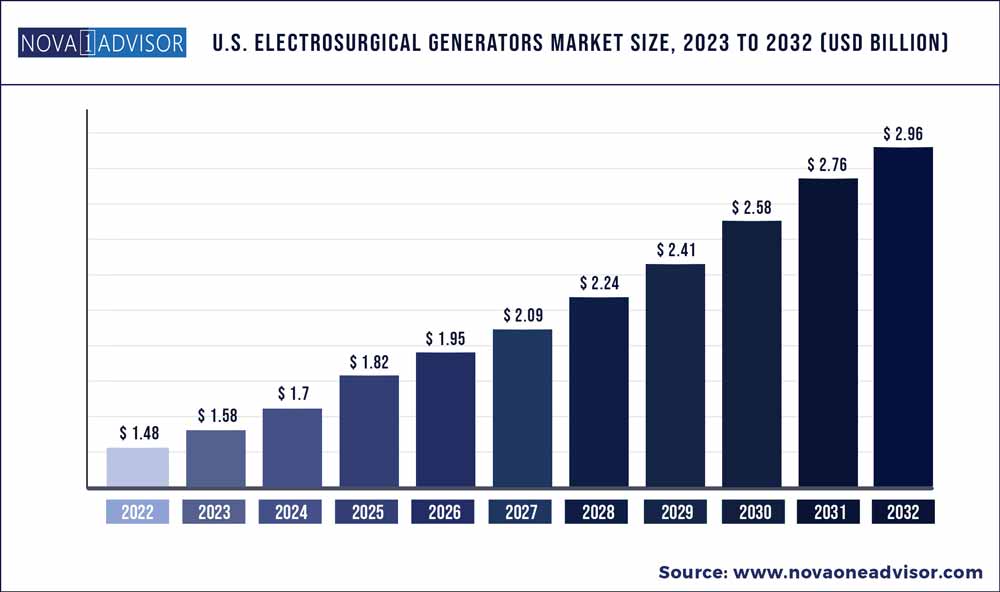

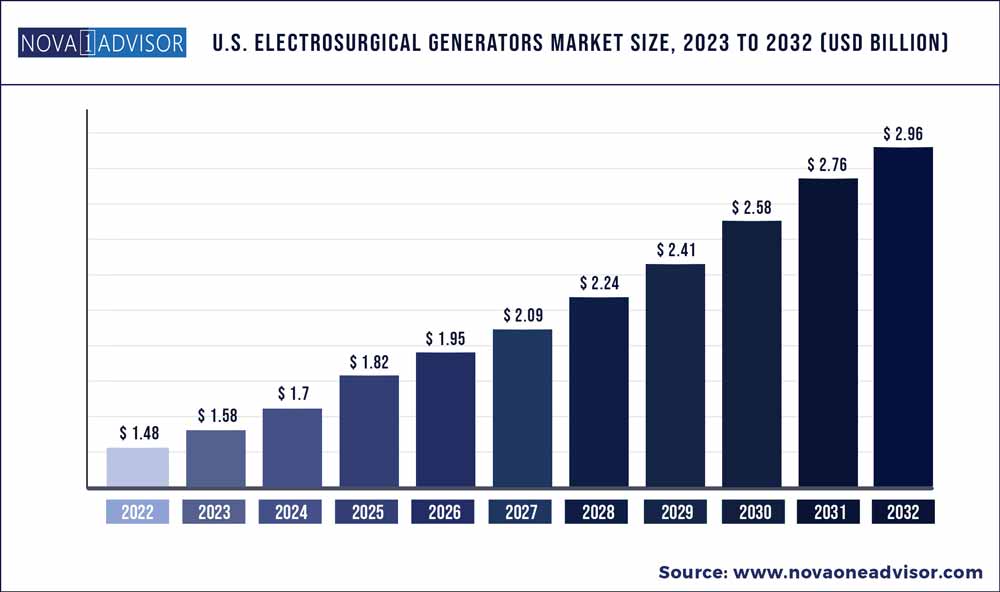

The U.S. Electrosurgical Generators market size accounted for USD 1.48 billion in 2022 and is estimated to achieve a market size of USD 2.96 billion by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

Key Pointers:

- The bipolar electrosurgical generators market in U.S. accounted for more than USD 760 million in 2022

- The optical segment is estimated to witness around 8% CAGR over the forecast period.

