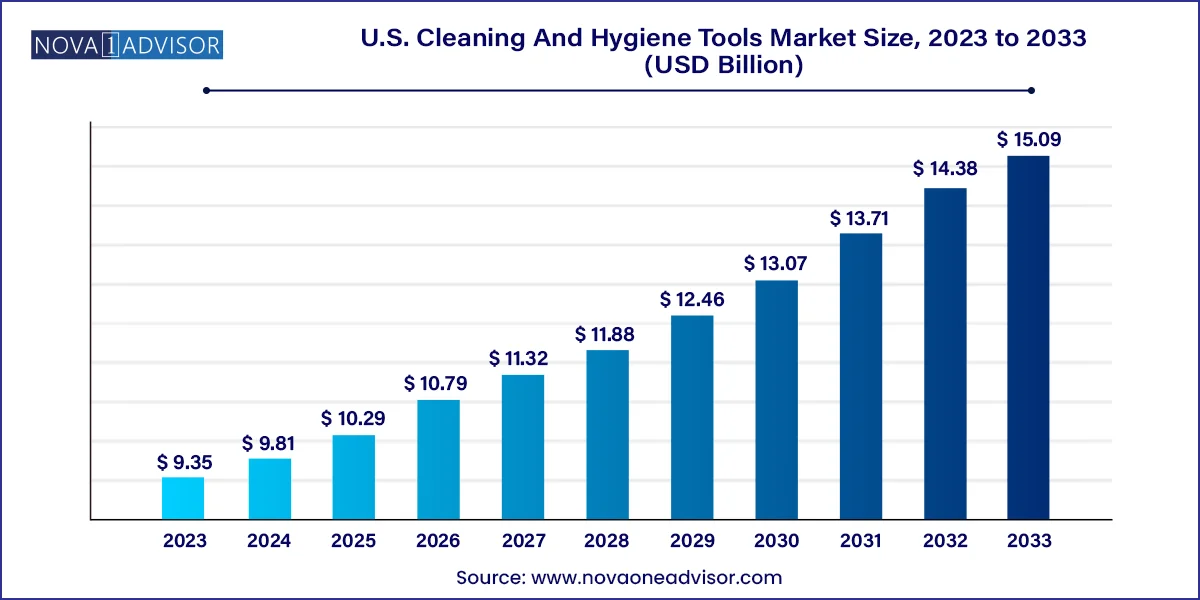

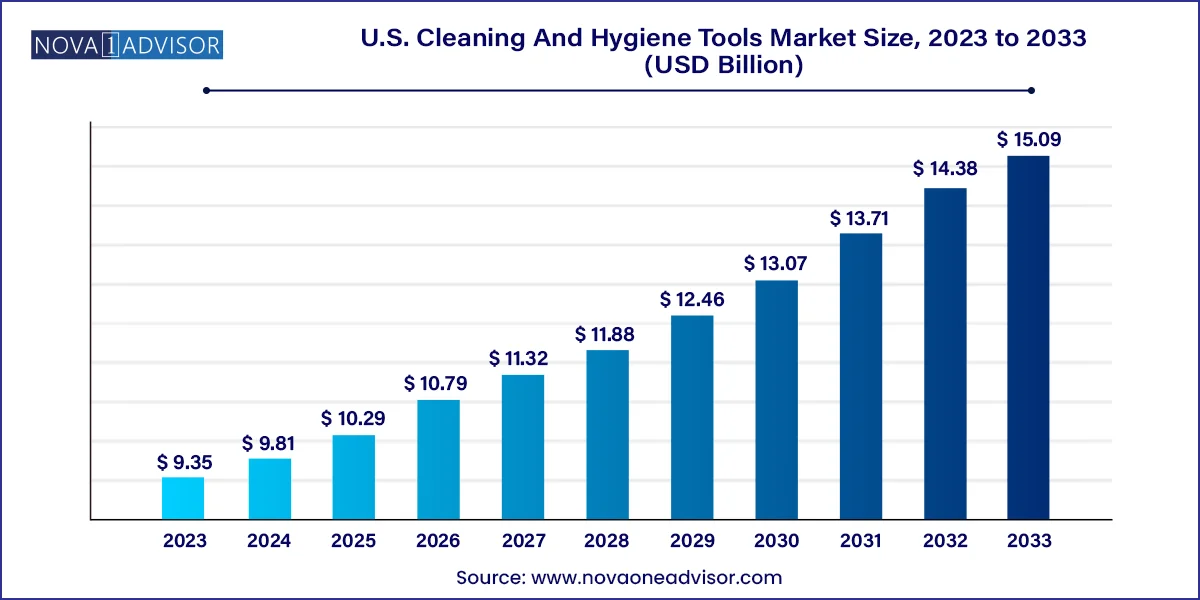

The U.S. cleaning & hygiene tools market size was exhibited at USD 9.35 billion in 2023 and is projected to hit around USD 15.09 billion by 2033, growing at a CAGR of 4.9% during the forecast period 2024 to 2033.

- The wipes segment accounted for the revenue share of 26.2% in 2023.

- The cleaning mops is expected to grow at the fastest CAGR from 2024 to 2033.

