U.S. Pancreatic Cancer Treatment Market Size and Research

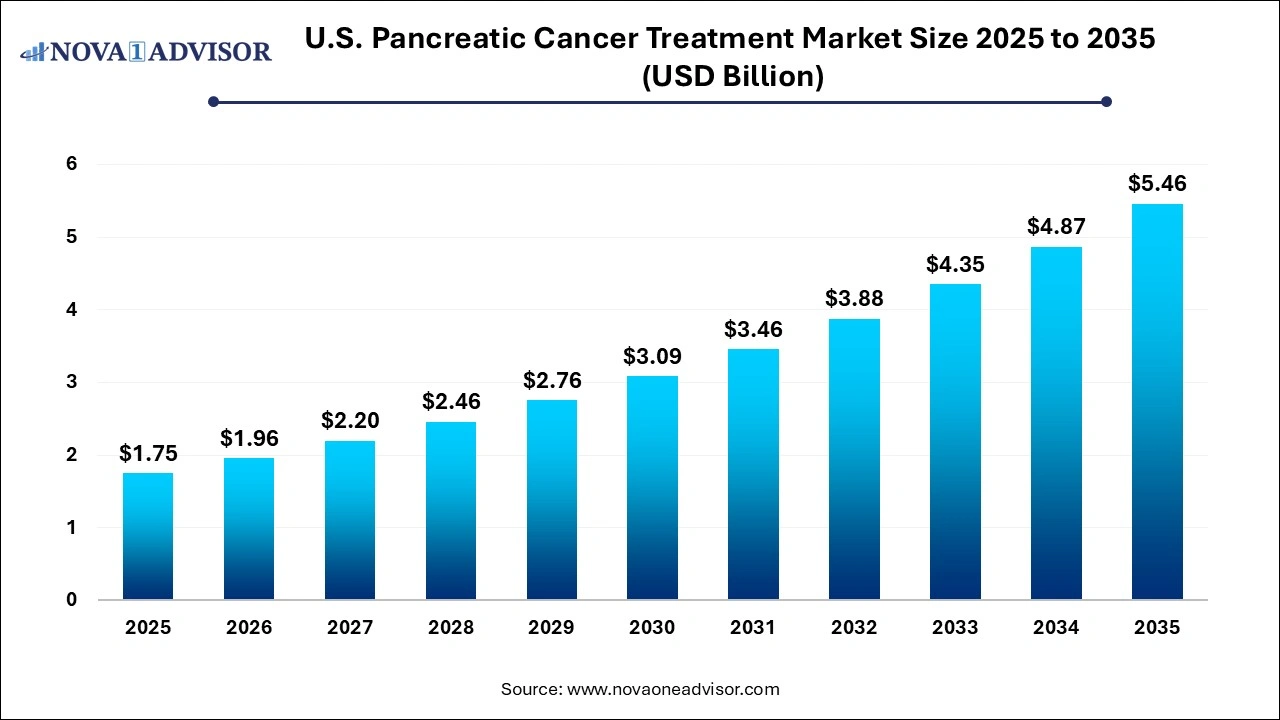

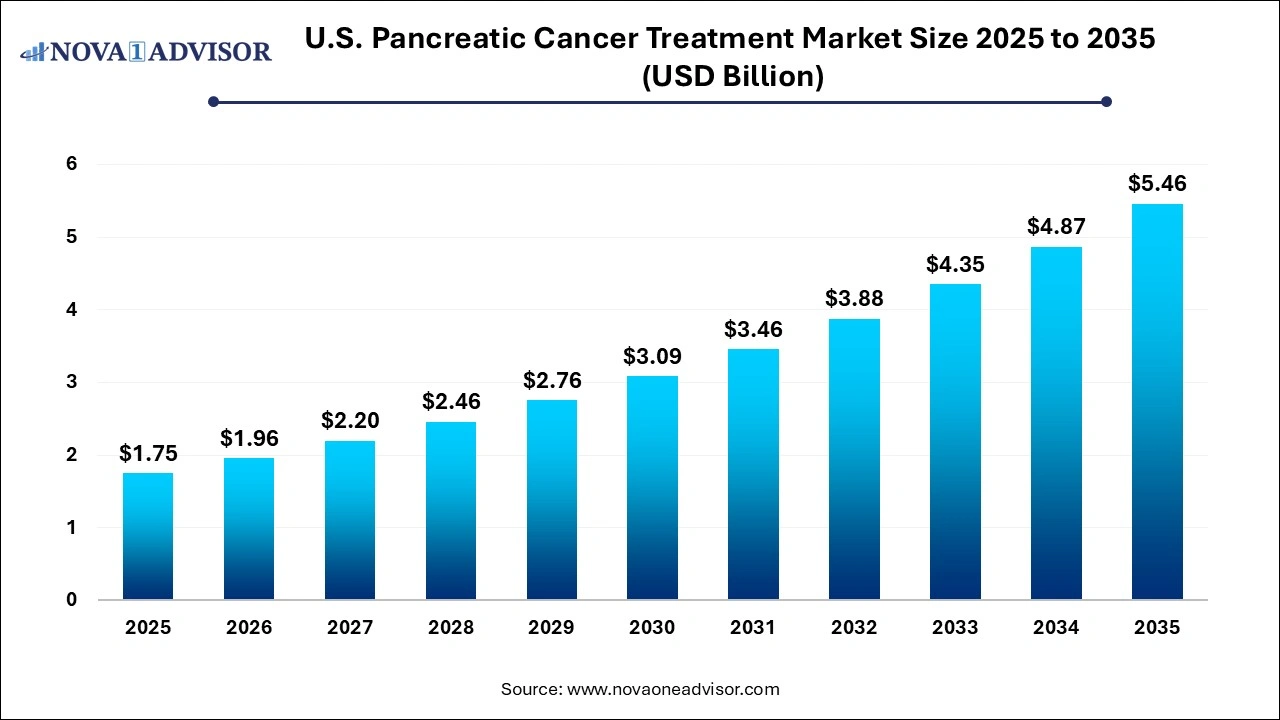

The U.S. pancreatic cancer treatment market size was exhibited at USD 1.75 billion in 2025 and is projected to hit around USD 5.46 billion by 2035, growing at a CAGR of 12.05% during the forecast period 2026 to 2035.

Market Overview

The U.S. pancreatic cancer treatment market is witnessing a critical evolution as healthcare providers, pharmaceutical innovators, and policy regulators rally to combat one of the deadliest forms of cancer. Pancreatic cancer, often referred to as a “silent killer” due to its asymptomatic early stages and poor prognosis, remains one of the most challenging oncology areas to treat. It is currently the fourth leading cause of cancer-related deaths in the U.S., and projections suggest it may become the second by the end of the decade if advancements in treatment and diagnostics do not accelerate.

Pancreatic cancer is broadly categorized into exocrine tumors, which account for the majority (over 90%) of cases, and the less common endocrine tumors. Among exocrine tumors, pancreatic ductal adenocarcinoma (PDAC) is the most prevalent and aggressive form. Late-stage diagnosis, limited treatment windows, and resistance to conventional therapies compound the complexity of managing this malignancy.

Over recent years, advances in chemotherapy regimens (such as FOLFIRINOX and gemcitabine combinations), radiation therapy protocols, immunotherapy trials, and genomic profiling have incrementally improved outcomes. Yet, median survival remains dismally low—usually less than 12 months in metastatic cases. The U.S. market reflects a robust research environment with continuous investments in targeted therapies, early diagnostic tools, and personalized medicine approaches, backed by strong clinical trial infrastructure and FDA regulatory support.

