U.S. Corporate Wellness Market Size and Trends

The U.S. corporate wellness market size was exhibited at USD 19.45 billion in 2025 and is projected to hit around USD 28.46 billion by 2035, growing at a CAGR of 3.89% during the forecast period 2026 to 2035.

Key Takeaways:

- The health risk assessment segment dominated the market in 2025 with a revenue share of 21.0%.

- The stress management segment is anticipated to witness a maximum CAGR of 5.33% during the forecast period.

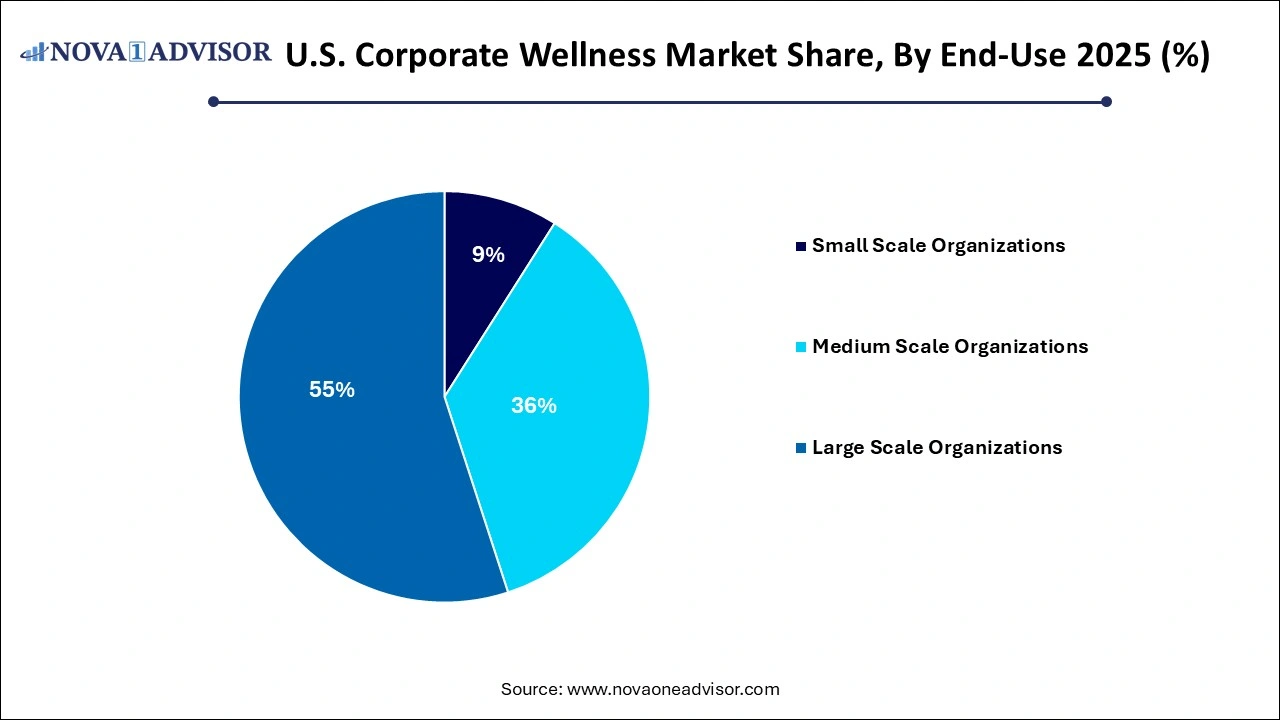

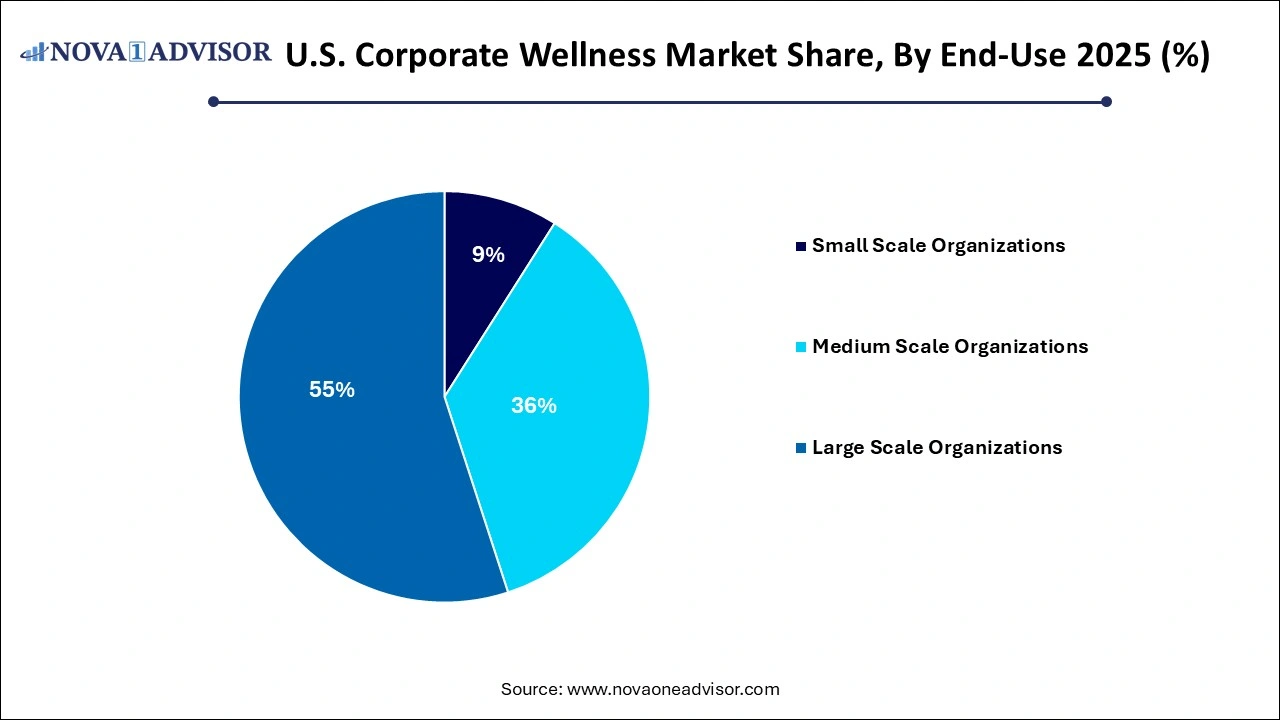

- The large-scale organizations with a share of 54.0% dominated the market in 2025.

- The medium-scale organizations segment is projected to register the highest CAGR of 4.30% during 2026-2035.

- The organizations/ employers segment with 49.9% in 2023 accounted for the maximum portion of the market.

- The onsite segment held the maximum market share of 57.5% in 2025.

- The offsite segment is projected to witness lucrative growth of 4.47% during the forecast period.

U.S. Corporate Wellness Market Overview

The U.S. corporate wellness market is undergoing a transformative phase driven by a growing emphasis on employee well-being as a strategic business objective. The evolving work culture, increased awareness of mental and physical health, and rising healthcare costs have collectively fueled the demand for integrated wellness programs. These programs are no longer limited to fitness classes or gym memberships; they have expanded to include holistic offerings such as mental health support, nutrition planning, stress management workshops, biometric screenings, and lifestyle coaching.

The market is witnessing a surge in employer-sponsored initiatives aimed at improving productivity, enhancing employee engagement, and reducing absenteeism. According to surveys conducted across Fortune 500 companies, nearly 85% now offer some form of corporate wellness service, underscoring the shift from optional to essential wellness integration. Moreover, the economic rationale for wellness investment is becoming increasingly evident. For example, Johnson & Johnson reported a return of $2.71 for every dollar spent on wellness programs through lower medical costs and improved employee performance.

