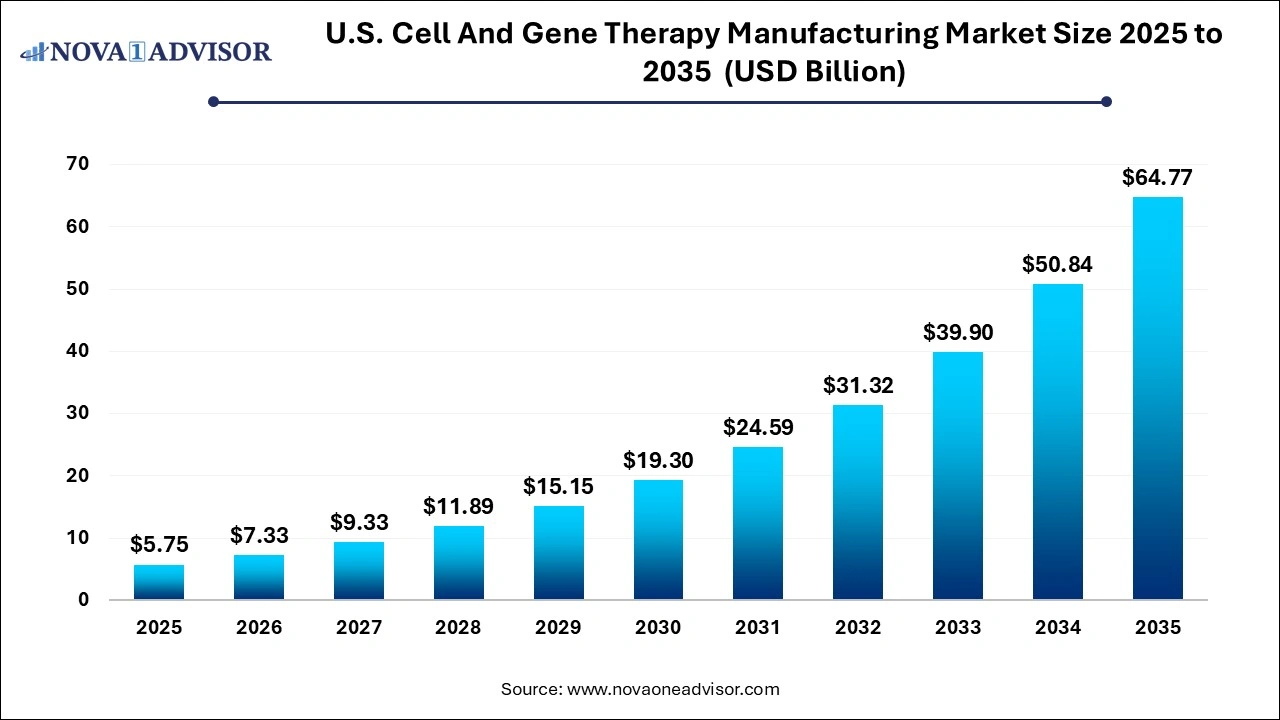

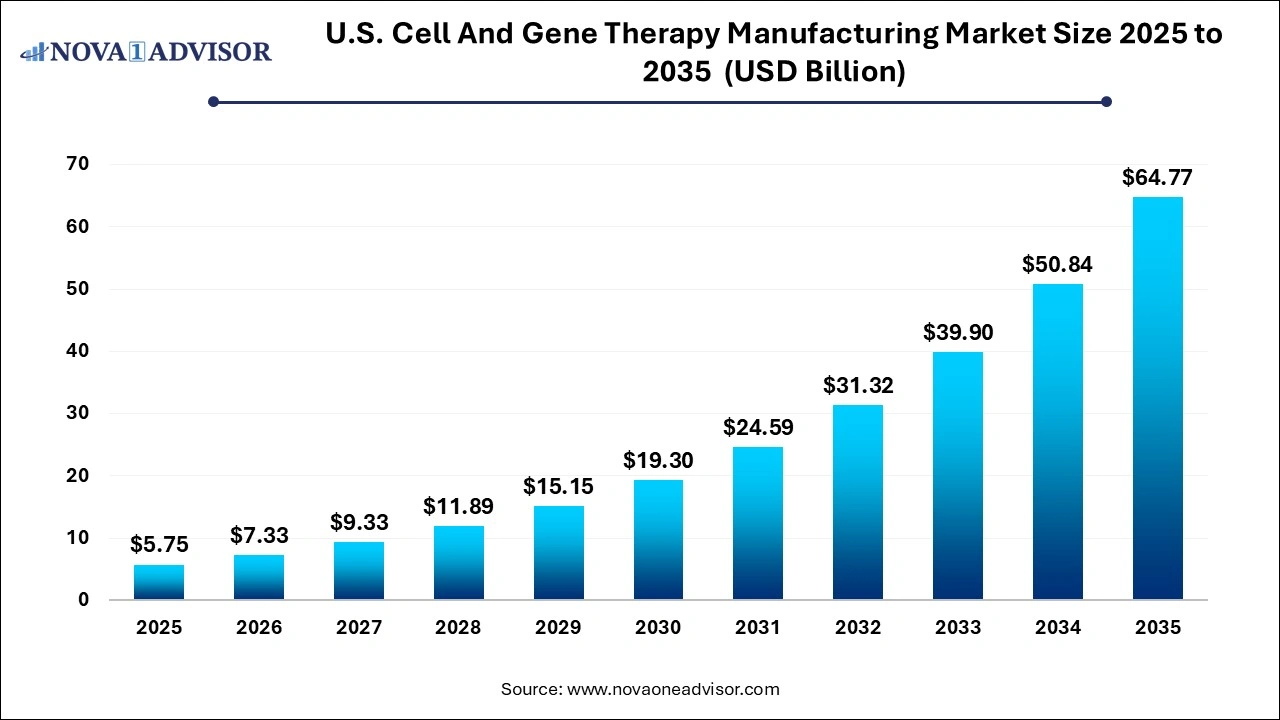

U.S. Cell And Gene Therapy Manufacturing Market Size and Growth 2026 to 2035

The U.S. cell and gene therapy manufacturing market size was estimated at USD 5.75 billion in 2025 and is expected to surpass around USD 64.77 billion by 2035 and poised to grow at a compound annual growth rate (CAGR) of 27.4% during the forecast period 2026 to 2035.

Key Takeaways:

- The cell therapy manufacturing segment dominated the market with a revenue share of 56.12% in 2025.

- The gene therapy segment is expected to grow significantly during the forecast period.

- Pre-commercial/ R&D scale manufacturing captured a significant revenue share of 72.4% in 2025.

- Commercial scale manufacturing segment is projected to garner the fastest CAGR during the forecast period.

