U.S. Variable Frequency Drive Market Size and Trends

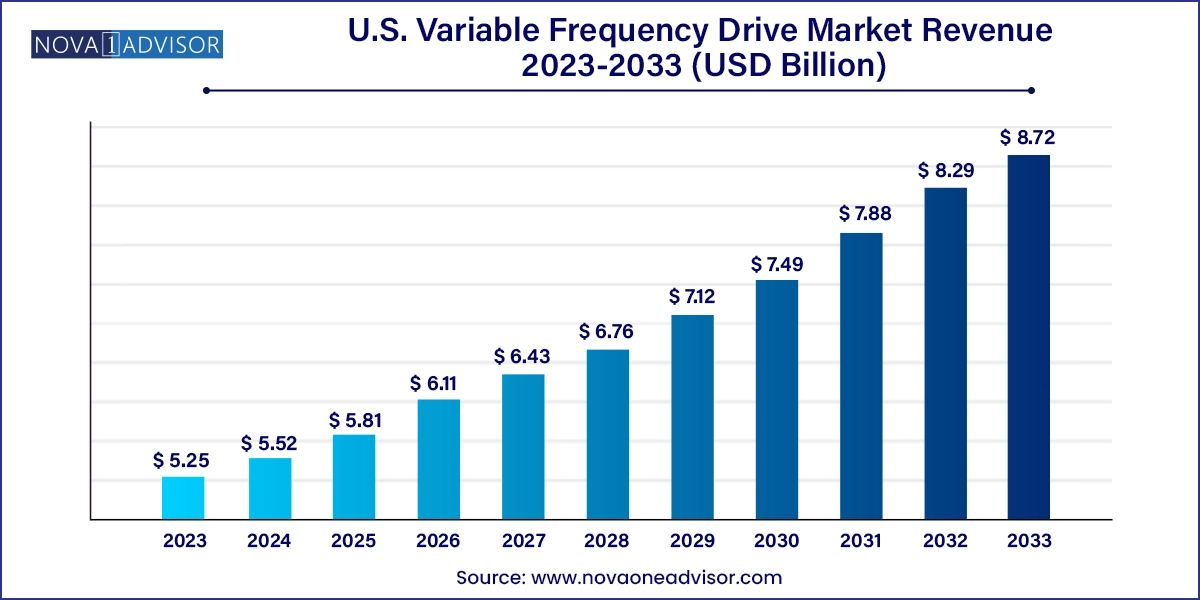

The U.S. variable frequency drive market size was exhibited at USD 5.25 billion in 2023 and is projected to hit around USD 8.72 billion by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

U.S. Variable Frequency Drive Market Key Takeaways:

- The oil & gas segment accounted for the largest revenue share of 20.66% in the market in 2023.

- The infrastructure segment is expected to advance at the fastest CAGR during the forecast period.

- In terms of power range, the micro (0-5 kW) segment accounted for the leading revenue share of 34.17% in 2023.

- Meanwhile, the low (6-40 kW) power drive segment is expected to advance at the fastest growth rate through 2033.

- Based on application, pumps accounted for the leading revenue share of 29.43% in 2023 in the U.S. variable frequency drive market.

- The HVAC segment, on the other hand, is expected to advance at the highest CAGR during the forecast period.