Driven by digital transformation and an influx of health-tech startups, the U.S. corporate wellness market is characterized by innovation, scalability, and personalization. Employers are investing in tailored digital platforms and mobile applications that provide on-demand fitness programs, personalized health insights, and virtual therapy sessions an approach that resonates particularly well with a hybrid or remote workforce. Additionally, the increased focus on Diversity, Equity, and Inclusion (DEI) has encouraged wellness program providers to develop more culturally inclusive and gender-sensitive services.

Major Trends in the U.S. Corporate Wellness Market

-

Hybrid Wellness Models: Companies are increasingly adopting hybrid delivery models that blend in-person and digital wellness services to cater to remote and on-site employees.

-

Mental Health as a Core Component: Post-pandemic, there is a heightened focus on integrating mental health and psychological support as central pillars of corporate wellness.

-

Gamification and Incentives: Wellness programs increasingly use gamified platforms that reward healthy behaviors, fostering engagement and participation.

-

AI-Powered Personalization: Artificial intelligence is being leveraged to offer personalized wellness plans based on real-time employee health data and preferences.

-

Focus on Preventive Care: Employers are shifting from reactive to preventive health strategies, offering biometric screenings and lifestyle coaching.

-

Employee Assistance Programs (EAPs) Expansion: EAPs now go beyond crisis support, covering financial counseling, childcare solutions, and career coaching.

-

Wellness Analytics Platforms: Employers are using advanced analytics to assess program effectiveness, employee participation rates, and ROI.

-

Integration with Health Insurance: More wellness initiatives are being bundled with employee insurance plans to optimize benefits and reduce claims.