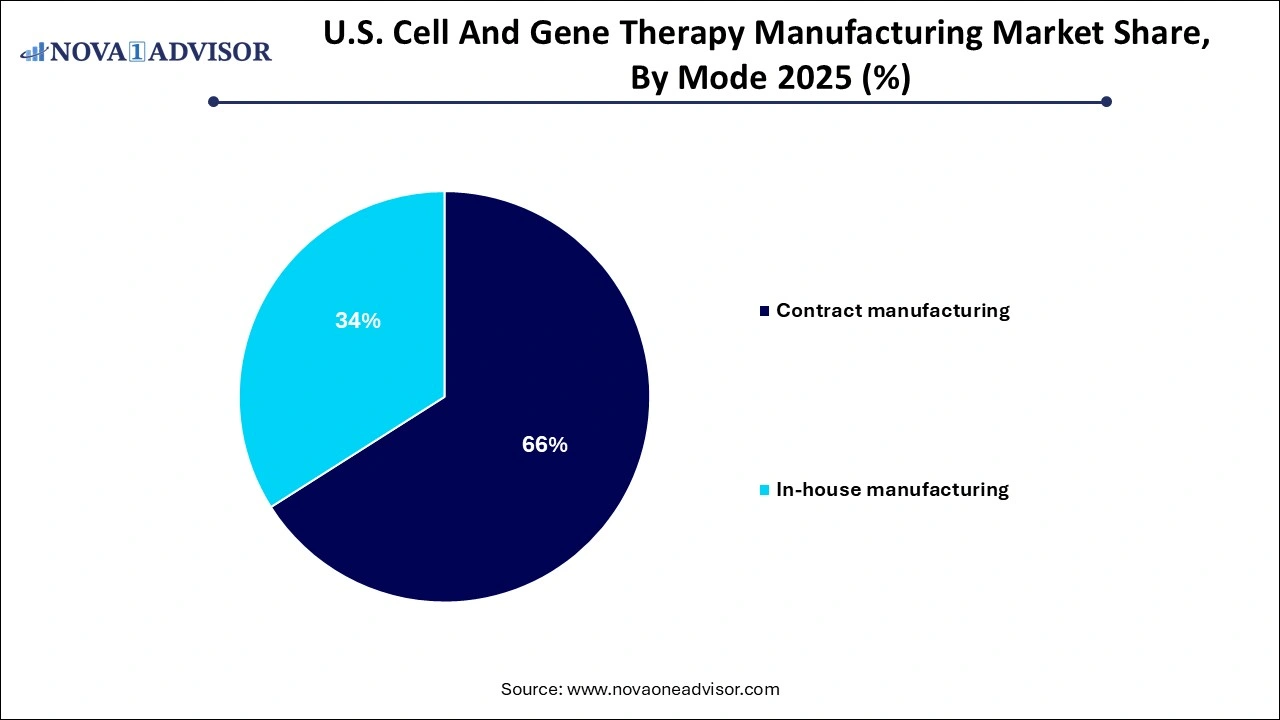

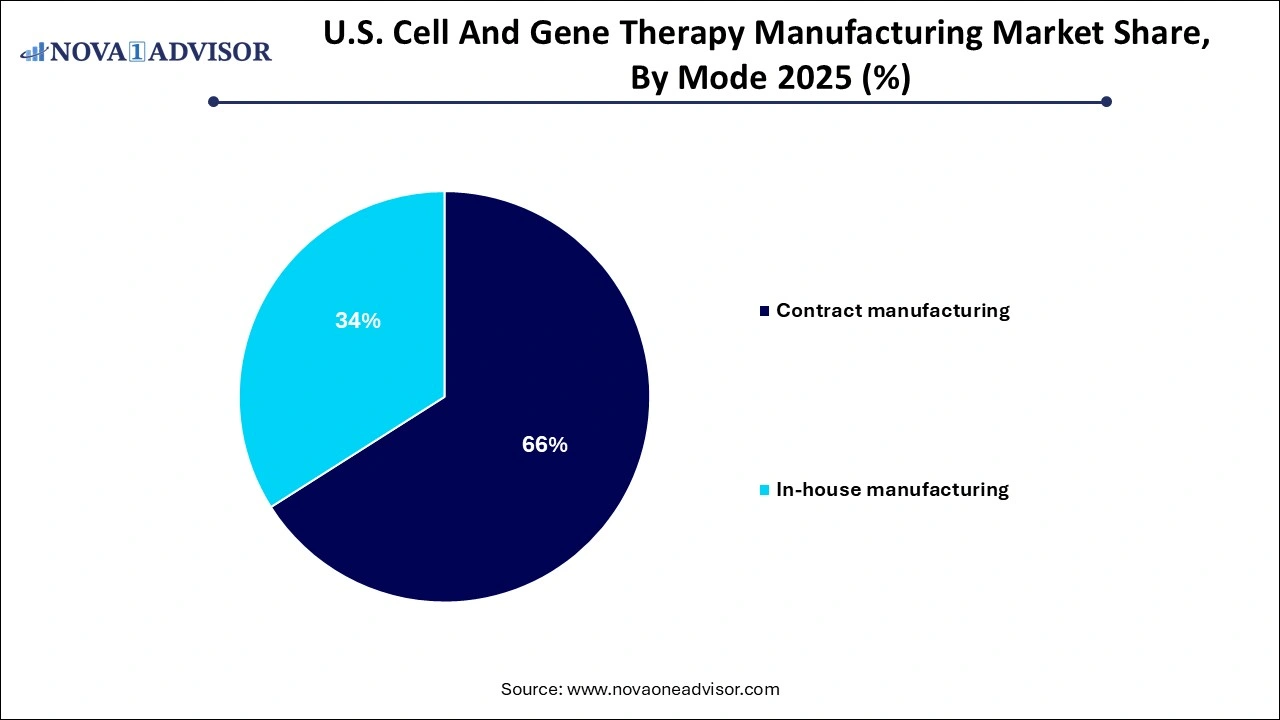

- The contract manufacturing segment held the highest revenue share of 66% in 2025.

- The in-house manufacturing segment is projected to exhibit the fastest CAGR during the forecast period.

- The process development segment had a significant revenue share of 16.9% in 2025.

- The vector production segment is estimated to register the fastest CAGR during the forecast period.

U.S. Cell And Gene Therapy Manufacturing Market Overview

The U.S. cell and gene therapy (CGT) manufacturing market stands at the frontier of modern medicine, symbolizing a paradigm shift from symptom-targeted treatment toward potentially curative interventions. Cell and gene therapies are redefining therapeutic approaches for previously untreatable diseases such as genetic disorders, certain cancers, and rare conditions. As a result, the manufacturing landscape in the United States is witnessing transformative growth and innovation, driven by robust clinical pipelines, favorable regulatory frameworks, and increasing investment from biopharmaceutical companies and venture capitalists.

