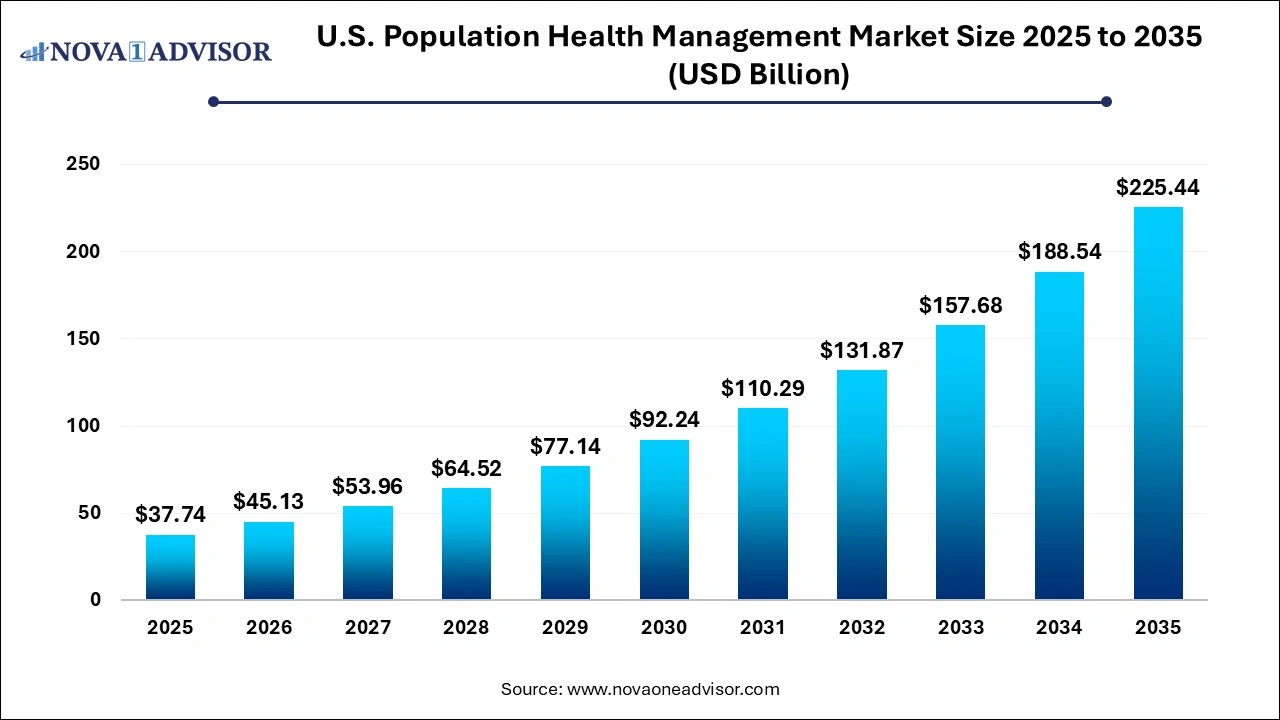

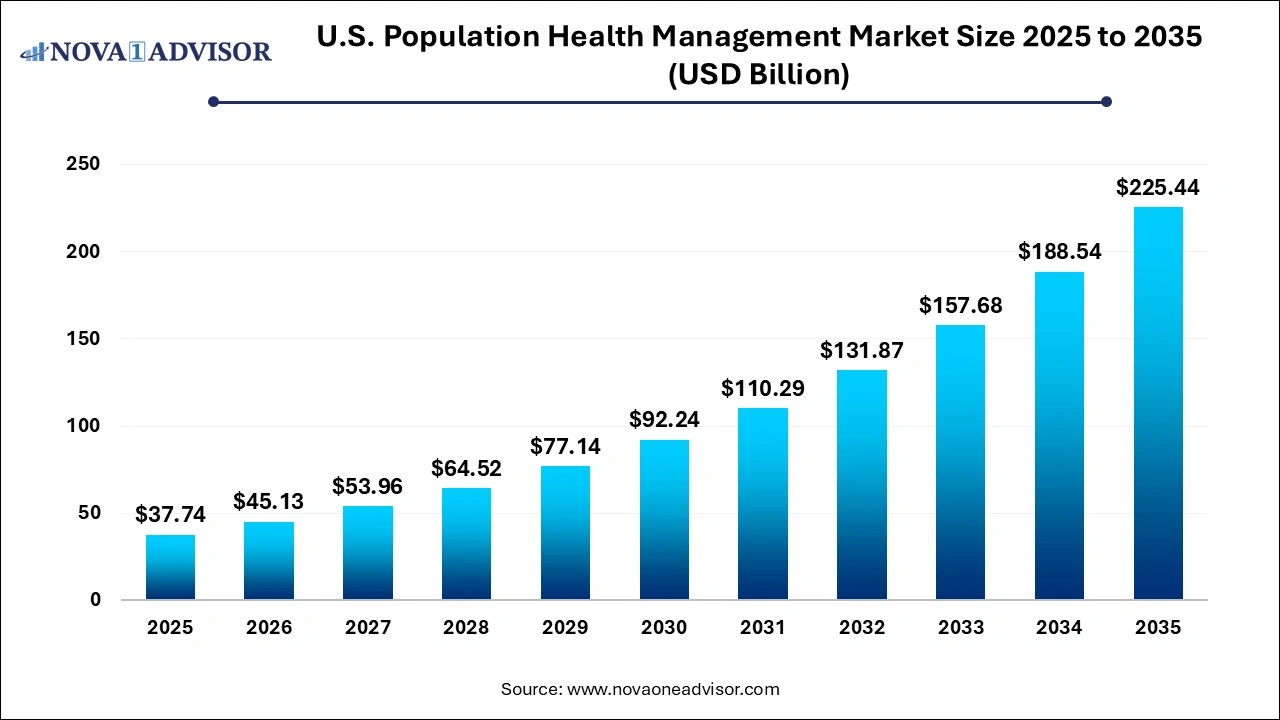

U.S. Population Health Management Market Size and Growth 2026 to 2035

The U.S. population health management market size was exhibited at USD 37.74 billion in 2025 and is projected to hit around USD 225.44 billion by 2035, growing at a CAGR of 19.57% during the forecast period .

Key Takeaways:

- The services segment dominated the market in 2025 with a revenue share of more than 51.97%.

- The software segment is expected to register the fastest CAGR of 19.72% over the forecast years.