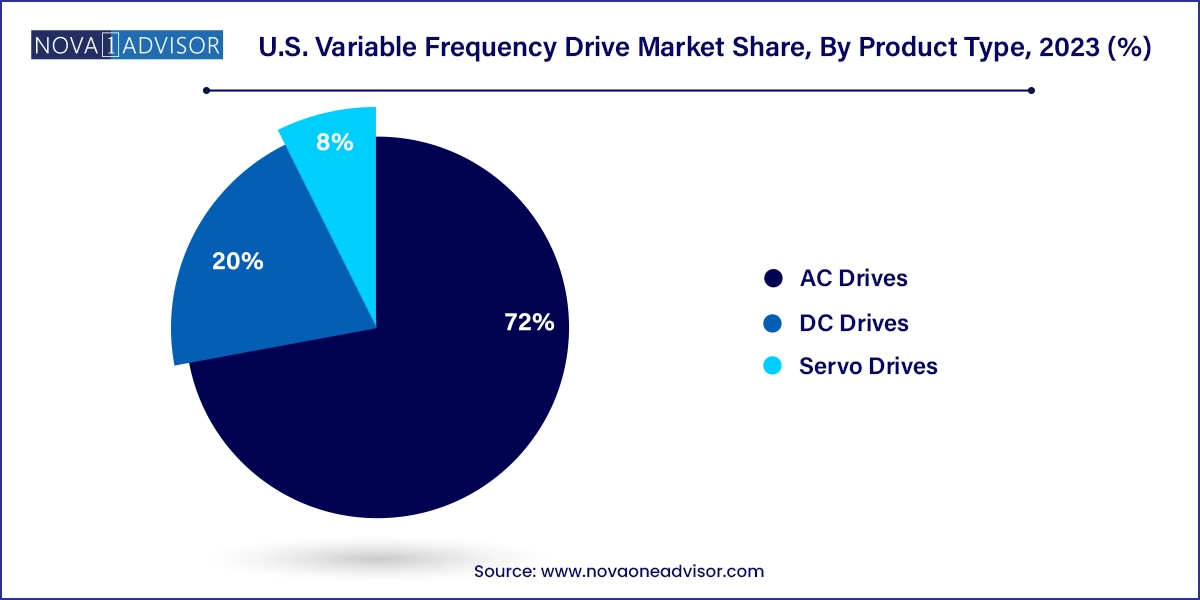

- The AC drive segment accounted for a dominant share of 72.0% in the U.S. market for variable frequency drives in 2023.

- The DC drives segment accounted for a substantial revenue share in the market in 2023.

- Southern U.S. accounted for the highest revenue share of 31.46% in 2023

- The Midwest U.S. region is expected to advance at the fastest CAGR during the assessment period.

Market Overview

The U.S. Variable Frequency Drive (VFD) market has emerged as a cornerstone in the modernization of industrial and infrastructure systems. VFDs—also known as adjustable-speed drives or inverters—are electronic devices used to control the speed and torque of electric motors by varying the input frequency and voltage. These systems are instrumental in optimizing energy use, reducing mechanical stress, and improving process control across a wide array of applications, from HVAC systems to industrial automation lines.

Historically, the adoption of VFDs was driven by the need to enhance energy efficiency, especially in large-scale industrial processes. However, the market has evolved significantly due to digitization, the rise of smart manufacturing, stringent energy regulations, and growing electrification across sectors. With the U.S. aiming to reduce greenhouse gas emissions and modernize its aging infrastructure, VFDs play a pivotal role in enabling operational efficiency and sustainability.

Today, VFDs are embedded across sectors like oil & gas, automotive, power generation, and commercial buildings, with new opportunities opening up in electric vehicle (EV) manufacturing, renewable energy systems, and food & beverage automation. The U.S. remains one of the most mature VFD markets globally, supported by a strong manufacturing base, high electricity costs (which incentivize energy savings), and regulatory incentives from entities like the Department of Energy (DOE) and Environmental Protection Agency (EPA).

Major Trends in the Market

-

Integration of VFDs into Smart Grids and IIoT Ecosystems: VFDs are increasingly being linked with Industrial Internet of Things (IIoT) platforms for remote diagnostics, energy monitoring, and predictive maintenance.

-

Growth of HVAC-focused VFD Installations in Commercial Infrastructure: As energy codes tighten, commercial buildings are installing VFDs in HVAC systems to comply with standards like ASHRAE 90.1 and LEED.

-

Rising Demand for Compact, High-efficiency Servo Drives: Servo drives are gaining popularity in robotics, CNC machines, and semiconductor manufacturing.