The complexity of manufacturing CGTs arises from their biological nature. Unlike conventional pharmaceutical cell and gene therapies are developed from living organisms and tailored to individual patients or disease-specific genetic targets. This necessitates stringent manufacturing protocols, state-of-the-art infrastructure, and high precision in maintaining cell viability, vector integrity, and sterility throughout the process. From process development to vector production and fill-finish operations, each step demands specialized expertise and compliance with rigorous quality standards.

In the U.S., a strong ecosystem encompassing academic institutions, biotech start-ups, pharmaceutical giants, and contract development and manufacturing organizations (CDMOs) supports the growth of this sector. The Food and Drug Administration (FDA) has approved multiple CGT products in recent years—like Kymriah, Zolgensma, and Luxturna and continues to offer accelerated approval pathways that further propel the market. With over 2,000 ongoing clinical trials and a steady stream of investigational new drug (IND) applications, the U.S. CGT manufacturing market is positioned for substantial expansion in the coming decade.

Major Trends in the U.S. Cell And Gene Therapy Manufacturing Market

-

Integration of Digital Manufacturing Platforms: Companies are adopting digital twins, automation, and AI-driven process control systems to improve scalability and reproducibility in CGT manufacturing.

-

Rise in Outsourcing to CDMOs: Given the infrastructure costs and technical challenges, more companies are outsourcing manufacturing to specialized CDMOs with established capabilities.

-

Adoption of Modular and Flexible Facilities: To enhance manufacturing agility and reduce setup time, companies are investing in modular cleanrooms and prefabricated bioprocessing units.

-

Emphasis on Vector Manufacturing Capacity: With viral vectors being a critical component for gene therapies, manufacturers are expanding capacity for AAV, lentiviral, and retroviral vector production.

-

Development of Allogeneic Cell Therapies: The focus is shifting toward off-the-shelf, allogeneic therapies to reduce costs and manufacturing turnaround time compared to autologous options.

-

Public-Private Collaborations and Funding Support: Federal and state-level initiatives are supporting infrastructure development, R&D, and workforce training in CGT manufacturing.

-

Regulatory Flexibility and Fast-Track Approvals: The FDA’s regenerative medicine advanced therapy (RMAT) designation and other expedited programs continue to drive clinical and commercial CGT manufacturing demand.

U.S. Cell And Gene Therapy Manufacturing Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 7.33 Billion |

| Market Size by 2035 |

USD 64.77 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 27.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Therapy type, scale, mode, workflow |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Lonza; Bluebird Bio; Catalent Inc.; F. Hoffmann-La Roche Ltd.; Samsung Biologics; Boehringer Ingelheim; Cellular Therapeutics; Hitachi Chemical Co., Ltd.; Bluebird Bio Inc.; Takara Bio Inc.; Miltenyi Biotec; Thermo Fisher Scientific; F. Hoffmann-La Roche Ltd; Novartis AG; Merck KGaA; Wuxi Advanced Therapies |

U.S. Cell And Gene Therapy Manufacturing Market Dynamics

Driver

Growing Number of Approved and Late-Stage Products

One of the strongest drivers of the U.S. CGT manufacturing market is the increasing number of approved therapies and late-stage pipeline candidates. As more therapies achieve regulatory milestones, manufacturing demand surges both in pre-commercial and commercial stages. The FDA has approved numerous transformative therapies like Yescarta (CAR-T therapy for large B-cell lymphoma) and Zynteglo (a gene therapy for beta-thalassemia). These successes validate the therapeutic potential and regulatory feasibility of CGTs.

Furthermore, the robust pipeline with hundreds of Phase II and Phase III candidates indicates sustained growth in manufacturing requirements. Companies are increasingly moving from proof-of-concept to commercialization, driving demand for scalable, compliant manufacturing processes. This surge necessitates expansion in both in-house and contract manufacturing capacities, fueling investments in bioprocessing equipment, cleanroom infrastructure, and advanced analytics.

Restraint

Manufacturing Complexity and Cost Challenges

Despite its promise, the U.S. CGT manufacturing market faces significant challenges related to technical complexity and high costs. Manufacturing autologous cell therapies, for instance, requires patient-specific processes that limit scalability. Each batch must be personalized, managed under tight timelines, and manufactured under aseptic conditions, resulting in high per-patient costs—often exceeding $500,000.

