U.S. Memory Care Market Size and Trends 2026 to 2035

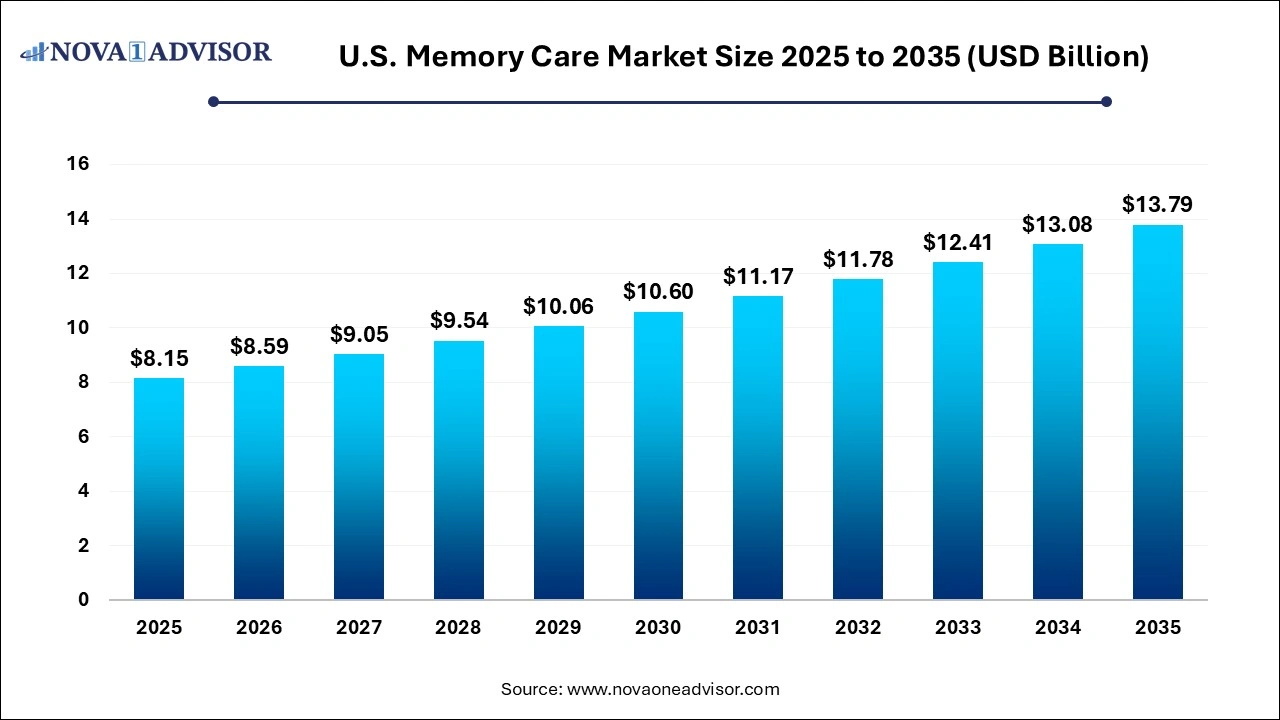

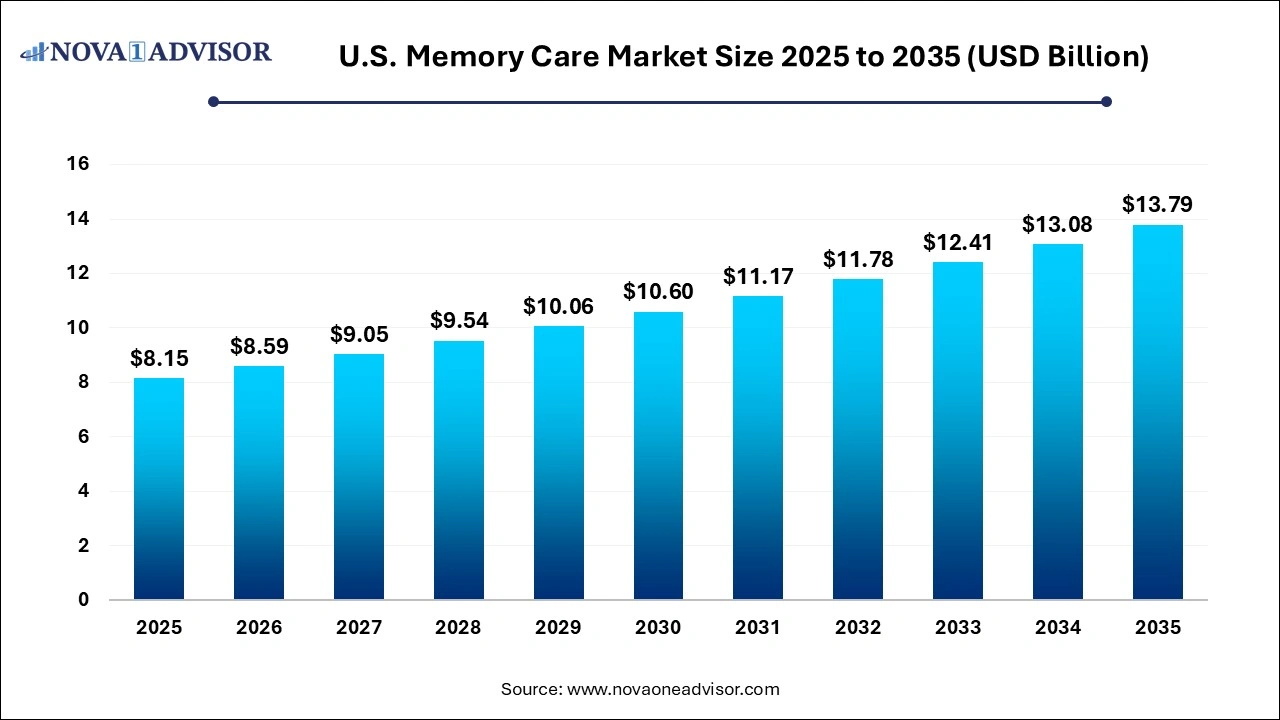

The U.S. memory care market size was exhibited at USD 8.15 billion in 2025 and is projected to hit around USD 13.79 billion by 2035, growing at a CAGR of 5.4% during the forecast period 2026 to 2035.

Key Takeaways:

- In 2025, the memory exercise & activity services segment accounted for the largest market share of 40.4% in terms of revenue share pertaining to the number of patients suffering from neurodegenerative diseases.

- Personal assistance safety services segment is expected to project the fastest CAGR of 6.0% over the forecast period.

