations

Centralized mode of operations dominated the market owing to its efficiency in large-scale facilities.

Centralized inventory management systems are primarily used in hospital settings or pharmacy chains where a unified control over stock levels across multiple departments is necessary. These systems reduce medication redundancy, optimize procurement costs, and provide consistent quality assurance. Central hubs can monitor demand across satellite units and automate replenishment, minimizing downtime. Health systems in countries like the U.S. and Germany prefer centralized setups to ensure consistency in care and logistics.

Decentralized systems are growing rapidly, driven by flexibility and suitability for point-of-care settings.

In contrast, decentralized systems are gaining momentum in outpatient clinics, long-term care centers, and rural healthcare setups. These models offer flexibility, faster medication access, and autonomy to smaller units. For instance, LTC pharmacies using decentralized smart cabinets can immediately dispense medicines without waiting for centralized approvals. This not only enhances patient experience but also reduces administrative burden. As healthcare moves toward more localized and patient-centric models, the demand for decentralized inventory tools is expected to grow.

End-use Outlook

Hospital Pharmacies dominated the market segment in 2024 and are expected to retain leadership due to high medication throughput.

Hospitals require robust inventory systems to manage a large volume of medications, ensure continuous supply, and comply with regulatory mandates. Smart inventory solutions reduce human error, expedite emergency dispensing, and provide audit-ready data logs. Many hospitals now integrate their pharmacy systems with EHRs to create a seamless workflow from prescription to administration. These integrations are vital for multi-specialty hospitals that manage complex drug regimens. For example, hospitals like Mayo Clinic and Cleveland Clinic have invested heavily in automated dispensing cabinets and real-time inventory software to ensure seamless care delivery.

LTC facilities are emerging as the fastest growing end-use segment due to increasing geriatric population and chronic disease management.

Long-term care settings are becoming critical to healthcare systems globally due to aging demographics. These facilities need efficient medication management to reduce administration errors and maintain compliance with geriatric care standards. Smart cabinets and tailored software solutions are helping LTC centers monitor medication cycles, track controlled substances, and align with care plans. Vendors are now offering LTC-specific modules in their inventory platforms, driving adoption in this previously underserved segment.

Regional Analysis

North America dominated the global market in 2024, thanks to advanced healthcare infrastructure and high adoption of automation technologies.

The U.S. leads in terms of pharmacy automation with widespread deployment of systems like Omnicell XT and BD Pyxis. High regulatory standards, rising labor costs, and increasing focus on operational efficiency have compelled hospitals and retail pharmacy chains to invest in smart inventory solutions. Government policies like the HITECH Act and Medicare reforms also promote digital infrastructure, including inventory systems. Additionally, the presence of major players such as McKesson, Omnicell, and BD boosts innovation and market penetration.

Asia Pacific is the fastest growing region, propelled by expanding healthcare infrastructure and digital health initiatives.

Countries like India, China, and Thailand are experiencing healthcare digitization at an unprecedented pace. Government initiatives to modernize public hospitals, increasing pharmaceutical demand, and rising middle-class healthcare spending are fueling the market. Additionally, the demand for low-cost, scalable inventory solutions has led to innovations tailored for resource-constrained settings. Local startups are also entering the space with mobile-first, AI-integrated solutions that cater to diverse pharmacy setups.

Recent Developments

-

March 2025: BD (Becton, Dickinson and Company) announced an update to its Pyxis ES System, enabling integration with third-party medication tracking platforms for improved interoperability.

-

January 2025: Omnicell partnered with Vizient to provide automated inventory solutions across a wider network of U.S. hospitals, enhancing visibility and reducing medication waste.

-

December 2024: McKesson launched “One Pharmacy Hub,” a software enhancement for its existing EnterpriseRx platform, focusing on real-time analytics and multi-site inventory management.

-

November 2024: Swisslog Healthcare unveiled its next-gen medication management cabinet series with AI-enabled inventory forecasting at the American Society of Health-System Pharmacists (ASHP) conference.

Some of The Prominent Players in The Pharmacy inventory management software solutions and cabinets market Include:

- ARxIUM

- BD

- Clanwilliam IRL

- Datascan

- DCS INFOWAY

- Epicor Software Corporation

- GlobeMed Ltd.

- Health Business Systems Inc.

- JVM Co., Ltd.

- LIBERTY SOFTWARE

- Logic ERP Solutions Pvt Ltd.

- McKesson Corporation

- Omnicell Inc.

- Oracle

- Supplylogix LLC

- Swisslog Healthcare

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Operating room equipment market

By Type

- Cabinets/Systems

- Software Solutions

By Mode Of Operations

- Centralized

- Decentralized

By End-use

- Independent Pharmacies

- Hospital Pharmacies

- LTC

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)