Additionally, vector production, a key bottleneck in gene therapy, requires sophisticated facilities and skilled workforce, and suffers from limited global capacity. Raw material shortages, batch failures, contamination risks, and quality control issues further complicate manufacturing timelines and raise operational risks. Many smaller biotech firms lack the infrastructure and resources to build GMP-compliant facilities, making manufacturing one of the major cost centers in therapy development.

Opportunity

Rise of Allogeneic and Off-the-Shelf Therapies

A notable opportunity in the U.S. CGT manufacturing landscape lies in the emergence of allogeneic (donor-derived) therapies, which offer the potential for large-scale, off-the-shelf treatment products. Unlike autologous therapies that are customized for each patient, allogeneic products can be manufactured in bulk, stored, and distributed globally, resembling the scalability model of traditional biologics.

Companies like Allogene Therapeutics and Fate Therapeutics are pioneering allogeneic CAR-T and NK cell therapies, significantly reducing production costs and logistical complexities. These therapies can be produced in centralized facilities, allowing for better control of quality, consistency, and supply chain. With promising clinical data and increasing regulatory engagement, the transition toward allogeneic manufacturing holds immense potential for both commercial scalability and patient accessibility.

Segments Insights

By Therapy Type Insights

Gene therapy manufacturing dominated the market by therapy type. The rapid approval and commercialization of gene-based treatments have driven investment in specialized vector production facilities, which are integral to gene delivery. Therapies like Luxturna, Zolgensma, and Roctavian have demonstrated the potential to cure genetic conditions with a single administration, creating significant demand for scalable and high-quality gene manufacturing solutions. Companies are prioritizing viral vector development, especially AAV and lentiviral vectors, with increasing focus on capsid engineering and yield optimization.

Stem cell therapy is the fastest-growing subsegment within cell therapy manufacturing. The regenerative potential of stem cells in repairing damaged tissues or modulating immune responses has gained traction across applications such as spinal cord injuries, stroke, and autoimmune diseases. In the U.S., several clinical trials are exploring mesenchymal stem cells (MSCs), hematopoietic stem cells (HSCs), and induced pluripotent stem cells (iPSCs). Stem cell manufacturing demands stringent compliance with GMP, cryopreservation techniques, and scalability—factors that are being addressed through advanced bioreactors and closed-loop systems.

By Scale Insights

Pre-commercial/R&D scale manufacturing led the market. Most cell and gene therapy products in the U.S. are still in clinical phases, resulting in a high demand for pre-commercial manufacturing services. Companies need small-batch, flexible, and GMP-compliant facilities to support early-stage development. Academic partnerships, government funding, and incubators are also bolstering R&D manufacturing ecosystems. This segment includes activities like pilot production, tech transfer, and preclinical process validation.

Commercial scale manufacturing is the fastest-growing segment due to the increase in FDA-approved therapies and the scaling up of successful clinical candidates. As products transition from bench to bedside, manufacturers must develop robust production systems that ensure consistency, yield, and compliance. The need for large-scale vector production, automated cell expansion, and real-time quality monitoring is driving innovation in commercial facilities. Companies like Bristol Myers Squibb and Novartis have inaugurated U.S.-based commercial CGT facilities capable of supplying global demand.

By Mode Insights

Contract manufacturing dominated the mode segment. The complexity, cost, and regulatory compliance required for CGT production make outsourcing an attractive option. Startups and even mid-sized biotech companies often rely on CDMOs for everything from plasmid preparation to finished product packaging. Leading U.S. CDMOs offer turnkey solutions, including regulatory submissions, process optimization, and aseptic fill-and-finish. This mode reduces upfront capital investment and shortens time-to-market.

In-house manufacturing is witnessing fast growth, especially among large pharmaceutical firms with multiple candidates in the pipeline. These companies are investing in proprietary facilities to maintain control over intellectual property, ensure supply chain reliability, and customize production to therapeutic requirements. Recent examples include Pfizer’s $470 million cell therapy facility in North Carolina and Novartis’ expansion of its Durham plant to support CAR-T production.

In-house manufacturing is witnessing fast growth, especially among large pharmaceutical firms with multiple candidates in the pipeline. These companies are investing in proprietary facilities to maintain control over intellectual property, ensure supply chain reliability, and customize production to therapeutic requirements. Recent examples include Pfizer’s $470 million cell therapy facility in North Carolina and Novartis’ expansion of its Durham plant to support CAR-T production.

