U.S. Single-use Bioprocessing Market Size and Research

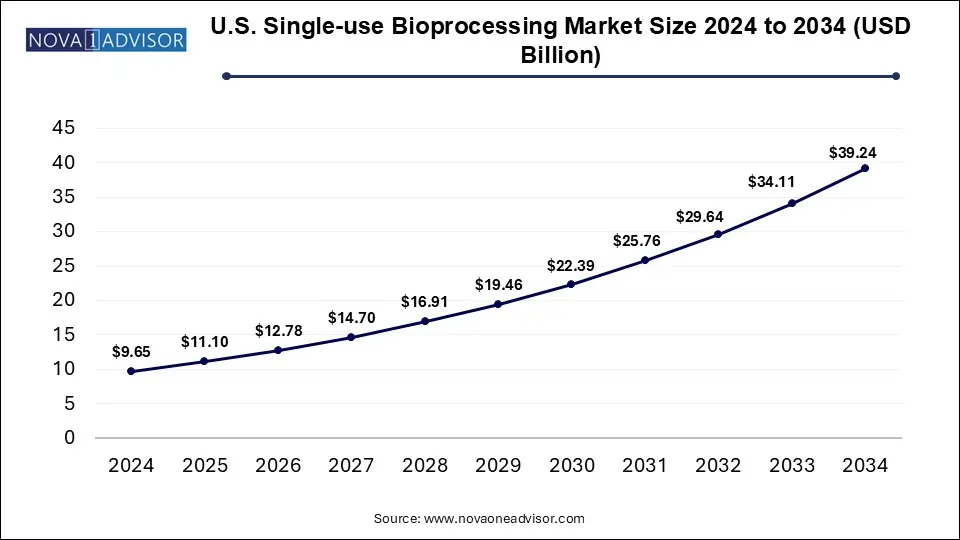

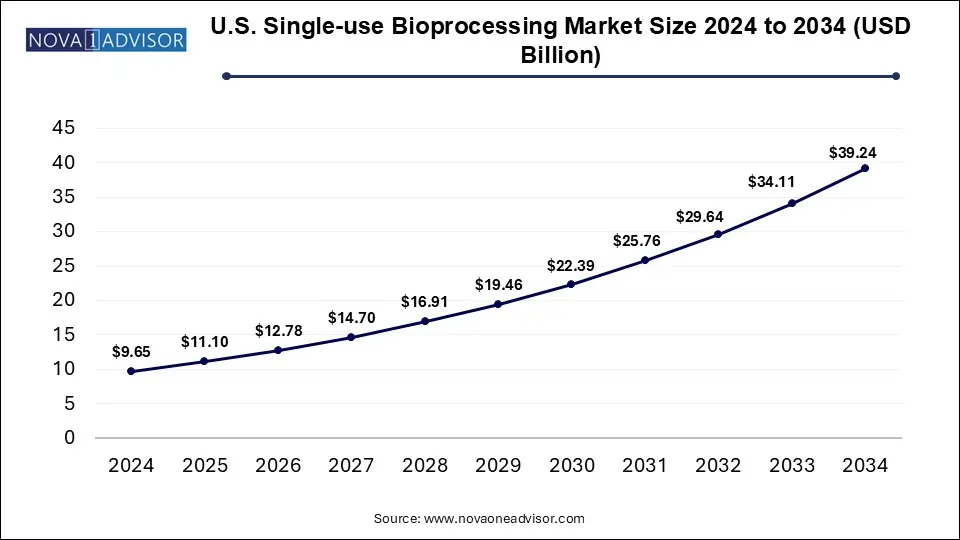

The U.S. single-use bioprocessing market size is calculated at USD 9.65 billion in 2024, grows to USD 11.10 billion in 2025, and is projected to reach around USD 39.24 billion by 2034, grow at a CAGR of 15.06% from 2025 to 2034. The U.S. single-use bioprocessing market is expanding with the rising use of single-use bioreactors, growing demand for biopharmaceuticals and automation of bioprocessing technologies.

U.S. Single-use Bioprocessing Market Key Takeaways:

- By product, the simple & peripheral elements segment dominated the market with the largest share in 2024.

- By product, the apparatus & plants segment is expected to show the fastest growth over the forecast period.

- By workflow, the upstream segment accounted for the highest market share in 2024.