Public awareness campaigns, national cancer programs, and the efforts of advocacy organizations like PanCAN (Pancreatic Cancer Action Network) have also enhanced early detection and funding for research. The U.S. market is particularly distinguished by a collaborative ecosystem that includes academic research centers, biotech startups, and leading pharmaceutical companies, all contributing to a pipeline rich with investigational agents and innovative delivery systems.

Major Trends in the Market

-

Increased Use of Combination Therapies: New chemotherapy regimens combining multiple agents, such as FOLFIRINOX, are now widely adopted for eligible patients to extend survival.

-

Rising Investments in Immunotherapy: Checkpoint inhibitors, cancer vaccines, and adoptive T-cell therapies are under investigation, with several early-phase trials underway in U.S. academic hospitals.

-

Liquid Biopsy and Genomic Profiling Adoption: Non-invasive tests and next-generation sequencing (NGS) are being utilized to tailor treatments based on a tumor’s molecular characteristics.

-

Tele-oncology and Remote Monitoring: Expansion of virtual oncology consultations and wearable devices for symptom monitoring has gained traction post-COVID-19.

-

Emergence of mRNA-Based Therapeutics: Inspired by vaccine advances, mRNA platforms are being explored to generate tumor-specific antigens for pancreatic cancer treatment.

-

Artificial Intelligence in Oncology Workflows: AI tools are increasingly used to identify high-risk individuals, optimize treatment planning, and monitor progression in real time.

-

Financial Assistance and Access Programs: Pharma-sponsored programs and public-private partnerships are being created to improve access to expensive oncology treatments.