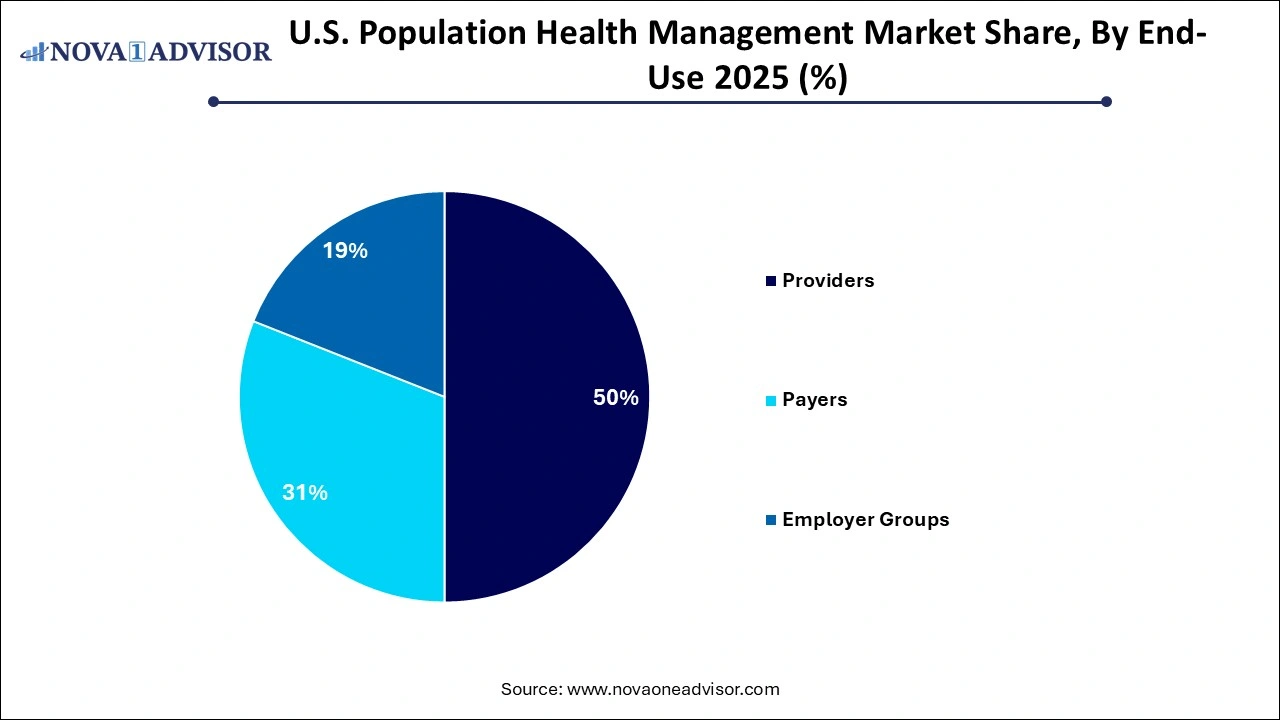

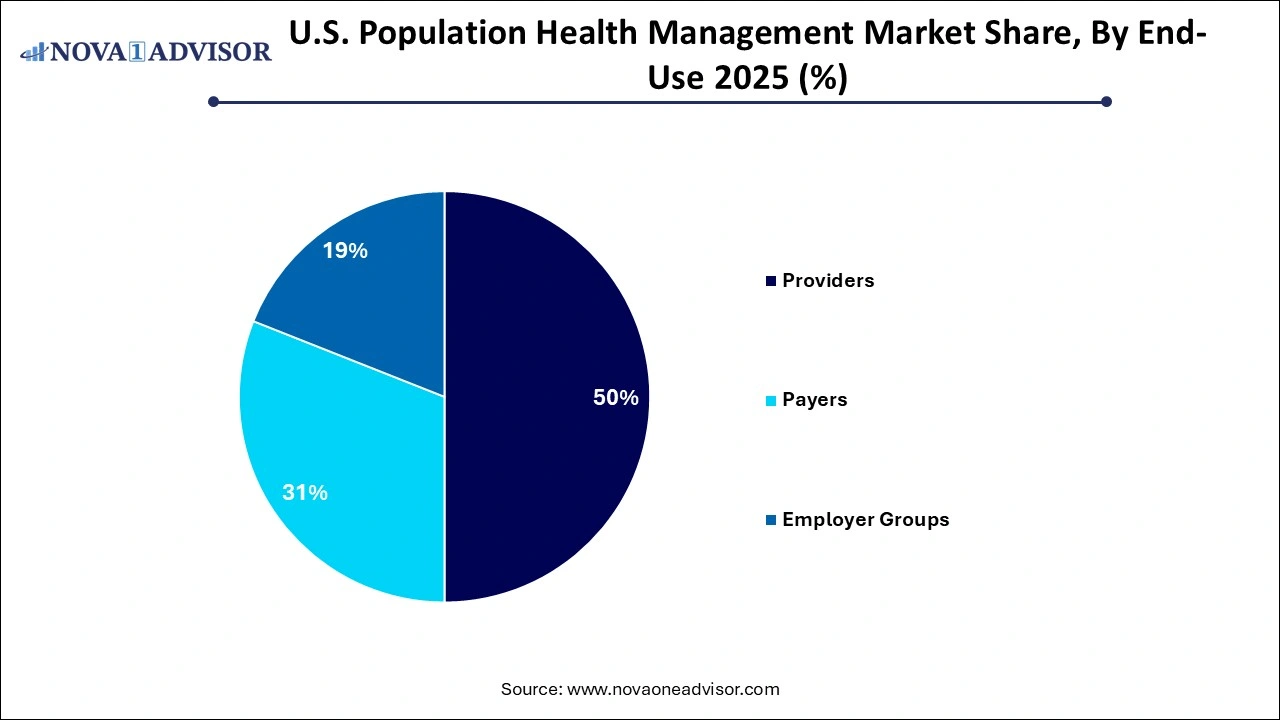

- Based on end use, the market is segmented into providers, payers, and employer groups, out of which, providers held a majority of the market share of over 49.85% in 2025.