Report Scope of The U.S. Corporate Wellness Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 22.18 Billion |

| Market Size by 2035 |

USD 31.27 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 3.89% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Service, End use, Category, Delivery Model |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness; Privia Health; Vitality; Wellsource, Inc.; Sonic Boom Wellness |

U.S. Corporate Wellness Market Driver

Increasing Healthcare Costs

One of the most compelling drivers of the U.S. corporate wellness market is the surging cost of healthcare for employers. According to the Kaiser Family Foundation, employer-sponsored health insurance premiums have been rising steadily, reaching an average of over $22,000 annually for family coverage in 2023. In this climate, corporate wellness programs are not just a perk but a cost-containment strategy. By identifying health risks early and encouraging healthier lifestyle choices, these programs can significantly reduce preventable medical claims. A study by Harvard University found that for every dollar invested in wellness, employers save $3.27 in healthcare costs. This economic incentive is leading more companies to proactively integrate wellness into their corporate culture and benefits strategy.

U.S. Corporate Wellness Market Restraint

Low Participation and Engagement Rates

Despite widespread adoption, one of the key restraints in the market is the persistently low engagement rates among employees. Studies suggest that only 20-40% of eligible employees participate actively in wellness programs. Several factors contribute to this, including lack of personalization, poor communication, perceived lack of time, and concerns over data privacy. Employees may also be skeptical about employer intentions, viewing wellness initiatives as superficial or intrusive. Additionally, without tangible and immediate benefits, many employees find it difficult to stay motivated. This limits the impact and ROI of wellness investments. To overcome this, employers must focus on building trust, offering tailored services, and demonstrating clear, measurable outcomes.

U.S. Corporate Wellness Market Opportunity

Integration of Digital Therapeutics

The growing field of digital therapeutics presents a transformative opportunity for the corporate wellness market. These evidence-based interventions, delivered via software, provide scalable and personalized care for conditions such as diabetes, anxiety, obesity, and insomnia. When integrated into corporate wellness platforms, digital therapeutics can offer measurable clinical benefits and allow real-time tracking of health outcomes. For instance, companies like Omada Health and Noom are partnering with large U.S. employers to deliver behavior change programs via mobile apps. These platforms can easily be embedded into broader employee wellness offerings, increasing accessibility, reducing costs, and enhancing long-term effectiveness. As FDA-approved digital therapies gain wider adoption, they could redefine the efficacy of corporate wellness strategies.

By Service Insights

Health Risk Assessment dominated the service segment due to its foundational role in identifying employee health profiles and shaping personalized wellness interventions. Most employers begin their wellness journey with health risk assessments (HRAs), which typically include questionnaires, biometric data, and basic medical screenings. These assessments help organizations identify high-risk individuals and enable the design of focused wellness programs. As awareness around preventive health increases, the demand for HRA solutions continues to grow. Companies such as Virgin Pulse and Wellsource have built specialized platforms that collect and analyze HRA data to guide long-term health interventions. Moreover, HRAs serve as a gateway to other services like fitness, nutrition counseling, and disease management programs.

Fitness is emerging as the fastest-growing segment, driven by the rising interest in physical health, virtual workouts, and active lifestyle promotion. Employers are increasingly offering access to gym memberships, step challenges, virtual fitness sessions, and wearable fitness trackers. The rise of wearable technology, such as Fitbit and Apple Watch integrations, has boosted the appeal and effectiveness of fitness initiatives. Additionally, with hybrid work models becoming standard, employers are incorporating mobile fitness applications that employees can access from anywhere. The demand for personalized and convenient fitness routines is reshaping how corporate wellness providers deliver this service.

By End-use Insights

Large Scale Organizations continue to dominate this segment due to their robust financial capability to invest in comprehensive wellness programs and partnerships with premium wellness vendors. These corporations often have dedicated wellness budgets, HR teams, and health benefits coordinators to manage and measure wellness initiatives. Companies like Google and Microsoft are known for pioneering holistic wellness ecosystems, offering everything from on-site gyms to mindfulness retreats and telehealth counseling. Their extensive infrastructure enables them to test, evaluate, and scale wellness offerings rapidly across their workforce, giving them a significant edge in adoption and effectiveness.

Medium Scale Organizations are the fastest-growing end-use segment, fueled by increasing recognition of employee well-being as a factor in retention and productivity. Mid-sized firms are turning to modular and outsourced wellness solutions that are cost-effective yet impactful. Cloud-based platforms and virtual coaching services make it feasible for these organizations to roll out scalable wellness programs. For example,platforms like Limeade and Wellable offer customizable packages tailored for smaller HR teams. The growing awareness that wellness programs can reduce turnover and enhance employer branding is a key motivator behind this growth.

Medium Scale Organizations are the fastest-growing end-use segment, fueled by increasing recognition of employee well-being as a factor in retention and productivity. Mid-sized firms are turning to modular and outsourced wellness solutions that are cost-effective yet impactful. Cloud-based platforms and virtual coaching services make it feasible for these organizations to roll out scalable wellness programs. For example,platforms like Limeade and Wellable offer customizable packages tailored for smaller HR teams. The growing awareness that wellness programs can reduce turnover and enhance employer branding is a key motivator behind this growth.

