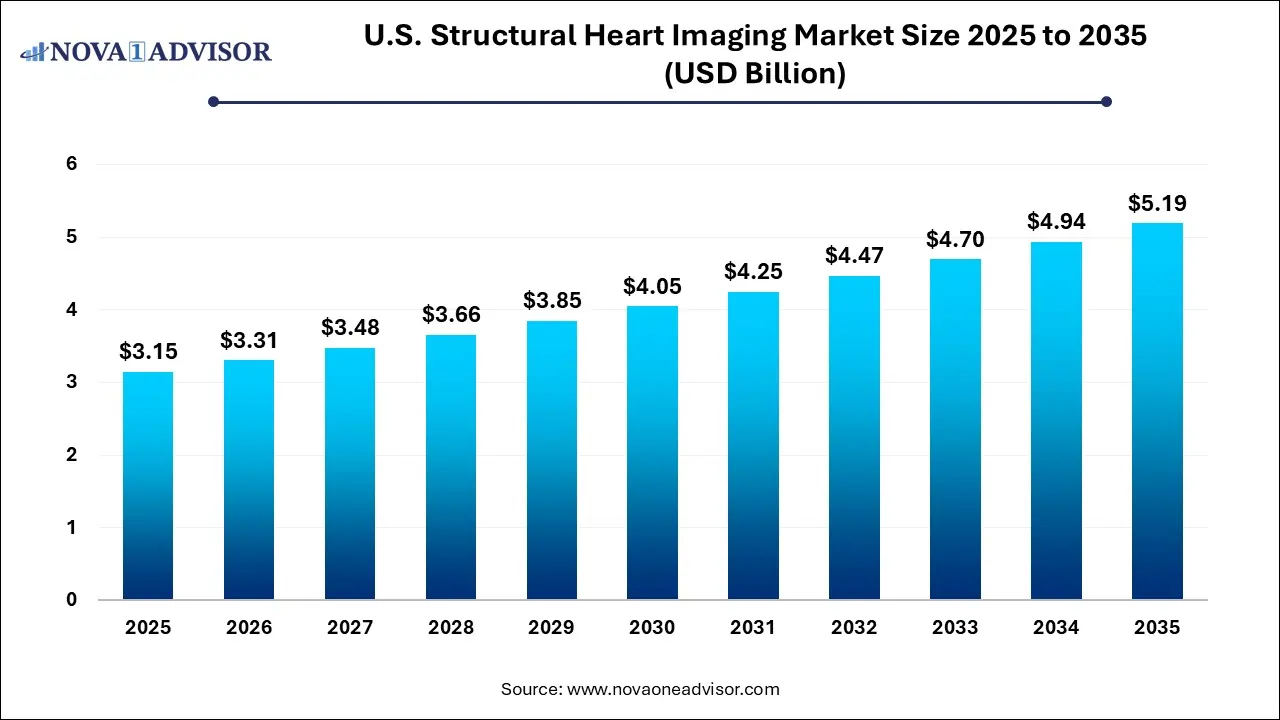

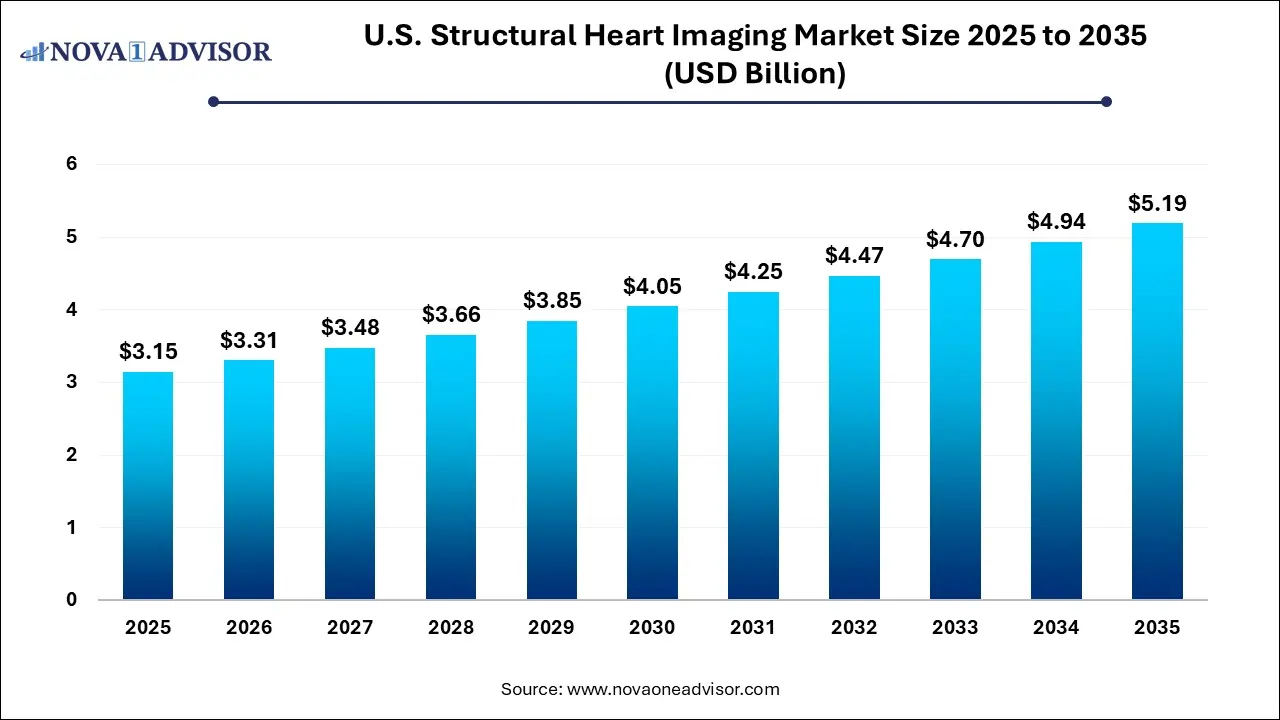

U.S. Structural Heart Imaging Market Size and Growth

The U.S. structural heart imaging market size was exhibited at USD 3.15 billion in 2025 and is projected to hit around USD 5.19 billion by 2035, growing at a CAGR of 5.13% during the forecast period 2026 to 2035.

Market Overview

The U.S. structural heart imaging market represents a crucial intersection between diagnostic imaging technologies and the evolving domain of structural heart interventions. Structural heart diseases (SHD), which include defects and abnormalities in the heart's valves, walls, chambers, and vessels, have become increasingly prevalent due to the aging population and the rising burden of cardiovascular risk factors such as hypertension, diabetes, and obesity.

Imaging plays an indispensable role in both diagnosing and treating these conditions. From screening congenital defects to guiding transcatheter procedures such as TAVR (Transcatheter Aortic Valve Replacement) and TMVR (Transcatheter Mitral Valve Repair), advanced imaging modalities have transformed the clinical landscape. In the United States, where the adoption of innovative cardiac care is comparatively higher, the structural heart imaging ecosystem is witnessing a surge in demand, driven by robust healthcare infrastructure, increased procedure volumes, and growing preference for minimally invasive cardiac interventions.