- The employer group end use segment is expected to emerge as the fastest-growing segment with a CAGR of 21.23% during the forecast period.

U.S. Population Health Management Market Overview

The U.S. Population Health Management (PHM) market represents a critical cornerstone in the nation’s journey toward value-based care. It encapsulates a suite of strategies, technologies, and data-driven approaches aimed at improving the health outcomes of defined populations while controlling costs. As healthcare in the U.S. shifts from a fee-for-service model to value-based frameworks, PHM has gained immense prominence among payers, providers, and public health stakeholders alike.

At its core, PHM involves the proactive management of populations by aggregating patient data across multiple health information technology resources, analyzing that data into actionable insights, and stratifying patients by risk levels. This data enables care coordination and targeted interventions for high-risk, high-cost individuals an essential function in managing chronic diseases like diabetes, hypertension, COPD, and heart failure that account for the majority of U.S. healthcare expenditure.

The Affordable Care Act (ACA) and subsequent CMS initiatives such as the Medicare Shared Savings Program (MSSP) have been significant catalysts in promoting accountable care organizations (ACOs), which are key adopters of PHM platforms. Additionally, the rising adoption of electronic health records (EHRs), wearable health devices, telemedicine platforms, and AI-driven analytics has fueled exponential growth in the PHM ecosystem. These tools help integrate disparate data sources from hospital visits to pharmacy usage into a single comprehensive view of a patient’s health journey.

The U.S. market is also being reshaped by the increasing influence of social determinants of health (SDoH), which contribute up to 80% of health outcomes. As a result, population health strategies are expanding to include socioeconomic factors such as housing, food security, and education moving beyond just clinical metrics. By doing so, healthcare organizations are developing more holistic intervention models that aim not just to treat, but to prevent.

Major Trends in the U.S. Population Health Management Market

-

Value-Based Care Acceleration: Transition from fee-for-service to value-based reimbursement models continues to drive the adoption of PHM tools.

-

Integration of Social Determinants of Health (SDoH): PHM platforms are increasingly incorporating non-clinical data such as income, housing, and education to improve care strategies.

-

AI-Powered Risk Stratification: Advanced machine learning algorithms are being used to predict patient risk and automate care coordination.

-

Telehealth Synergies: Telemedicine and PHM platforms are converging to extend care beyond hospitals and clinics into patient homes.

-

EHR Interoperability: Enhanced integration of EHRs and Health Information Exchanges (HIEs) is enabling seamless population-level data analysis.

-

Personalized Outreach: PHM solutions are offering customized care plans and communication strategies tailored to individual patient preferences.

-

Mobile Health Expansion: The use of apps and wearable devices to collect real-time patient data is revolutionizing proactive monitoring.

-

Public-Private Collaborations: States and commercial payers are collaborating on data-sharing initiatives and pilot programs to scale PHM tools.

Report Scope of The U.S. Population Health Management Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 45.13 Billion |

| Market Size by 2035 |

USD 225.44 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 19.57% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Scope |

U.S. |

| Key Companies Profiled |

Allscripts Healthcare; Cerner Corp.; Conifer Health Solutions, LLC; EClinicalWorks; Enli Health Intelligence; McKesson Corp.; Medecision; Optum, Inc.; Advisory Board; Koninklijke Philips N.V.; Athenahealth, Inc.; RedBrick Health; Welltok |

U.S. Population Health Management Market Driver

Surge in Chronic Disease Prevalence

The U.S. is witnessing a sharp rise in the prevalence of chronic conditions, which continues to be the primary driver behind the increasing demand for population health management solutions. According to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the U.S. suffer from at least one chronic disease, and 4 in 10 have two or more. Chronic illnesses account for nearly 90% of the nation’s $4.3 trillion in annual healthcare expenditures.