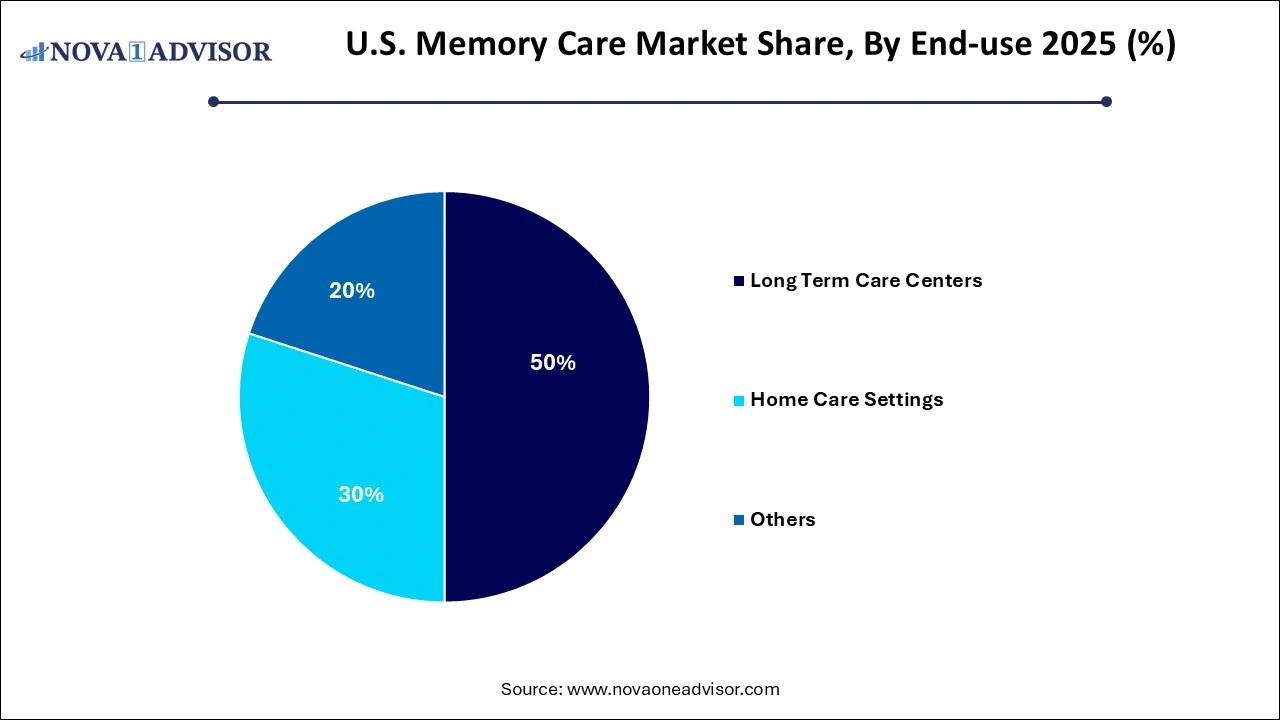

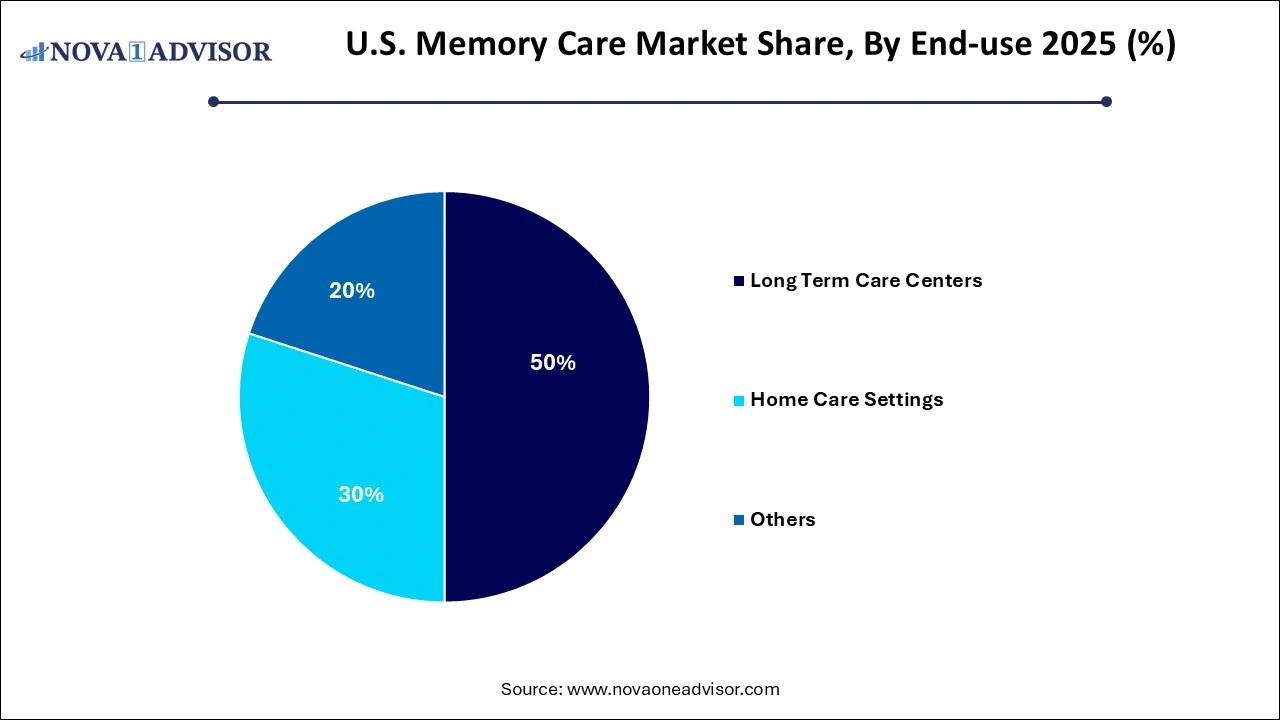

- In 2025, the long-term care centers held a majority of the market share of 50% in terms of revenue and is also likely to witness the fastest CAGR of 5.5% over the forecast period.

The U.S. Memory Care Market is emerging as a vital pillar within the broader senior care ecosystem, shaped by the rapid aging of the population and a corresponding rise in cognitive disorders. Memory care refers to specialized long-term services tailored to individuals experiencing Alzheimer’s disease, dementia, or other forms of memory impairment. These services aim to support the daily living, safety, health, and emotional well-being of patients while offering peace of mind to families and caregivers.

As of 2025, more than 6.9 million Americans are estimated to live with Alzheimer’s disease a figure projected to nearly double by 2050, according to the Alzheimer’s Association. The increasing prevalence of memory disorders is placing growing pressure on healthcare systems, family structures, and long-term care resources. Memory care facilities and services are evolving to meet this demand with integrated approaches that combine medical supervision, personalized engagement, and innovative care technologies.

Memory care settings in the U.S. range from dedicated wings within assisted living communities to specialized standalone facilities, and home care models that incorporate cognitive assistance. These models are supported by a multidisciplinary workforce of nurses, therapists, geriatricians, and trained memory care professionals. Technology is also playing a transformative role, with digital health platforms, wearable safety devices, and smart home integrations being adopted to enhance care outcomes and ensure resident safety.

The market’s growth is underpinned by expanding insurance coverage, investment from real estate developers in senior living, and public awareness initiatives. As families seek solutions that preserve dignity and improve quality of life for loved ones with memory conditions, the U.S. memory care market is transitioning from a niche offering to a mainstream healthcare service.

Major Trends in the U.S. Memory Care Market

-