The market encompasses a wide range of modalities, including echocardiograms, cardiac computed tomography (CT), cardiac magnetic resonance imaging (MRI), angiography, and nuclear imaging. These modalities support preoperative planning, intra-procedural guidance, and post-procedural monitoring making them indispensable across the care continuum. Moreover, the evolution of 3D imaging, artificial intelligence (AI)-based image analytics, and fusion imaging technologies is enhancing procedural outcomes and enabling physicians to personalize therapies.

Major Trends in the Market

-

Increased adoption of 3D and 4D echocardiography to improve precision in pre-procedural planning and real-time intraoperative guidance.

-

AI and machine learning integration in cardiac imaging for automated measurement, anomaly detection, and workflow optimization.

-

Rising procedural volume of TAVR and TMVR, driving the need for high-resolution multimodal imaging for accurate sizing and deployment.

-

Growth in hybrid operating rooms that integrate interventional cardiology with real-time imaging platforms.

-

Technological innovations in cardiac CT and MRI, allowing better soft tissue visualization without invasive catheterization.

-

Increased prevalence of structural heart disease in aging population, necessitating longitudinal imaging monitoring.

-

Strategic partnerships between device manufacturers and imaging companies to offer bundled procedural solutions.

-

Expansion of outpatient cardiac imaging centers, offering same-day diagnostics and follow-ups.