- By workflow, the fermentation segment is expected to expand rapidly during the predicted timeframe.

- By end use, the biopharmaceutical manufacturers segment held the largest market share in 2024.

- By end use, the academic & clinical research institutes segment is expected to register fastest growth during the forecast period.

Market Overview

The U.S. single-use bioprocessing market represents a transformative shift in the biopharmaceutical manufacturing landscape. Traditionally, bioprocessing has relied on stainless-steel equipment and clean-in-place (CIP) systems that involve intensive labor, time, and capital expenditure. However, with the rise of biologics, increasing demand for flexible manufacturing, and a need for faster production cycles, single-use technologies (SUTs) have emerged as a preferred alternative. Single-use bioprocessing systems (SUBs) are pre-sterilized, disposable systems used in the production of biologics, vaccines, and biosimilars.

The U.S. leads globally in both innovation and adoption of these technologies. With a robust biotechnology sector, highly developed R&D infrastructure, and a dynamic network of contract manufacturing organizations (CMOs) and contract research organizations (CROs), the country continues to witness exponential growth in demand for scalable, agile, and contamination-free bioprocessing solutions. The COVID-19 pandemic further highlighted the need for rapid scale-up, driving unprecedented adoption of single-use systems in vaccine and therapeutic production. Today, U.S. facilities use single-use equipment across all phases of biologics development, from early-stage cell culture to commercial manufacturing.

How is the U.S. Single-use Bioprocessing Market Evolving?

Single-use bioprocessing (SUB), also called as disposable bioprocessing or single-use technology (SUT) refers to utilization of disposable components and equipment in biopharmaceutical manufacturing by replacing traditional stainless steel systems for production of single batch and then discarding them. These systems are applied across various stages of biopharmaceutical manufacturing such as upstream processing, downstream processing, fil-finish, preparation and storage of media and buffer as well as for drug product transport and storage.

Increasing demand for biopharmaceuticals in the large U.S. populations, continuous advancements in SUT offering enhanced scalability and reduced risk of contamination, automation of bioprocessing procedures and cost-efficiency is driving the adoption of SUB by various biopharmaceutical manufacturers and research organizations. Expanding biopharmaceutical manufacturing market with the increasing number of biopharmaceutical companies as well as rising trend of outsourcing research and manufacturing processes to Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) is fuelling the growth the U.S. single-use bioprocessing market.

What Are the Key Trends in the U.S. Single-use Bioprocessing Market in 2025?

- In June 2025, Qosina, a supplier of single-use components for medical devices, formed a strategic collaboration with Sealed Air, a packaging specialist. The partnership facilitated the addition of Nexcel Bio1250, a robust, co-extruded bioprocessing bag film to Qosina’s portfolio of bioprocessing products.

- In January 2025, PBS Biotech, a supplier of novel single-use bioreactor systems and bioprocess development services, received $17 million as an additional growth funding from Avego Management, LLC and BroadOak Capital Partners. The funds will be deployed for accelerating PBS’ new product advancement, process development services and improvement of quality systems, further expanding and improving company’s offerings in the cell therapy industry and reducing market reach time of life-saving therapies for its customers.

Where is AI Finding Applications in the U.S. Single-use Bioprocessing Market?

Increased adoption of artificial intelligence (AI) and machine learning in the U.S. single-use bioprocessing market is enhancing the efficiency, scalability and sustainability of biomanufacturing processes. AI algorithms can be applied for predicting critical process parameters (CPPs) by analyzing sensor data, further allowing timely adjustments for maintaining optimal conditions. Optimization of various elements of bioprocessing such as bioreactor design, cell culture and media formulation can be achieved with the help of AI. Personalized medicine approaches and simulation of human diseases by deploying AI models can potentially accelerate development of new therapies. Automation of bioprocessing systems with AI-powered solutions can streamline tasks such as cell culture and purification, further minimizing human error. Development of smart drug delivery systems with AI can improve the safety and efficacy of therapeutic agents.