Report Scope of U.S. Pancreatic Cancer Treatment Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 1.96 Billion |

| Market Size by 2035 |

USD 5.46 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.05% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Treatment, Distribution Channel |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Accuray Incorporated; AstraZeneca; Novartis AG; Pfizer Inc; Genentech, Inc (Roche Holding AG); Bristol-Myers Squibb Company; Ipsen Pharma; Eli Lilly and Company; Elekta AB; Siemens Healthineers AG (Varian Medical Systems, Inc. part of the company) |

Key Market Driver: Rising Incidence and Late Diagnosis of Pancreatic Cancer in the U.S.

A core driver propelling the U.S. pancreatic cancer treatment market is the rising incidence coupled with the challenge of late-stage diagnosis. According to the American Cancer Society, over 64,000 new cases of pancreatic cancer are expected in the U.S. in 2025 alone, with the majority diagnosed at an advanced or metastatic stage. The anatomical location of the pancreas, combined with vague early symptoms such as abdominal pain or weight loss, often delays diagnosis until curative surgery is no longer viable.

This grim epidemiological reality fuels the demand for more effective systemic treatments—especially chemotherapy and radiation therapy—as surgical resection is only feasible for 15-20% of newly diagnosed cases. The growing burden of disease necessitates not just novel drugs but also better screening tools and supportive care models. The rise in obesity, type 2 diabetes, chronic pancreatitis, and aging demographics are also contributing to higher risk and case volumes, intensifying the urgency for scalable treatment solutions in the U.S.

Key Market Restraint: High Treatment Costs and Limited Survival Benefit

One of the most pressing restraints for the U.S. pancreatic cancer treatment market is the high cost of therapies relative to modest survival benefits. While newer drug combinations have demonstrated marginal improvements in progression-free survival, they often come with intense toxicity profiles and significant financial burdens. For instance, regimens like nab-paclitaxel plus gemcitabine or FOLFIRINOX may cost tens of thousands of dollars per month, excluding hospitalization, supportive care, and diagnostic expenses.

Even with insurance coverage, out-of-pocket costs for patients can be overwhelming, particularly for those undergoing extended chemotherapy cycles or radiation sessions. Moreover, the cost-effectiveness of some newer treatments is under scrutiny, especially in the absence of predictive biomarkers that can ensure patient response. This economic challenge limits broader accessibility and contributes to disparities in care, particularly among uninsured or underinsured populations in the U.S.

Key Market Opportunity: Personalized Medicine and Targeted Therapy Advancements

The rise of personalized medicine presents a transformative opportunity for the pancreatic cancer treatment market in the U.S. Advances in genomic profiling and molecular diagnostics are now enabling the identification of actionable mutations such as BRCA1/2, KRAS, and NTRK, which can inform the use of targeted therapies like PARP inhibitors or kinase inhibitors.

Moreover, initiatives like the National Cancer Institute's MATCH trial and the AACR Project GENIE have laid the groundwork for precision oncology in pancreatic cancer. These platforms are allowing oncologists to match patients with investigational agents based on genetic alterations rather than tumor location. For example, the approval of olaparib for BRCA-mutated pancreatic cancer marked a significant milestone in this approach. As sequencing becomes more affordable and accessible, this precision treatment model is expected to unlock more therapeutic avenues, increase survival, and reduce unnecessary exposure to ineffective treatments.

U.S. Pancreatic Cancer Treatment Market By Type Insights

Exocrine pancreatic cancer dominated the U.S. market in 2025, representing the vast majority of diagnosed cases and driving the highest demand for aggressive treatment strategies. This includes pancreatic ductal adenocarcinoma (PDAC), which is particularly resistant to treatment and frequently diagnosed at an advanced stage. Exocrine cancers are primarily treated with systemic chemotherapy, radiation therapy, and in some cases, palliative surgical interventions. Given the difficulty in resecting these tumors, most treatment plans revolve around life extension and quality-of-life improvement. The prevalence of PDAC and its clinical aggressiveness has led to substantial research investments in overcoming its chemoresistance.

Conversely, endocrine tumors of the pancreas, although less prevalent, represent the fastest-growing segment, largely due to better detection and diagnostic advancements. These include pancreatic neuroendocrine tumors (pNETs), which tend to grow more slowly and can be managed effectively with targeted therapies like everolimus or sunitinib. Unlike exocrine tumors, pNETs are more amenable to long-term management and sometimes surgical resection. The rising use of peptide receptor radionuclide therapy (PRRT) and the availability of more personalized treatment options make this segment increasingly important in shaping the future of niche pancreatic cancer therapies.