By Category Insights

Organizations/Employers lead this category, as internal HR departments and corporate leadership play a central role in funding and implementing wellness programs. Companies are creating in-house wellness teams and partnering with third-party vendors to provide a unified wellness experience. Employer-driven initiatives often reflect corporate values and are designed to align with broader talent strategies. For example, Salesforce’s wellness program includes mental health days, mindfulness training, and financial wellness tools—all orchestrated by the employer.

Psychological Therapists are becoming the fastest-growing category, in line with the increased emphasis on mental health support post-COVID. The growing prevalence of anxiety, depression, and burnout among U.S. employees has pushed employers to prioritize psychological wellness. As a result, demand for on-site therapists, teletherapy services, and mental health workshops has surged. Platforms like BetterHelp and Talkspace have partnered with employers to provide accessible and confidential therapy services, boosting employee morale and productivity.

By Delivery Model Insights

Onsite delivery continues to dominate due to its perceived reliability, visibility, and engagement. Onsite wellness initiatives, including yoga sessions, ergonomic consultations, and medical check-ups, allow face-to-face interactions and higher participation rates. Especially in sectors like manufacturing, hospitality, and retail where remote work is limited, onsite models remain highly effective. Employers appreciate the convenience of delivering care during work hours, which reduces absenteeism and improves employee morale.

Offsite models are growing fastest, particularly in response to hybrid and remote work trends. With flexible working becoming the norm, employers are adopting offsite and virtual wellness delivery. Employees now have access to 24/7 online consultations, fitness apps, meditation guides, and virtual nutrition coaches. The convenience and flexibility of offsite models appeal to a geographically dispersed workforce. Digital-first wellness providers like Headspace for Work and Calm Business exemplify this trend by offering app-based mindfulness and sleep support tailored for professional settings.

Country-Level Insights – United States

In the U.S., corporate wellness programs have evolved from optional fringe benefits into essential components of employee retention and cost-saving strategies. The country’s unique employment-based health insurance model has positioned employers as key stakeholders in managing healthcare costs and employee well-being. U.S. corporations are at the forefront of wellness innovation, often setting global benchmarks. Tech giants like Google and Apple offer wellness campuses, while companies like Aetna have integrated wellness scores into health plan benefits.

Furthermore, the U.S. labor market’s competitive nature compels companies to differentiate through employee benefits. Startups and SMEs are increasingly embracing wellness as a way to build inclusive, performance-oriented cultures. Public-private partnerships and government-led initiatives, such as the CDC's Workplace Health Resource Center, have also accelerated the adoption of structured wellness programs across sectors.

Some of the prominent players in the U.S. corporate wellness market include:

Recent Developments

-

January 2025 – Virgin Pulse merged with HealthComp, forming one of the largest tech-enabled wellness and benefits platforms in the U.S. The merger aims to provide an integrated solution combining claims analytics, personalized health insights, and guided wellness pathways.

-

March 2025 – Teladoc Health expanded its mental health offering through “myStrength Complete,” a virtual therapy platform designed specifically for employer-sponsored wellness plans, emphasizing AI-guided care navigation.

-

February 2025 – Wellable launched a new wellness gamification suite to enhance employee engagement through customizable rewards, social leaderboards, and health goal tracking. The update targets mid-sized firms looking for cost-effective engagement tools.

-

December 2024 – Limeade introduced a new AI-powered empathy engine that delivers personalized communication and wellness content based on employee mood and sentiment analysis.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. corporate wellness market

Service

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition & Weight Management

- Stress Management

- Others

End-use

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

Category

- Fitness & Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

Delivery Model

Medium Scale Organizations are the fastest-growing end-use segment, fueled by increasing recognition of employee well-being as a factor in retention and productivity. Mid-sized firms are turning to modular and outsourced wellness solutions that are cost-effective yet impactful. Cloud-based platforms and virtual coaching services make it feasible for these organizations to roll out scalable wellness programs. For example,platforms like Limeade and Wellable offer customizable packages tailored for smaller HR teams. The growing awareness that wellness programs can reduce turnover and enhance employer branding is a key motivator behind this growth.

Medium Scale Organizations are the fastest-growing end-use segment, fueled by increasing recognition of employee well-being as a factor in retention and productivity. Mid-sized firms are turning to modular and outsourced wellness solutions that are cost-effective yet impactful. Cloud-based platforms and virtual coaching services make it feasible for these organizations to roll out scalable wellness programs. For example,platforms like Limeade and Wellable offer customizable packages tailored for smaller HR teams. The growing awareness that wellness programs can reduce turnover and enhance employer branding is a key motivator behind this growth.