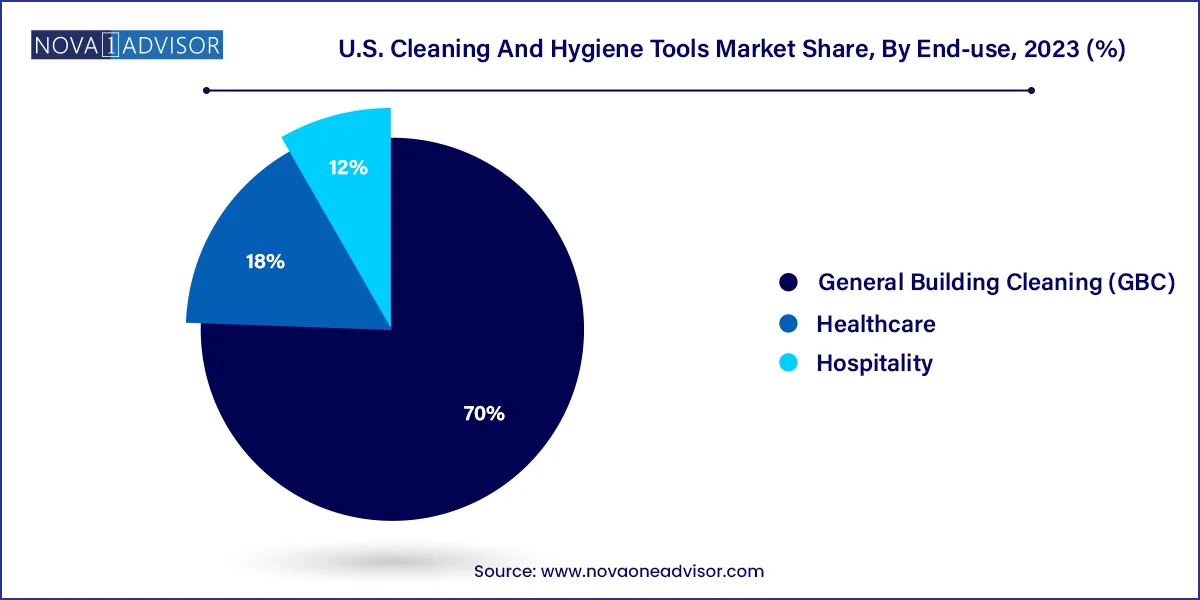

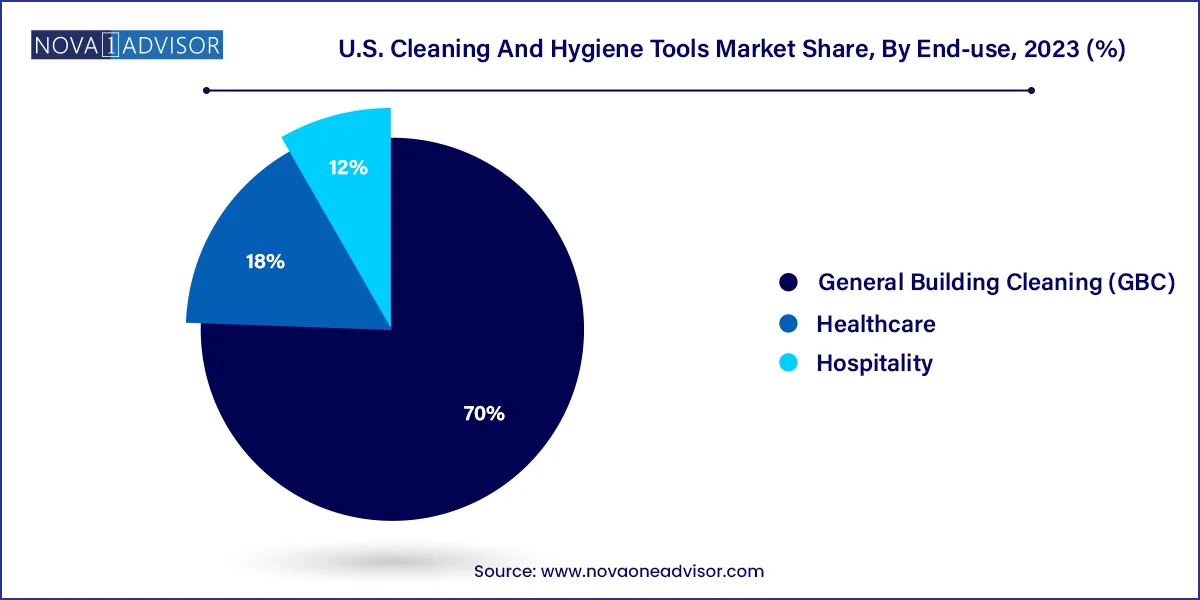

- General building cleaning end-use segment accounted for a market share of 70.0% in 2023.

- The hospitality segment is projected to grow at the fastest CAGR from 2024 to 2033.

Market Overview

The U.S. cleaning and hygiene tools market is a robust and multifaceted segment that plays a vital role in the nation’s public health, sanitation, and commercial infrastructure. As hygiene awareness intensifies across both residential and commercial environments, demand for efficient, sustainable, and ergonomically designed cleaning tools has increased significantly. The COVID-19 pandemic served as a catalyst for long-term behavioral change in hygiene practices, driving demand not just for cleaning chemicals, but also the tools and equipment that facilitate effective sanitation.

The cleaning and hygiene tools market in the U.S. encompasses a broad spectrum of products—from simple manual tools such as mops, brooms, and dustpans to technologically advanced cleaning trolleys and specialized disposable wipes. These tools are crucial across multiple sectors, including healthcare, hospitality, education, commercial buildings, and even industrial facilities. The market has seen a shift from traditional labor-intensive cleaning practices to professional and mechanized cleaning supported by ergonomic tools and accessories.

Driven by consumer expectations for cleanliness, the adoption of hygiene tools is evolving from an operational necessity to a brand differentiator, especially in customer-facing industries like hotels, hospitals, and retail. Innovation, automation, and sustainability now play key roles in product design and purchasing decisions. In addition, there is growing emphasis on eco-friendly and antimicrobial tools, aligning with broader environmental, social, and governance (ESG) commitments. From disinfectant-ready reusable mop systems in hospitals to lightweight microfiber cloths in households, the market continues to advance on the back of innovation, regulation, and consumer demand.

Major Trends in the Market

-

Surge in Demand for Disposable Cleaning Tools: Increased preference for disposable wipes and mop heads in hospitals and food service due to hygiene concerns.

-

Sustainable Cleaning Tools Gaining Traction: Growing adoption of eco-friendly materials, biodegradable products, and reusable alternatives.

-

Technology Integration in Cleaning Carts and Trolleys: Emergence of modular, sensor-equipped trolleys for efficient and automated facility cleaning.