U.S. Pancreatic Cancer Treatment Market By Treatment Insights

The Chemotherapy remains the dominant treatment modality in the U.S. pancreatic cancer treatment landscape, owing to its central role in managing both resectable and unresectable cases. Gemcitabine-based regimens and FOLFIRINOX combinations continue to be standard-of-care options for patients eligible for systemic therapy. Despite the modest survival benefits, chemotherapy is widely accessible and forms the cornerstone of most treatment pathways, either as adjuvant, neoadjuvant, or palliative care. Its dominance is also driven by its ability to be used across all stages and subtypes of pancreatic cancer, making it indispensable in the current therapeutic arsenal.

However, radiation therapy is emerging as the fastest-growing treatment segment, particularly with advances in precision radiation techniques such as stereotactic body radiation therapy (SBRT). These newer technologies allow for high-dose radiation delivery with minimal impact on surrounding tissues, offering better local control with fewer side effects. The growing role of radiation in borderline resectable tumors and its integration into neoadjuvant strategies has led to increased adoption. Furthermore, the convergence of radiation with immunotherapy in clinical trials is opening new possibilities, contributing to this segment’s accelerated growth.

U.S. Pancreatic Cancer Treatment Market By Distribution Channel Insights

Hospital pharmacies dominated the distribution channel segment in 2025, driven by the fact that most pancreatic cancer treatments, especially chemotherapy and radiation, are administered in hospital settings. Given the intensive nature of oncology care, which includes infusions, inpatient management of side effects, and surgical procedures, the hospital environment remains the primary hub for treatment access. Hospital pharmacies ensure the availability of high-cost oncology drugs, manage supportive care medications, and coordinate closely with multidisciplinary teams to ensure timely drug administration and dosing adjustments.

On the other hand, retail pharmacies are experiencing the fastest growth, particularly as oral chemotherapy agents and targeted therapies become more prevalent. Drugs like olaparib and everolimus, used for specific genetic profiles and neuroendocrine tumors, can be dispensed in outpatient settings. Additionally, the integration of specialty pharmacy services and mail-order drug delivery models is making it easier for patients to manage long-term medication regimens from home. This shift not only enhances convenience but also reduces hospitalization costs and improves adherence, especially for patients on chronic therapy.

Country-Level Analysis – United States

The U.S. stands as one of the most active markets globally for pancreatic cancer research and treatment, with a multi-stakeholder ecosystem including federal agencies (e.g., NIH, NCI), academic cancer centers (e.g., MD Anderson, Mayo Clinic, Dana-Farber), and private pharmaceutical and biotech companies. The country’s robust clinical trial infrastructure supports early-phase innovation and rapid market entry for new drugs.

States like California, New York, and Massachusetts serve as hubs for biotech innovation and clinical research, while the Southeastern U.S. reports some of the highest incidences of pancreatic cancer, correlating with risk factors like obesity and diabetes. Public health initiatives are increasingly focused on high-risk populations, genetic screening, and early detection programs. Despite high costs, the U.S. benefits from the availability of advanced diagnostics, novel treatment access, and patient support organizations.

Ongoing FDA approvals and fast-track designations for promising agents highlight the U.S. commitment to addressing the high mortality associated with pancreatic cancer. The country is likely to maintain its leadership position due to a continuous pipeline of therapies under development and strong patient advocacy networks that influence funding and policy priorities.

Some of the prominent players in the U.S. pancreatic cancer treatment market include:

- Accuray Incorporated

- AstraZeneca

- Novartis AG

- Pfizer Inc

- Genentech, Inc (Roche Holding AG)

- Bristol-Myers Squibb Company

- Ipsen Pharma

- Eli Lilly and Company

- Elekta AB

- Siemens Healthineers AG (Varian Medical Systems, Inc., part of the company)

U.S. Pancreatic Cancer Treatment Market Recent Developments

-

In March 2025, Rafael Pharmaceuticals announced positive Phase 2 trial results for devimistat, a targeted therapy aimed at disrupting cancer cell metabolism in pancreatic cancer patients.

-

Immunovia, a diagnostics company, launched its IMMray PanCan-d blood test in January 2025, designed to aid in early detection of pancreatic cancer in high-risk individuals across select U.S. cancer centers.

-

In December 2024, AstraZeneca received accelerated FDA approval for the expanded use of Lynparza (olaparib) in BRCA-mutated metastatic pancreatic cancer as a maintenance therapy post-chemotherapy.

-

Bristol Myers Squibb, in October 2024, initiated a new U.S.-based clinical trial evaluating nivolumab in combination with radiation therapy for locally advanced pancreatic cancer.

-

In February 2025, PanCAN and the National Cancer Institute announced a public-private partnership to advance early detection biomarkers and fund first-in-human clinical trials for novel therapeutics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. pancreatic cancer treatment market

By Type

By Treatment

- Chemotherapy

- Radiation Therapy

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others