This trend has pushed healthcare providers and payers to adopt PHM tools that allow early identification, tracking, and personalized interventions for patients at risk. For example, PHM platforms enable flagging of diabetic patients who have missed screenings or are overdue for medication refills. Using such data-driven insights, providers can execute timely outreach, prevent complications, and reduce hospitalizations. The ability to manage chronic diseases at scale not only improves patient outcomes but also optimizes resource allocation and significantly cuts costs for healthcare systems.

U.S. Population Health Management Market Restraint

Data Integration and Interoperability Challenges

Despite widespread digitization of healthcare systems, a significant restraint in the U.S. PHM market remains the lack of seamless data integration and interoperability across care settings. Healthcare data is often fragmented, stored in different formats across EHRs, pharmacy systems, labs, insurance databases, and patient-generated sources. This siloed data environment hampers effective population-level analysis and coordinated care.

For example, a patient visiting an urgent care center might have their records stored separately from their primary care provider or pharmacy. Without a unified view, healthcare professionals may miss critical information that affects diagnosis or treatment. Moreover, data-sharing regulations such as HIPAA, though essential for privacy, add complexity to integration efforts. Although health information exchanges (HIEs) are improving the landscape, inconsistencies in data standards and reluctance among organizations to share information remain hurdles. This affects the real-time performance and utility of PHM platforms, limiting their ability to deliver full-spectrum care insights.

U.S. Population Health Management Market Opportunity

Rise of Predictive Analytics and AI in Healthcare

An emerging and transformative opportunity within the U.S. PHM market lies in the integration of predictive analytics and artificial intelligence (AI). These technologies are redefining how patient data is analyzed, enabling earlier interventions, risk mitigation, and resource optimization. By identifying hidden patterns in structured and unstructured health data, AI algorithms can forecast potential hospital admissions, readmissions, or disease exacerbations before they occur.

For example, predictive tools can flag patients with a high probability of emergency room visits based on their medication adherence, socio-demographic profile, past behaviors, and biometric readings. Such early warnings can prompt care coordinators to intervene proactively, potentially saving lives and reducing costs. Major U.S. health systems like Kaiser Permanente and Cleveland Clinic are already leveraging predictive AI models for patient triage and chronic disease management. As data lakes grow richer and real-time analytics become the norm, the integration of AI into PHM platforms will provide significant competitive advantages to healthcare organizations focused on preventive, value-driven care.

By Product Insights

Services dominated the product segment due to their essential role in providing operational, strategic, and clinical support to organizations adopting PHM models. Service providers typically offer consulting, training, implementation, and analytics support to ensure seamless integration of PHM platforms into existing healthcare infrastructures. In large healthcare systems, outsourced services are instrumental in managing tasks like data aggregation, regulatory compliance, and care coordination. Companies such as Optum and Cerner offer end-to-end services that encompass everything from population risk stratification to engagement strategy development. Given the complexity and customization required for PHM implementation, services continue to play a foundational role in driving outcomes.

Software is the fastest-growing segment, spurred by the digitization of care, rise of big data, and increasing need for real-time patient analytics. Cloud-based PHM platforms offer modular and scalable solutions capable of integrating data from EHRs, wearables, and insurance claims. These platforms provide intuitive dashboards that enable care teams to monitor cohorts, track performance metrics, and automate workflows. Examples include IBM Watson Health and Epic's Healthy Planet, which use AI to suggest interventions based on patient behavior and risk scores. As providers and payers seek greater autonomy and cost efficiency, software-based PHM tools are becoming indispensable for real-time decision-making and personalized care delivery.

By End Use Insights

Providers hold the dominant position in the end-use segment as hospitals, physician groups, and Accountable Care Organizations (ACOs) remain the primary users of PHM tools. These entities are directly involved in patient care delivery and hence rely on PHM systems to identify at-risk populations, close care gaps, and coordinate interdisciplinary teams. Integrated Delivery Networks (IDNs) such as Mayo Clinic and Providence Health have deployed robust PHM strategies to reduce readmissions and boost preventive care outcomes. Additionally, the shift towards value-based reimbursement has incentivized providers to adopt outcome-oriented tools to maximize their performance under CMS and private payer models.