Report Scope of U.S. Single-use Bioprocessing Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 11.10 Billion |

| Market Size by 2034 |

USD 39.24 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Workflow, End use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Avantor, Inc., Corning Incorporated, Danaher, Eppendorf SE, Lonza, Merck KGaA, Meissner Filtration Products, Inc., PBS Biotech, Inc., Sartorius AG, Thermo Fisher Scientific, Inc. |

Market Dynamics

Drivers

Demand for Biologics and Scaling-up Biomanufacturing Processes

Rising investments by biopharmaceutical industries for the development of biologics such as vaccines and monoclonal antibodies as well as for expanding product pipeline is driving the adoption of scalable and flexible manufacturing processes such as single-use systems. Furthermore, single-use bioprocessing systems enables quick scaling of production up or down as well as allows easy switching between various products without the need for extensive cleaning and validation processes, further aligning with the evolving therapeutic needs of the industry.

Restraints

High Costs and Environmental Impact

Single-use manufacturing facility involves high initial investment for setting up specialized infrastructure and equipment designed specifically for these systems. Scalability limitations for large-scale commercial production of single-use disposable components can be quite costly, as compared to small scale production. Additionally, recurring maintenance costs and increased purchases of disposable components, especially for large-scale production can significantly impact the market growth.

Rising environmental concerns with the use of single-use systems and lack of sustainable solutions for effective waste management of these systems, mostly made from plastic polymers is potentially impacting the environment. Complexities in disposing these components such as use of costly methods like incineration due to their biohazardous nature is leading to rise in greenhouse gas levels and overall carbon footprint.

Opportunities

Increasing Adoption of Single-use Technologies and Sustainability Initiatives

Continuous advancements in cell and gene therapies, growing demand for biologics and biosimilars, increased emphasis on personalized medicine, development of hybrid manufacturing facilities as well as automation and digitalization of biomanufacturing processes is driving the adoption of single-use technologies. Moreover, stringent regulations and guidelines deployed by the Environmental Protection Agency (EPA) for reducing the environmental impact of these systems is leading to development of sustainable solutions by manufacturers. Implementation of biodegradable materials and focus on circular economy by manufacturers is accelerating regulatory approvals of single-use bioprocessing systems, further creating opportunities for market growth.

Segmental Insights

Why did the Simple & Peripheral Elements Segment Dominate the Market in 2025?

By product, the simple & peripheral elements segment captured the largest market share in 2024. Simple and peripheral elements are necessary for fluid transfer, monitoring and sampling procedures in bioprocessing workflows. Improvements in sensor technology, innovations in material science, customized single-use assemblies, automation bioprocessing workflows, focus on developing biodegradable and biocompatible products are some of the key advancements in single-use bioprocessing enhancing the efficacy and reliability of biomanufacturing processes. Various companies are offering advanced technologies with customizable options and are launching innovative products, further expanding their market presence and streamlining biomanufacturing processes for their customers.

By product, the apparatus & plants segment is expected to register the fastest growth during the forecast period. Single-use bioreactors (SUBs) are widely used in upstream bioprocessing workflows for cell culture and fermentation processes. Manufacturers are focused on developing SUBs for various scales and process needs such as from research and development to commercial production through continuous improvements in design, use of innovative materials and automation. Rising demand for biologics, advanced therapies and need for scaling up vaccine production processes is fuelling the demand for single-use apparatus.

How Upstream Segment Dominated the Market in 2024?

By workflow, the upstream segment dominated the market with the highest share in 2024. Upstream processes focus on the early stages of biomanufacturing which involves use of single-use bioprocessing solutions. Single-use technologies offer various benefits in upstream processing such as increased flexibility, faster production cycles, improved control over process parameters, enhanced reproducibility, cost-effectiveness, and no need for cleaning and sterilizing equipment which drives their adoption. Single-use bioreactors, single-use filtration systems, single-use mixers, and single-use tubing and connectors are the single-use technologies utilized in upstream bioprocessing.

Furthermore, increasing demand for biologics such as gene therapies and monoclonal antibodies, rising investments in R&D activities, continuous advancements in single-use components, government support, and growing number of Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs) are the factors driving the market dominance of the upstream segment.

By workflow, the fermentation segment is anticipated to show the fastest growth over the forecast period. The market growth of this segment is driven by the various advantages of single-use fermenters such as quick setup, fast changeovers and reduce time for cleaning validation for initial stages of research & development as well as for production of materials required in clinical trial settings. These systems allow exploration of various kinds of microbial strains, media and conditions, further leading to cost-effective production processes in both large-scale and small-scale production settings. Enhanced sterility, mitigation of cross-contamination risks, and elimination of Clean-in-Place (CIP) and Steam-in-Place (SIP) cycles with single-use fermenters is driving their adoption.