Report Scope of U.S. Structural Heart Imaging Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 3.31 Billion |

| Market Size by 2035 |

USD 5.19 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.13% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Modality, Procedure, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Siemens Healthineers; GE Healthcare; Koninklijke Philips N.V.; Canon Medical Systems; Fujifilm Holdings Corporation; Shanghai United Imaging Healthcare Co., LTD; Abbott; Terumo Corporation; Samsung Medison Co., Ltd.; Lepu Medical Technology |

Market Driver: Rising Prevalence of Structural Heart Diseases and Transcatheter Procedures

A pivotal driver for the U.S. structural heart imaging market is the increasing prevalence of structural heart diseases and the corresponding growth in transcatheter procedures. According to the CDC, cardiovascular diseases remain the leading cause of death in the U.S., and many of these stem from structural abnormalities like valvular stenosis or regurgitation. Conditions such as aortic stenosis, which commonly affect individuals over the age of 65, are being treated increasingly via transcatheter approaches due to lower surgical risks.

As the volume of TAVR, TMVR, and LAAC (Left Atrial Appendage Closure) procedures grows, so does the demand for detailed imaging throughout the patient journey. Imaging is essential for initial diagnosis, eligibility assessment, intra-procedural navigation, and post-treatment surveillance. Modalities like 3D echocardiography and cardiac CT are indispensable for valve sizing and anatomical mapping. This dynamic has resulted in a significant expansion of imaging infrastructure, equipment procurement, and training programs across U.S. hospitals and outpatient cardiac centers.

Market Restraint: High Cost of Advanced Imaging Modalities and Procedures

One of the most critical restraints impeding the full-scale adoption of structural heart imaging technologies is the high cost associated with advanced imaging modalities and procedures. Technologies such as cardiac MRI and CT angiography require sophisticated equipment, trained professionals, and dedicated imaging labs. The initial capital expenditure for these systems—often exceeding several million dollars—poses a financial barrier for smaller healthcare institutions and rural clinics.

Moreover, procedures such as TMVR or LAAC that depend on intraoperative imaging necessitate hybrid ORs and real-time imaging integration, further increasing infrastructural and operational costs. While large metropolitan hospitals can absorb these costs, community hospitals and standalone diagnostic centers may struggle to invest. Additionally, disparities in reimbursement policies can make it challenging for facilities to recover imaging costs, particularly when dealing with Medicare or Medicaid patients.

Market Opportunity: Technological Integration of AI and Image-Guided Interventions

A promising opportunity in the U.S. structural heart imaging market lies in the technological integration of AI and image-guided interventions. Artificial intelligence is rapidly being adopted across the imaging spectrum, offering clinicians enhanced capabilities such as automated segmentation, anomaly detection, and 3D reconstructions. These tools reduce interpretation time, enhance diagnostic precision, and support complex surgical decision-making.

Several AI-powered imaging software solutions are now FDA-approved, enabling real-time assessment of cardiac structure and function. In the context of procedures like TAVR or TMVR, AI assists in virtual valve sizing and anatomical simulations, significantly reducing operative risks. The opportunity is particularly significant for vendors who can combine imaging hardware with AI-driven software to deliver end-to-end solutions. As hospitals seek to reduce procedural times and improve outcomes, demand for AI-integrated imaging platforms will likely see exponential growth in the coming years.

U.S. Structural Heart Imaging Market By Modality Insights

The echocardiogram segment dominates the U.S. structural heart imaging market due to its non-invasive nature, real-time capabilities, and widespread clinical utility. Transthoracic echocardiography (TTE) remains the first-line diagnostic tool for valvular heart diseases, congenital anomalies, and chamber assessment. Transesophageal echocardiography (TEE) offers even greater clarity for evaluating structures like the mitral and aortic valves, especially before and during TAVR and TMVR procedures. The adoption of 3D and 4D echocardiography is further propelling the segment, enabling volumetric imaging and enhanced intraoperative guidance.

On the other hand, cardiac CT is witnessing the fastest growth, particularly in the planning and assessment of TAVR procedures. It provides precise anatomical measurements of the aortic root and coronary arteries, which are essential for prosthetic valve sizing. Cardiac CT is also increasingly used in coronary artery assessment, adding value to the structural heart workup. MRI and nuclear imaging are utilized selectively for functional assessment and tissue viability, but their growth is comparatively slower due to cost and availability factors.