-

Ergonomics and Worker Safety: Focus on designing tools that reduce strain and injury among janitorial staff, especially in large facilities.

-

Rise of Touchless Waste Receptacles and PPE Kits: Touch-free dustbins and increased PPE distribution across public buildings post-pandemic.

-

Commercial-Grade Cleaning Tools for Household Use: Uptick in consumers purchasing professional-grade wipes, mop systems, and brooms for home use.

-

Shift Toward Professional Cleaning Contracts: Outsourcing of cleaning services by offices, schools, and institutions driving bulk tool procurement.

-

Increased Emphasis on Infection Control in Healthcare: Demand for color-coded tools, antimicrobial handles, and surface-specific wipes.

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.81 Billion |

| Market Size by 2033 |

USD 15.09 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

3M Company; Newell Brands Inc. (Rubbermaid Commercial Products); The Clorox Company; Diversey Holdings, Inc.; Ecolab Inc.; W. W. Grainger, Inc.; Unger Global; Remco Products; The Libman Company; Carolina Mop |

Market Driver: Heightened Hygiene Awareness Post-COVID-19

A pivotal driver accelerating the U.S. cleaning and hygiene tools market is the permanent shift in hygiene awareness following the COVID-19 pandemic. The virus underscored the critical importance of surface-level sanitation in preventing disease transmission—not just in healthcare, but across schools, airports, restaurants, and workplaces. This shift transformed cleanliness from a periodic task into a continuous process backed by protocols and visible practices.

Today, hospitals mandate frequent surface sanitization using disposable mop heads, while hospitality venues must maintain spotless lobbies and restrooms to assure customers. Cleaning personnel are now equipped with gloves, color-coded wipes, and touch-free waste receptacles as standard practice. As organizations integrate hygiene into their brand reputation and customer trust strategies, the demand for advanced, efficient, and compliance-friendly tools continues to rise. The move toward higher cleaning frequency, greater accountability, and visible hygiene routines is not expected to reverse, sustaining long-term demand across end-use segments.

Market Restraint: Labor Shortages and High Dependence on Manual Processes

Despite increasing automation in the broader cleaning industry, the U.S. cleaning tools market remains heavily dependent on manual labor, which is facing persistent shortages and high turnover rates. Commercial cleaning services, janitorial teams, and facility maintenance departments struggle to retain skilled workers amid rising wage demands and physically intensive job roles. This workforce challenge limits the full optimization of cleaning routines—even when quality tools are available.

Furthermore, some cleaning tools, particularly in older institutions and under-budgeted government facilities, remain outdated, inefficient, or non-ergonomic. This not only reduces cleaning effectiveness but also leads to staff fatigue and injury, exacerbating attrition rates. Until further automation or worker-assist technologies are adopted at scale, this human dependency poses a bottleneck for operational scalability and product innovation adoption.

Market Opportunity: Growth in Healthcare and Institutional Sanitation Standards

A major opportunity lies in the expanding institutional focus on sanitation compliance, particularly within the U.S. healthcare ecosystem. Regulatory mandates from bodies such as the Centers for Disease Control and Prevention (CDC) and the Occupational Safety and Health Administration (OSHA) continue to evolve, compelling hospitals and healthcare facilities to adopt advanced, traceable, and sterilizable cleaning protocols.

This opportunity is being tapped through color-coded tools to prevent cross-contamination, disposable wipes with targeted disinfectant compatibility, and PPE-integrated safety kits. Surgical theaters, outpatient clinics, and elder care homes are upgrading from general-purpose mops to microfiber systems that retain pathogens and are autoclavable. As patient safety becomes an institutional performance metric, procurement of high-quality hygiene tools will remain a priority, creating a lucrative growth path for manufacturers offering medical-grade or compliance-ready solutions.

The wipes segment accounted for the revenue share of 26.2% in 2023. driven by their convenience, hygiene effectiveness, and compatibility with disinfectants. Disposable wipes are preferred in critical environments like healthcare, food services, and public transport, where quick surface cleaning is needed multiple times a day. Their use extends beyond commercial environments—homeowners have embraced antibacterial wipes for kitchen counters, doorknobs, and mobile devices. Brands offering textured wipes with rapid-drying solutions and hospital-grade germ-killing capacity have gained significant market traction.