- The Hospital segment held around 40% revenue share in 2022

Report Scope of the U.S. Electrosurgical Generators Market

|

Report Coverage

|

Details

|

|

Market Size in 2023

|

USD 1.58 Billion

|

|

Market Size by 2032

|

USD 2.96 Billion

|

|

Growth Rate from 2023 to 2032

|

CAGR of 7.2%

|

|

Base Year

|

2022

|

|

Forecast Period

|

2023 to 2032

|

|

Segments Covered

|

By Type, By Application, By End-use

|

|

Key companies profiled

|

CONMED Corporation, Erbe Elektromedizin, Smith & Nephew, Elliquence, Utah Medical Products and Cooper Surgical.

|

The market is growing exponentially owing to increasing demand for minimally invasive surgeries. Application of electrosurgical instruments in surgical procedures such as thermo-fusion, coagulation, cutting and devitalization will increase its adoption over the coming years. Moreover, rapidly growing geriatric population base and increasing prevalence of chronic diseases in the U.S. will further impact the market growth.

Electrosurgical generators are used in minimally invasive procedures that reduce surgery time, minimize blood loss, and are cost effective. The electrosurgical instruments operate on basic principle of varied electrical waveforms, that are used for cutting, coagulation, dissection and shrinking of targeted tissue.

Patient preference for electrosurgery is increasing over other surgeries owing to its benefits including ease of usage, minimal chances of infection, speedy recovery as well as low risk to patients. Rising government investment for the enhancement of target-specific surgical devices and advanced medical treatment will significantly contribute to electrosurgical generators market expansion in the U.S.

The electrosurgical generators are becoming an integral part of surgeries due to ease of use and high success rates. Numerous applications of these generators in field of ophthalmology, gynaecology, dermatology, dental, ENT, maxillofacial, orthopaedic, neurology and others will increase their demand over the forthcoming years.

The electrosurgeries are organ/tissue specific procedures that avoid unnecessary damage to other tissues/organs. Increasing adoption of these devices in various dermatology and cosmetic surgeries will further spur the market size. However, side-effects associated with the current used in generators and stringent regulations for product development may hinder market growth over the analysis timeframe.

The bipolar electrosurgical generators market in U.S. accounted for more than USD 760 million in 2022, owing to their numerous applications in the wet field surgeries. The bipolar electrosurgery involves active electrode and returns electrode at the surgery site. This system can be used regardless of the medium as it coagulates in the fluid.

The surgery offers concentrated electric energy to the specific tissue, thus, reducing the risk of patient burns. Usage of bipolar generators to avoid misfire and short-circuit, among patients with implanted devices will further upsurge market size over the coming years.

The electrosurgical generator has applications in optical, gynaecology, dermatology, cardiac, dental, ENT, maxillofacial, orthopaedic, urology, neurology and other fields. The optical segment is estimated to witness around 8% CAGR over the forecast period. Electrosurgical generators are regularly used in eye surgeries to coagulate, cut, dissect, ablate and fulgurate the tissue.

Eye surgery requires haemostasis as it reduces the risk of bleeding, blindness as well as retrobulbar hematoma. The regulated electric current provides accuracy and eliminates the risk of coagulation during the surgical procedure. Rising demand for safe and painless ophthalmic procedures will offer various opportunities for market expansion.

The end-user segment of the market is bifurcated into hospitals, ambulatory surgical centres, clinics and others. Hospital segment held around 40% revenue share in 2022, owing to increasing number of surgeries being performed in hospital settings. Availability of advanced instruments in hospitals, presence of skilled healthcare professionals and increasing healthcare expenditure in the country will prove beneficial for the hospitals segment growth.

U.S. Electrosurgical Generators Market Segmentation

| By Type |

By Application |

By End-use |

|

Bipolar

Monopolar

|

Optical

Gynecology

Dermatology

Cardiac

Dental

ENT

Maxillofacial

Orthopedic

Urology

Neurology

Others

|

Hospitals

Ambulatory Surgical Centers

Clinics

Others

|