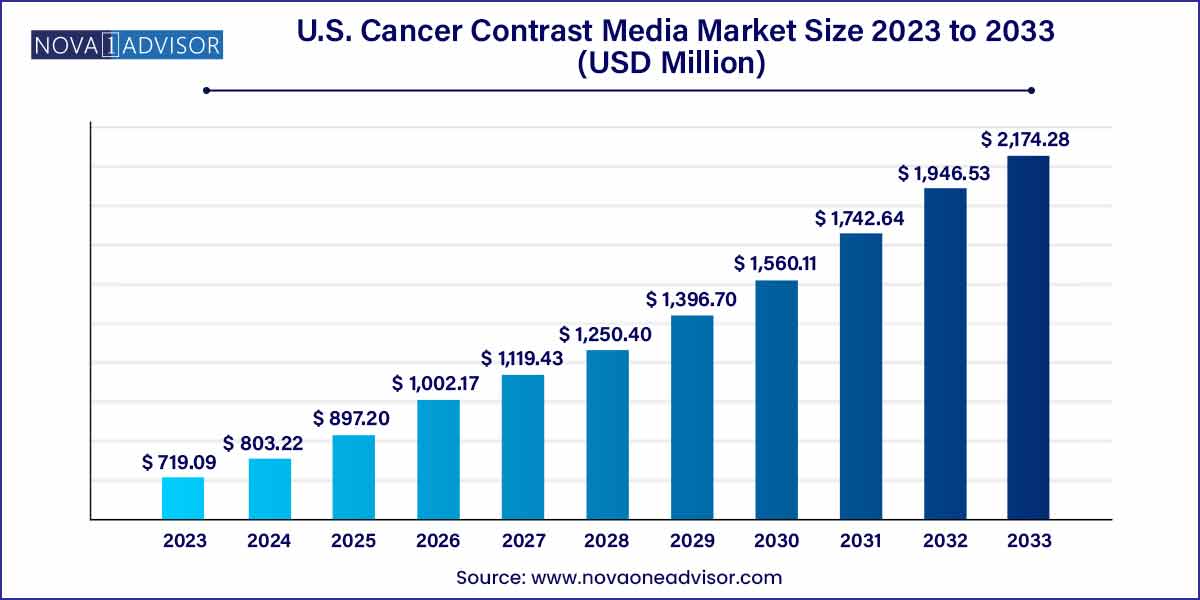

The U.S. cancer contrast media market size was estimated at USD 719.09 million in 2023 and is expected to surpass around USD 2,174.28 million by 2033 and poised to grow at a compound annual growth rate (CAGR) of 11.7% during the forecast period 2024 to 2033.

Key Takeaways:

- In 2023, the iodinated contrast media segment dominated the U.S. cancer contrast media with the market share of 40%.

- The radioactive agents segment is expected to grow at a highest CAGR over the forecast period.

- The nuclear imaging segment held the largest share in the market in 2023 and is also expected to grow at the fastest CAGR over the forecast period.

- The others segment held the largest share in the U market in 2023.

- The lung cancer segment is expected to grow at the fastest CAGR over the forecast period.

The U.S. Cancer Contrast Media Market plays a crucial role in the diagnostic landscape, providing healthcare professionals with essential tools for accurate imaging and detection of cancerous conditions. This overview aims to delve into the key facets of this market, encompassing its current state, growth factors, challenges, and future prospects.

The growth of the U.S. Cancer Contrast Media Market is underpinned by several key factors. Firstly, technological advancements in diagnostic imaging have significantly enhanced the capabilities of contrast media, enabling more precise and detailed visualization of cancerous conditions. This technological evolution contributes to the market's expansion as healthcare providers increasingly adopt state-of-the-art imaging modalities. Additionally, the rising incidence of cancer cases in the U.S. amplifies the demand for effective diagnostic tools, positioning contrast media as a critical component in the early and accurate detection of tumors. Furthermore, the growing awareness among both healthcare professionals and the general population regarding the importance of early cancer diagnosis propels the market forward. As a result, the convergence of advanced technology, increasing cancer prevalence, and a heightened focus on early detection collectively drive the robust growth of the U.S. Cancer Contrast Media Market

| Report Attribute |

Details |

| Market Size in 2024 |

USD 803.22 Million |

| Market Size by 2033 |

USD 2,174.28 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 11.7% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, Modality, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Bayer AG; Bracco; Guerbet; Trivitron Healthcare; Lantheus; Cardinal Health; Telix Pharmaceuticals Limited; GE HealthCare; Nano Therapeutics Pvt. Ltd.; IMAX Diagnostic Imaging |

Drivers

- Technological Advancements in Imaging Modalities: The continuous evolution and improvement in diagnostic imaging technologies, such as computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound, serve as a primary driver for the U.S. Cancer Contrast Media Market. Technological innovations enhance the sensitivity and specificity of these modalities, making them more effective tools for detecting and characterizing cancerous lesions.