The cleaning mops is expected to grow at the fastest CAGR from 2024 to 2033. Reusable mops are preferred in general building cleaning and hospitality due to their low long-term cost and compatibility with various cleaning agents. Microfiber mop heads that can be sanitized and reused are a staple in hotels, schools, and office spaces. Mops with extendable handles, swivel joints, and bucket-wringer systems are now standard purchases for custodial teams.

General building cleaning end-use segment accounted for a market share of 70.0% in 2023. These facilities require a broad portfolio of hygiene tools—from floor maintenance kits and bathroom sanitation tools to waste receptacles and PPE kits. GBC relies heavily on manual tools for daily operations and standardized cleaning protocols. The push toward green buildings and LEED certifications has also led to the adoption of environmentally sustainable cleaning solutions and tools.

The hospitality segment is projected to grow at the fastest CAGR from 2024 to 2033. These environments require constant visual cleanliness and often employ visible cleaning staff as part of their guest reassurance strategy. Cleaning carts with aesthetically pleasing designs, lightweight brooms, and air-sanitizing wipes are increasingly in demand. The rise in travel and tourism post-pandemic recovery is also revitalizing procurement in this sector.

Country-Level Analysis

As the focal market of this report, the United States presents a well-developed and innovation-driven cleaning tools landscape, backed by sophisticated retail, institutional, and logistics frameworks. The U.S. is characterized by widespread janitorial service outsourcing, which has standardized cleaning tool specifications across sectors. Key procurement drivers include product durability, OSHA compliance, brand reputation, and sustainability credentials.

Urban centers such as New York, Chicago, and Los Angeles are leading demand hotspots for professional-grade hygiene tools due to high commercial real estate density. Meanwhile, states with aging populations and healthcare infrastructure—like Florida and California—are driving institutional tool upgrades. Additionally, local manufacturing initiatives and government hygiene campaigns support domestic tool producers.

Online B2B marketplaces, janitorial supply portals, and specialty distributors have facilitated procurement, while big-box retailers like Home Depot and Lowe’s dominate consumer-facing sales. Public-private partnerships in sectors like education and transportation are also spurring bulk procurement of safety and sanitation equipment.

- 3M Company

- Newell Brands Inc. (Rubbermaid Commercial Products)

- The Clorox Company

- Diversey Holdings, Inc.

- Ecolab Inc.

- W. W. Grainger, Inc.

- Unger Global

- Remco Products

- The Libman Company

- Carolina Mop

-

March 2024 – Rubbermaid Commercial Products announced its new generation of color-coded cleaning kits designed to help facilities meet cross-contamination prevention protocols across U.S. hospitals.

-

January 2024 – 3M introduced its next-gen Scotch-Brite High Performance Mop System with improved wringing technology for commercial cleaning contractors.

-

October 2023 – Vileda Professional expanded its U.S. footprint with a new distribution center in Ohio to accelerate supply chain capabilities for cleaning mops and wipes.

-

August 2023 – Tork (an Essity brand) unveiled a sustainability campaign targeting U.S. institutions, introducing recyclable packaging for its disposable cleaning wipes and paper hygiene tools.

-

June 2023 – Clorox Professional launched a new line of disinfectant wipes integrated with a multi-surface fabric technology that traps pathogens on contact, aimed at the foodservice and retail industries.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. cleaning & hygiene tools market

Product

-

- Disposable Wipes

- Reusable Wipes

- Sponges and Scouring Pads

- Trolleys and Carts

- Cleaning Mops

- Buckets and Wringers

- Manual Sweeper Broom and Dustpans

- Gloves & Safety Kit (PPE)

- Matting

- Waste Receptacles/Dustbins

- Others (Duster, Squeegees, etc.)

End-use

- Healthcare

- Hospitality

- General Building Cleaning (GBC)