Integration of Technology: Wearables, fall detection systems, and smart medication reminders are now integral components of memory care plans.

-

Rise of Home-Based Memory Care: Due to cost and personal preference, many families are opting for home care with remote cognitive support tools.

-

Expansion of Purpose-Built Facilities: Operators are designing memory care units with dementia-friendly architecture, such as circular hallways and natural lighting.

-

Person-Centered Programming: Therapeutic approaches like music therapy, memory games, and life story work are becoming standard to improve patient engagement.

-

Increased Workforce Training: Facilities are investing in specialized dementia training for all staff to improve outcomes and comply with state regulations.

-

Dementia-Friendly Community Movements: Several cities and neighborhoods are becoming certified as dementia-friendly, promoting inclusive public environments.

-

Financial Planning Services: Care providers now assist families in navigating insurance, Medicaid waivers, and veteran benefits to afford memory care.

-

Cross-Sector Collaborations: Partnerships between healthcare providers, tech firms, and senior living operators are fostering innovation in care delivery.

Report Scope of The U.S. Memory Care Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 8.59 Billion |

| Market Size by 2035 |

USD 13.79 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Service, End-use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Brookdale Senior Living; Sunrise Senior Living; Life Care Services; Five Star Senior Living; Atria Senior Living; Erickson Living; Kensington Park Senior Living; Masonicare; ProMedica Health System, Inc.; Azura Memory Care; Affinity Living Group; |

Market Driver: Aging Population and the Rising Incidence of Cognitive Disorders

A significant driver for the memory care market is the accelerating incidence of cognitive decline among the aging U.S. population. As Baby Boomers enter their late 70s and 80s, the risk of Alzheimer’s and other forms of dementia rises dramatically. Approximately one in three seniors in the U.S. dies with Alzheimer’s or another dementia-related condition. Memory loss not only impairs quality of life but also increases the likelihood of falls, infections, malnutrition, and emotional distress.