U.S. Structural Heart Imaging Market By Procedure Insights

TAVR stands as the leading procedure driving imaging demand in the U.S. structural heart imaging market. Approved for use in high, intermediate, and even low-risk patients, TAVR has seen exponential adoption since its FDA approval. Accurate imaging—via echocardiography, CT, and angiography—is essential at every stage, from eligibility screening to deployment and post-procedure monitoring. The surge in TAVR cases has directly fueled imaging equipment upgrades across U.S. cardiovascular centers.

Meanwhile, Transcatheter Mitral Valve Repair (TMVR) is growing at the fastest rate, reflecting innovation in mitral valve devices and a high prevalence of mitral regurgitation in aging adults. TMVR requires even more intricate imaging due to the complex anatomy of the mitral valve. As new TMVR systems enter clinical trials and receive FDA clearance, demand for high-fidelity 3D imaging is expected to rise sharply. Procedures like LAAC and annuloplasty also rely heavily on real-time imaging, contributing to the segment’s overall expansion.

U.S. Structural Heart Imaging Market By Application Insights

The diagnostic imaging segment dominates the market, supported by a broad base of patients undergoing routine cardiac evaluations. With increased awareness and regular screening for heart murmurs, congenital anomalies, and valvular dysfunctions, demand for echocardiography and other non-invasive imaging modalities remains robust. Diagnostic imaging is foundational for clinical decision-making and is routinely integrated into cardiovascular risk assessments.

However, interventional cardiology represents the fastest-growing segment, as structural heart procedures move from surgical to catheter-based approaches. These interventions are heavily reliant on intra-procedural imaging for device navigation, deployment, and outcome verification. For example, TEE and angiography are essential during valve implantations, while CT and MRI offer preoperative mapping and follow-up surveillance. As hybrid ORs and cath labs continue to expand, the imaging needs of interventional cardiologists are expected to grow significantly.

U.S. Structural Heart Imaging Market By End-use Insights

Hospitals and clinics dominate the U.S. structural heart imaging market due to their role in comprehensive cardiac care. These facilities are equipped with advanced imaging modalities, cath labs, and surgical suites to handle both diagnostics and interventional procedures. Academic medical centers and large hospital chains are particularly active in adopting the latest imaging platforms, including AI-assisted tools and fusion imaging systems.

Diagnostic imaging centers, however, are the fastest-growing end-use segment. The push toward outpatient imaging services—offering convenience, shorter wait times, and competitive pricing—is driving this trend. These centers increasingly cater to patients needing pre- or post-procedural imaging, and many are partnering with cardiology practices to provide integrated care. As reimbursement policies evolve and technology becomes more accessible, imaging centers are expected to capture a growing share of procedural imaging services.

Some of the prominent players in the U.S. structural heart imaging market include:

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips N.V.

- Canon Medical Systems

- Fujifilm Holdings Corporation

- Shanghai United Imaging Healthcare Co., LTD

- Abbott

- Terumo Corporation

- Samsung Medison Co., Ltd.

- Lepu Medical Technology

U.S. Structural Heart Imaging Market Recent Developments

-

March 2025 – Philips launched a new AI-enabled echocardiography platform optimized for structural heart applications, including 4D real-time visualization during TAVR.

-

February 2025 – GE HealthCare partnered with Cleveland Clinic to co-develop imaging protocols for TMVR and LAAC procedures using hybrid imaging suites.

-

December 2024 – Siemens Healthineers announced FDA clearance for its cardiac CT scanner with enhanced soft tissue resolution and lower radiation exposure.

-

October 2024 – Canon Medical Systems introduced an MRI-guided procedural platform aimed at non-contrast cardiac imaging, reducing nephrotoxic risks in renal-compromised patients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. structural heart imaging market

By Modality

- Echocardiogram

- Angiogram

- CT

- MRI

- Nuclear Imaging

- Other Modalities

By Procedure

- Transcatheter Aortic Valve Replacement (TAVR)

- Surgical Aortic Valve Replacement (SAVR)

- Transcatheter Mitral Valve Repair (TMVR)

- Left Atrial Appendage Closure (LAAC)

- Tricuspid Valve Replacement and Repair

- Paravalvular Leak Detection and Repair

- Annuloplasty

- Valvuloplasty

- Other Structural Heart Procedures

By Application

- Diagnostic Imaging

- Interventional Cardiology

By End-use

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Diagnostic Imaging Centers

- Other End Use