Payers are emerging as the fastest-growing segment, largely due to their ability to collect large-scale longitudinal data and their increasing involvement in preventive care. Health insurers like Anthem and UnitedHealthcare are using PHM platforms to manage population risk, assess plan performance, and design targeted member engagement programs. Payers also have unique access to pharmacy, diagnostic, and cost data, enabling them to offer more holistic and financially optimized care plans. Their expanding partnerships with technology firms to deploy predictive analytics, SDoH tracking, and mobile health management platforms are propelling this segment’s growth.

Payers are emerging as the fastest-growing segment, largely due to their ability to collect large-scale longitudinal data and their increasing involvement in preventive care. Health insurers like Anthem and UnitedHealthcare are using PHM platforms to manage population risk, assess plan performance, and design targeted member engagement programs. Payers also have unique access to pharmacy, diagnostic, and cost data, enabling them to offer more holistic and financially optimized care plans. Their expanding partnerships with technology firms to deploy predictive analytics, SDoH tracking, and mobile health management platforms are propelling this segment’s growth.

Country-Level Insights – United States

The U.S. is at the epicenter of population health management innovation, driven by its unique combination of fragmented care delivery, high healthcare costs, and strong government push for accountable care models. Federal mandates under MACRA (Medicare Access and CHIP Reauthorization Act) and the shift towards value-based purchasing have provided fertile ground for PHM adoption. The Centers for Medicare & Medicaid Services (CMS) continues to fund alternative payment models that require robust population-level data analytics, care coordination, and performance measurement.

Private-sector innovation is equally dynamic. U.S.-based health systems are pioneering risk-based contracts with commercial payers, leveraging PHM solutions to enhance performance metrics and bonuses. Furthermore, the U.S. workforce’s tech-savviness and growing reliance on digital health tools have made it easier for providers and employers to roll out PHM initiatives through mobile apps, virtual coaching, and patient portals. State-level initiatives, such as California’s Health Information Exchange expansion or New York’s Medicaid Redesign Team (MRT), also highlight localized government efforts to use PHM for better public health outcomes. These factors solidify the U.S. as the most mature and dynamic market for population health management globally.

Some of the prominent players in the U.S. population health management market include:

Recent Developments

-

January 2025 – Epic Systems announced the integration of real-time SDoH tracking within its PHM tool “Healthy Planet,” enabling providers to address issues like housing insecurity and food deserts during care planning.

-

March 2025 – UnitedHealthcare launched a new population health collaboration with American Well, aimed at integrating telehealth into PHM platforms to improve chronic care outreach for rural populations.

-

February 2025 – Optum, a part of UnitedHealth Group, unveiled a next-generation PHM analytics engine powered by AI and machine learning, enhancing real-time risk stratification and predictive modeling capabilities.

-

December 2024 – Cerner Corporation (now Oracle Health) expanded its partnership with the U.S. Department of Veterans Affairs, enhancing population health tracking tools across 130+ VA medical centers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. population health management market.

Product

End-use

- Providers

- Payers

- Employer Groups

Payers are emerging as the fastest-growing segment, largely due to their ability to collect large-scale longitudinal data and their increasing involvement in preventive care. Health insurers like Anthem and UnitedHealthcare are using PHM platforms to manage population risk, assess plan performance, and design targeted member engagement programs. Payers also have unique access to pharmacy, diagnostic, and cost data, enabling them to offer more holistic and financially optimized care plans. Their expanding partnerships with technology firms to deploy predictive analytics, SDoH tracking, and mobile health management platforms are propelling this segment’s growth.

Payers are emerging as the fastest-growing segment, largely due to their ability to collect large-scale longitudinal data and their increasing involvement in preventive care. Health insurers like Anthem and UnitedHealthcare are using PHM platforms to manage population risk, assess plan performance, and design targeted member engagement programs. Payers also have unique access to pharmacy, diagnostic, and cost data, enabling them to offer more holistic and financially optimized care plans. Their expanding partnerships with technology firms to deploy predictive analytics, SDoH tracking, and mobile health management platforms are propelling this segment’s growth.