Memory care services address these issues through structured routines, 24/7 supervision, therapeutic activities, and safety infrastructure. For instance, residents in dedicated memory care communities often receive assistance with daily tasks, participate in cognitive stimulation programs, and benefit from secure living environments. Moreover, memory care offers respite to family caregivers, reducing burnout and improving overall care coordination. This demographic-driven demand ensures long-term growth potential across institutional and home-based care models.

Market Restraint: High Costs and Limited Affordability

Despite growing demand, a major restraint to memory care adoption is the high cost of services, which can be prohibitive for many families. Monthly fees for memory care in assisted living facilities often exceed $5,000 to $7,000, depending on location and level of support. Home-based memory care can also require 24-hour supervision or specialized nursing, incurring substantial recurring expenses.

While some patients qualify for Medicaid waivers or long-term care insurance, coverage gaps remain, especially for middle-income seniors who fall between eligibility thresholds. Additionally, the out-of-pocket nature of many memory care services adds financial stress to families already dealing with emotional and logistical challenges. As inflation affects staffing, food, and real estate costs, operators are passing expenses onto consumers, further widening the accessibility divide.

Market Opportunity: Technological Innovation for Remote and Personalized Care

An emerging opportunity in the U.S. memory care market lies in leveraging technology to deliver remote, personalized, and preventive support. Digital tools such as AI-based cognitive assessment apps, wearable alert systems, and remote caregiver platforms are enabling families to monitor loved ones from a distance while still maintaining high standards of care.

For instance, companies are developing smart pillboxes that alert caregivers if a dose is missed, while others use facial recognition and motion sensors to detect agitation or wandering behaviors. Telehealth capabilities also allow geriatricians and neurologists to consult with patients in memory care facilities, reducing travel stress and enabling timely interventions. These innovations hold the potential to scale care access, reduce costs, and extend independent living for patients in early to mid-stage memory decline. Companies that harness technology effectively can unlock new consumer segments and set themselves apart in a competitive market.

Segmental Insights

By Service Insights

Personal safety services dominate the service segment in the U.S. memory care market due to their critical importance in managing risks such as wandering, falls, and medication mismanagement. These services typically include GPS-enabled wearables, secure perimeters, surveillance cameras, and medical alert systems integrated with staff response protocols. Facilities that invest in comprehensive personal safety infrastructure are able to reduce hospitalizations, enhance trust among families, and improve ratings from regulatory agencies. Safety is a foundational element of memory care, making this segment indispensable for both home-based and institutional providers.

Memory exercise and activity services are the fastest growing, reflecting a broader trend toward holistic, therapeutic care models. These services include structured programs like music therapy, puzzles, life story narration, and brain games that aim to slow cognitive decline and enhance emotional engagement. Facilities offering daily cognitive routines report improved resident morale and slower progression of symptoms. Programs such as “Memory Café” sessions and intergenerational activities are also being implemented to stimulate socialization. As the focus in memory care shifts from passive supervision to active engagement, this service line is expected to gain significant traction.

By End-use Insights

Long-term care centers are the dominant end-use category, encompassing assisted living facilities, nursing homes, and memory-specific communities. These centers offer structured schedules, licensed healthcare personnel, and comprehensive support, making them the preferred choice for patients in moderate to advanced stages of memory loss. The facilities are often designed with dementia-friendly features such as enclosed gardens, soft flooring, and color-coded hallways to promote familiarity and safety. Leading operators such as Belmont Village and Brookdale Senior Living are continuously upgrading their facilities with newer safety tech and staff training programs to enhance service quality and patient satisfaction.