- Rising Incidence of Cancer Cases: The increasing prevalence of cancer in the U.S. is a significant driver for the growth of the contrast media market. With a higher number of individuals being diagnosed with various forms of cancer, there is a corresponding surge in the demand for accurate and efficient diagnostic tools. Contrast media play a crucial role in enhancing the visibility of tumors during imaging, aiding in early and precise detection.

Restraints

- Potential Adverse Reactions and Safety Concerns: Despite advancements in contrast media formulations, concerns regarding potential adverse reactions and safety issues remain a restraint. While adverse events are relatively rare, the perception of risk can impact patient and clinician confidence. Manufacturers must address safety concerns through rigorous testing, education, and communication to mitigate potential restraints on market acceptance.

- Dependency on Imaging Equipment Manufacturers: The U.S. Cancer Contrast Media Market is dependent on the integration of contrast agents with imaging equipment. Any slowdown in the adoption or upgrading of imaging technologies, such as CT or MRI machines, can directly impact the demand for contrast media. Market participants face the challenge of aligning their product development strategies with the timelines and trends in the broader imaging equipment industry.

Opportunities

- Development of Novel Contrast Agents: The U.S. Cancer Contrast Media Market presents a ripe opportunity for the development of novel contrast agents. Investing in research and development to create innovative formulations with improved efficacy and safety profiles can give companies a competitive edge. Novel agents catering to specific imaging modalities or addressing unmet clinical needs have the potential to capture a significant market share.

- Integration of Artificial Intelligence (AI) in Imaging: The integration of artificial intelligence (AI) in diagnostic imaging represents a promising opportunity. AI technologies can enhance the accuracy and efficiency of cancer diagnosis, and contrast media play a crucial role in supporting these advanced algorithms. Developing contrast agents that synergize with AI-based diagnostic tools can revolutionize the precision and speed of cancer detection and characterization.

Challenges

- Concerns about Adverse Reactions and Safety: Despite advancements in contrast media formulations, concerns about potential adverse reactions and safety issues persist. These concerns can lead to hesitancy among both healthcare professionals and patients, impacting the widespread acceptance and use of contrast agents. Manufacturers must proactively address safety concerns through comprehensive testing, education, and communication efforts.

- Dependency on Imaging Equipment Manufacturers: The U.S. Cancer Contrast Media Market is closely tied to the adoption and upgrading of imaging technologies. Any slowdown or stagnation in the advancements of imaging equipment, such as CT or MRI machines, can directly impact the demand for contrast media. Market participants must navigate this challenge by closely aligning their strategies with the trends and developments in the broader imaging equipment industry.

Segments Insights

By Type Insights

Iodinated Contrast Media Dominated the Market

Among contrast agent types, iodinated contrast media dominate due to their widespread use in computed tomography (CT), one of the most common imaging modalities in cancer diagnostics. Iodine-based agents provide high contrast and fast visualization of blood vessels, tumors, and tissue structures, especially in lung, abdominal, and colorectal cancers.

These agents are integral to contrast-enhanced CT scans used in emergency diagnostics, radiation therapy planning, and surgical navigation. The development of low-osmolar and iso-osmolar iodinated agents has helped reduce side effects, increasing their clinical acceptance in high-volume hospital settings and outpatient imaging centers across the U.S.

.jpg)

Radioactive Agents are the Fastest-growing Segment

Radioactive agents, including PET and SPECT radiotracers, represent the fastest-growing segment, driven by the expanding role of molecular imaging in cancer diagnosis and staging. These agents help visualize functional and metabolic processes in tumors, offering deeper insights than anatomical scans.

For instance, fluorodeoxyglucose (FDG) is widely used in PET-CT scans to assess metabolic activity in cancer cells. Newer agents are under development targeting PSMA (prostate-specific membrane antigen), HER2, and other biomarkers for specific cancer types. The U.S. is leading in clinical trials and production of radiopharmaceuticals, contributing to the dynamic growth of this segment.