What Made Biopharmaceutical Manufacturers the Dominant Segment in 2024?

By end use, the biopharmaceutical manufacturers segment accounted for the largest market share in 2024. Rising adoption and setting up of single-use bioprocessing facility by biopharmaceutical manufacturers due to their cost efficiency and reduced capital expenditure is driving the market expansion. Increased flexibility and scalability with the addition of single-use systems offering development of diverse product portfolios is helping in effective management of evolving consumer needs in the fluctuating market and meet the growing demand for new product pipelines. Expansion of biologics sector, favorable government initiatives, accelerated development tines, continuous advancements in single-use technologies, shift towards patient-specific therapies and increased support by the FDA are the factors driving the market growth. Single-use facilities can rapidly deploy and scale up manufacturing of therapeutic proteins and vaccines in response urgent health needs such as pandemics and other emergencies.

By end use, the academic & clinical research institutes segment is expected to expand rapidly during the predicted timeframe. Academic and clinical research focuses on development of new drug candidates, small-scale experimentation and process optimization studies which involves the use of single-use systems offering agility and flexibility for accelerating the R&D cycles. Low capital investments and reduced operational costs, especially for small-scale productions in various research projects and early stage clinical trials drives the adoption of single-use systems. Furthermore, large number of academic institutes and research organizations in the U.S. focused on development of innovative therapies as well as increased government support are driving the market expansion of this segment.

Country-Level Analysis

Increased government influence in the U.S. single-use bioprocessing market through substantial investments in R&D purposes, rising regulatory approvals and funding provided for deploying biopharmaceutical manufacturing initiatives has developed a favourable environment for adoption of single-use technologies for bioprocessing. Companies in the U.S are focused on implementation of go-to-market strategies such as targeted product development focusing on specific applications, strategic partnerships, leveraging digital marketing approaches, competitive pricing, strengthening distributing network, management of customer relationship and addressing environmental concerns for effectively positioning themselves in the booming U.S. single-use bioprocessing market.

Recent Developments

- In November 2024, Thompson Street Capital Partners (TSCP) in collaboration with its portfolio company, Savillex, completed the acquisition of Optimum Processing, Inc., a producer of tailored, single-use bioprocessing systems.

- In September 2024, the life sciences business of Merck, MilliporeSigma announced the launch of Mobius ADC Reactor, a single-use reactor specifically designed for manufacturing antibody drug conjugates (ADCs).

- In September 2024, FUJIFILM Irvine Scientific, Inc., disclosed the progress of Oceo Rover which is a first-of-its-kind single-use technology system for improving bioprocessing workflows by automating and simplifying the hydration of buffers, feeds and media. The automated system is designed for enhancing bioprocessing workflows for biopharmaceutical manufacturers.

- In June 2024, Thermo Fisher Scientific Inc., launched an innovative solution, biobased films for its single-use technology bioprocessing containers (BPCs) which are built on Thermo Fisher’s their existing Aegis and CX film offerings. The biobased films are designed for eliminating carbon emissions from plastic resin and have acquired an International Sustainability and Carbon Certification (ISCC) PLUS certification.

Some of the prominent players in the U.S. single-use bioprocessing market include:

- Avantor, Inc.

- Corning Incorporated

- Danaher

- Eppendorf SE

- Lonza

- Merck KGaA

- Meissner Filtration Products, Inc.

- PBS Biotech, Inc.

- Sartorius AG

- Thermo Fisher Scientific, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. single-use bioprocessing market

Product

- Simple & Peripheral Elements

-

- Tubing, Filters, Connectors, & Transfer Systems

- Bags

- Sampling Systems

- Probes, Sensors, & Flow Meters

-

-

- pH Sensor

- Oxygen Sensor

- Pressure Sensors

- Temperature Sensors

- Conductivity Sensors

- Flow Meters & Sensors

-

-

- Upto 1000L

- Above 1000L to 2000L

- Above 2000L

-

- Mixing, Storage, & Filling Systems

- Filtration System

- Chromatography Systems

- Pumps

- Others

-

- Cell Culture System

- Syringes

- Others

Workflow

- Upstream

- Fermentation

- Downstream

End-use

- Biopharmaceutical Manufacturer

-

- CMOs & CROs

- In-house Manufacturer

- Academic & Clinical Research Institutes