Home care settings are emerging as the fastest-growing segment, driven by patient preference for familiar environments and the increasing availability of mobile healthcare support. Families are turning to at-home memory care for early-stage interventions, often combining personal caregivers with remote monitoring tools and periodic nursing visits. Startups and agencies offering hybrid care models integrating virtual check-ins, cognitive coaching, and in-person assistance are rapidly expanding their market presence. As healthcare policy and technology evolve to support aging in place, home-based memory care services are poised to redefine the traditional care paradigm.

Home care settings are emerging as the fastest-growing segment, driven by patient preference for familiar environments and the increasing availability of mobile healthcare support. Families are turning to at-home memory care for early-stage interventions, often combining personal caregivers with remote monitoring tools and periodic nursing visits. Startups and agencies offering hybrid care models integrating virtual check-ins, cognitive coaching, and in-person assistance are rapidly expanding their market presence. As healthcare policy and technology evolve to support aging in place, home-based memory care services are poised to redefine the traditional care paradigm.

Country-Level Insights – United States

The U.S. is at the forefront of memory care innovation, supported by strong demographics, an advanced healthcare infrastructure, and progressive policy environments. States like California, Florida, Texas, and New York lead in terms of both facility volume and innovation. For instance, Florida’s aging population and high retirement density have made it a hotspot for memory care investments, while California’s tech ecosystem supports the development of AI-enabled cognitive health tools.

The federal government continues to invest in Alzheimer’s research, while Medicaid waiver programs at the state level are being expanded to cover home and community-based memory care services. The Department of Health and Human Services (HHS) is also working with private sector partners to standardize quality metrics and improve transparency in memory care pricing and outcomes.

Veterans Affairs facilities, faith-based communities, and non-profit organizations are also actively participating in the delivery of memory support services. As demand continues to grow and caregiver shortages persist, the U.S. memory care market will increasingly depend on scalable, tech-driven, and collaborative care models.

Some of the prominent players in the U.S. memory care market include:

Recent Developments

-

March 2024 – Belmont Village Senior Living announced a major expansion of its memory care programs across multiple U.S. cities, integrating enhanced cognitive stimulation therapies and expanding its clinical partnerships with research institutions.

-

January 2024 – StoryPoint Group revealed a strategic investment plan to increase memory care unit capacity in Michigan, Indiana, and Ohio, citing growing regional demand and positive clinical outcomes from its proprietary life enrichment programming.

-

November 2023 – Brookdale Senior Living launched a pilot AI-powered patient monitoring system that uses motion tracking and biometric sensors to detect nighttime wandering and agitation in memory care residents.

-

September 2023 – Lutheran Senior Services received a grant to develop a dementia-friendly outdoor therapy garden in St. Louis, aimed at improving sensory stimulation and reducing anxiety among residents with moderate memory impairment.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. memory care market

Service

- Memory Exercise & Activity Services

- Daily Reminder Services

- Personal Assistance Safety Services

- Dining Aids

- Communication Services

- Personal Safety Services

- Others

End-use

- Long Term Care Centers

- Home Care Settings

- Others

Home care settings are emerging as the fastest-growing segment, driven by patient preference for familiar environments and the increasing availability of mobile healthcare support. Families are turning to at-home memory care for early-stage interventions, often combining personal caregivers with remote monitoring tools and periodic nursing visits. Startups and agencies offering hybrid care models integrating virtual check-ins, cognitive coaching, and in-person assistance are rapidly expanding their market presence. As healthcare policy and technology evolve to support aging in place, home-based memory care services are poised to redefine the traditional care paradigm.

Home care settings are emerging as the fastest-growing segment, driven by patient preference for familiar environments and the increasing availability of mobile healthcare support. Families are turning to at-home memory care for early-stage interventions, often combining personal caregivers with remote monitoring tools and periodic nursing visits. Startups and agencies offering hybrid care models integrating virtual check-ins, cognitive coaching, and in-person assistance are rapidly expanding their market presence. As healthcare policy and technology evolve to support aging in place, home-based memory care services are poised to redefine the traditional care paradigm.