By Workflow Insights

Cell processing dominated the workflow segment. This includes critical stages like cell isolation, activation, genetic modification, and expansion each requiring precise control and monitoring. Autologous therapies in particular rely heavily on successful cell processing since patient cells differ widely in quality and viability. Technologies like closed-system bioreactors, electroporation, and CRISPR gene editing are transforming how cells are processed at scale.

Vector production is the fastest-growing workflow. Viral vectors remain the gold standard for gene delivery in therapeutic applications. The surging number of gene therapy trials and commercial approvals has created a supply-demand mismatch, turning vector production into a bottleneck. U.S. manufacturers are investing in scalable production platforms like suspension-based bioreactors and synthetic vectors. Innovations such as transfection reagents, stable producer cell lines, and improved purification techniques are also enhancing yield and quality.

Country-Level Insights

The United States stands as the undisputed global leader in cell and gene therapy manufacturing. Home to a majority of the world’s approved therapies and a dense cluster of biotech startups, the U.S. benefits from a favorable ecosystem that includes regulatory support, academic excellence, funding availability, and technological infrastructure.

Biotech hubs like Boston, San Diego, and the San Francisco Bay Area serve as epicenters of CGT innovation and manufacturing. Companies operating here benefit from proximity to world-class research institutions, access to venture capital, and partnerships with leading hospitals. Additionally, government bodies like the NIH and BARDA continue to provide grants for infrastructure development and clinical research.

The FDA’s progressive stance, demonstrated by initiatives such as the Regenerative Medicine Advanced Therapy (RMAT) designation and real-time review mechanisms, accelerates market readiness. Major public-private partnerships, such as the Advanced Regenerative Manufacturing Institute (ARMI), are further nurturing talent and standardization in manufacturing practices. With over 500 manufacturing and development facilities dedicated to cell and gene therapies, the U.S. is poised to maintain its dominance in this space for the foreseeable future.

Recent Developments

-

March 2025: Thermo Fisher Scientific announced a $250 million expansion of its U.S.-based viral vector manufacturing site in Massachusetts to address surging demand from gene therapy developers.

-

February 2025: Catalent completed the construction of its commercial-scale cell therapy manufacturing center in Princeton, New Jersey, designed for autologous and allogeneic products.

-

January 2025: Novartis opened a new wing at its Durham, North Carolina facility, doubling its CAR-T therapy production capabilities in the U.S.

-

November 2024: Pfizer broke ground on a $470 million facility in Sanford, North Carolina dedicated to gene therapy manufacturing, with full operations expected by mid-2026.

-

October 2024: Lonza and Vertex Pharmaceuticals signed a long-term manufacturing agreement to support Vertex’s stem cell-based diabetes therapy at Lonza’s Portsmouth site.

Some of the prominent players in the U.S. Cell And Gene Therapy Manufacturing Market include:

- Lonza

- Bluebird Bio Inc.

- Catalent Inc.

- F. Hoffmann-La Roche Ltd

- Samsung Biologics

- Boehringer Ingelheim

- Cellular Therapeutics

- Hitachi Chemical Co., Ltd.

- Takara Bio Inc.

- Miltenyi Biotec

- Thermo Fisher Scientific

- Novartis AG

- Merck KGaA

- Wuxi Advanced Therapies

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Cell And Gene Therapy Manufacturing market.

By Therapy Type

- Cell therapy manufacturing

- Stem cell therapy

- Non-stem cell therapy

- Gene therapy manufacturing

By Scale

- Pre-commercial/ R&D scale manufacturing

- Commercial scale manufacturing

By Mode

- Contract manufacturing

- In-house manufacturing

By Workflow

- Cell processing

- Cell banking

- Process development

- Fill & finish operations

- Analytical and quality testing

- Raw material testing

- Vector production

- Others

In-house manufacturing is witnessing fast growth, especially among large pharmaceutical firms with multiple candidates in the pipeline. These companies are investing in proprietary facilities to maintain control over intellectual property, ensure supply chain reliability, and customize production to therapeutic requirements. Recent examples include Pfizer’s $470 million cell therapy facility in North Carolina and Novartis’ expansion of its Durham plant to support CAR-T production.

In-house manufacturing is witnessing fast growth, especially among large pharmaceutical firms with multiple candidates in the pipeline. These companies are investing in proprietary facilities to maintain control over intellectual property, ensure supply chain reliability, and customize production to therapeutic requirements. Recent examples include Pfizer’s $470 million cell therapy facility in North Carolina and Novartis’ expansion of its Durham plant to support CAR-T production.