By Modality

CT Scans Remain the Leading Modality

CT scans are the dominant modality for contrast-enhanced cancer imaging in the U.S., widely used due to their speed, accessibility, and high-resolution anatomical detail. They are standard in evaluating lung, colorectal, abdominal, and brain tumors, as well as in follow-up imaging post-surgery or therapy.

With technological advancements such as dual-energy and low-dose CT, coupled with iodinated agents, clinicians can now perform highly detailed scans with reduced radiation and improved contrast resolution. These features, along with ease of integration into hospital workflows, keep CT at the forefront of imaging in oncology.

MRI Scans are the Fastest-growing Modality

MRI scans, using gadolinium-based contrast agents, are the fastest-growing modality due to their superior soft-tissue contrast, especially for cancers of the brain, breast, liver, and prostate. MRI is favored for its non-ionizing radiation, making it suitable for repeated imaging and sensitive tissues.

In breast cancer, contrast-enhanced MRI plays a vital role in screening high-risk populations and evaluating tumor margins. Innovations such as dynamic contrast-enhanced (DCE) MRI and diffusion-weighted imaging (DWI) are enhancing diagnostic accuracy, further increasing MRI's utility in oncology workflows.

By Application

Breast Cancer Applications Lead the Market

Breast cancer dominates the application segment, driven by its high incidence and the central role of imaging in screening, diagnosis, and monitoring. Contrast-enhanced mammography, MRI, and CT are used to detect lesions, stage disease, and evaluate treatment response.

In high-risk patients, contrast-enhanced MRI is often used as a supplemental screening tool to mammography. In surgical planning and assessing neoadjuvant chemotherapy response, imaging contrast plays a vital role in influencing clinical decisions. The ongoing push for early detection programs across the U.S. continues to expand demand in this segment.

Prostate Cancer is the Fastest-growing Application

Prostate cancer imaging using contrast agents is the fastest-growing, particularly with the rise of multiparametric MRI (mpMRI). Gadolinium-enhanced MRI provides crucial data on tumor localization, helping guide biopsy and assess tumor aggressiveness. Additionally, PSMA-targeted PET imaging is revolutionizing staging and recurrence detection in prostate cancer.

With increasing adoption of MRI in routine prostate cancer workflows and the introduction of targeted radioactive agents, this segment is expected to witness the highest growth in both diagnostic and theranostic applications.

Country-Level Analysis

The U.S. remains the largest and most mature market for cancer contrast media, with a strong network of diagnostic imaging centers, advanced hospitals, and dedicated oncology clinics. Federal initiatives such as Medicare coverage for screening scans, the Cancer Moonshot program, and investments in AI-assisted imaging are reinforcing diagnostic capabilities across the country.

Academic institutions and cancer research centers like MD Anderson, Dana-Farber, and Memorial Sloan Kettering are actively involved in clinical trials for novel contrast agents and molecular imaging protocols. The presence of key industry players and radiopharmaceutical manufacturers also ensures the availability of innovative, regulated contrast solutions in the domestic market.

Recent Developments

-

April 2025 – Bracco Imaging launched a new gadolinium-based MRI contrast agent with improved safety and enhanced tumor tissue contrast, approved by the FDA for use in breast and liver cancer imaging.

-

March 2025 – GE HealthCare announced a collaboration with a major cancer institute to co-develop AI-enabled contrast-enhanced CT protocols for early-stage lung cancer detection.

-

February 2025 – Bayer Radiology began Phase III clinical trials in the U.S. for a novel PSMA-targeted radioactive contrast agent aimed at enhancing prostate cancer diagnosis through PET imaging.

-

January 2025 – Lantheus Holdings expanded production capacity for fluorinated radiotracers at its Massachusetts facility to meet growing demand for PET-CT in oncology.

-

December 2024 – Guerbet Group introduced a dual-modality contrast agent compatible with both MRI and CT, under evaluation for breast and liver cancer staging in U.S. academic hospitals.

- Bayer AG

- Bracco

- Guerbet

- Lantheus

- Cardinal Health

- Telix Pharmaceuticals Limited

- GE HealthCare

- Nano Therapeutics Pvt. Ltd.

- IMAX Diagnostic Imaging

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Cancer Contrast Media market.

By Type

- Gadolinium-based Contrast Media

- Iodinated Contrast Media

- Radioactive Agents

- Others

By Modality

- Nuclear Imaging

- CT scans

- Mammography

- MRI scans

- Ultrasound

By Application

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Bladder Cancer

- Others

.jpg)