-

Customization and Modularization of Drive Systems: End-users now demand modular drives tailored to specific applications, allowing easy upgrades and replacements.

-

Electrification of Industrial Transport Systems: Conveyor belts, hoists, and cranes are being electrified and equipped with VFDs for better control and safety.

-

Surge in Micro and Low Power Range VFDs for Small Equipment: These are ideal for fans, pumps, and compressors in small-scale industrial and commercial applications.

-

Growth of Regenerative VFDs: These systems can recover braking energy and feed it back into the grid, aligning with green energy strategies.

-

Shift Toward Cloud-based VFD Monitoring: VFDs with embedded communication protocols (Modbus, EtherCAT, Profibus) are enabling cloud analytics and performance benchmarking.

Report Scope of U.S. Variable Frequency Drive Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.52 Billion |

| Market Size by 2033 |

USD 8.72 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Power Range, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S. |

| Key Companies Profiled |

ABB Ltd.; General Electric; Hitachi, Ltd.; Schneider Electric; SIEMENS AG; Eaton; Addison Electric, Inc.; Rockwell Automation, Inc.; Yaskawa Electric Corporation; Johnson Controls International |

Market Driver: Emphasis on Energy Efficiency and Regulatory Compliance

A primary driver of the U.S. VFD market is the intensifying focus on energy efficiency, driven by both regulatory mandates and economic incentives. According to the U.S. Department of Energy, electric motors account for nearly 70% of electricity use in manufacturing sectors. VFDs enable variable-speed operation, helping motors operate closer to load demand, which can reduce energy consumption by 30-50% in some applications like pumps and fans.

Federal and state-level programs—such as the DOE’s Advanced Manufacturing Office and utility-sponsored rebate schemes—offer financial support for facilities that deploy energy-saving technologies, including VFDs. Furthermore, compliance with evolving standards such as NEMA Premium and ISO 50001 is pushing industrial players to invest in efficient motor control systems. As companies aim to meet their ESG (Environmental, Social, and Governance) goals, VFDs serve as a low-hanging fruit for rapid ROI through energy savings and process optimization.

Market Restraint: High Initial Cost and Complex Installation

Despite the clear benefits, one significant restraint to VFD adoption—particularly in small and mid-sized enterprises—is the high initial investment and the complexity involved in system integration. In addition to the VFD unit, costs can include sensors, protective enclosures, cabling, filters, and software. Installation requires specialized expertise, especially when retrofitting into legacy systems.

Moreover, without proper harmonics mitigation, VFDs can introduce electrical noise into the system, potentially affecting other equipment. These technical and financial barriers discourage some end-users, especially those operating on tight capital expenditure budgets or lacking in-house engineering resources. Therefore, vendors must provide bundled services, including training, technical support, and turnkey integration, to unlock adoption in price-sensitive segments.

Market Opportunity: Expansion in Electric Vehicles and Smart Manufacturing

An exciting growth opportunity lies in the rapid expansion of electric vehicle (EV) manufacturing and the broader transition to Industry 4.0. EV assembly lines and battery manufacturing facilities use precise motor control for automation in tasks such as welding, painting, material handling, and packaging. Servo drives, in particular, are critical for the fine control needed in robotics and motion-centric tasks.

Simultaneously, smart factories deploying sensors, cloud computing, and machine learning are integrating VFDs with real-time control systems to enable dynamic adjustments based on load, ambient conditions, and predictive maintenance cues. VFDs that support real-time data sharing via industrial communication protocols (e.g., Ethernet/IP, OPC UA) are gaining preference. As manufacturing re-shoring gains momentum in the U.S., the demand for digitally integrated VFDs will grow substantially.

U.S. Variable Frequency Drive Market By End-use Insights

Industrial end-use dominated the market, given the extensive application of VFDs in motors, conveyors, compressors, blowers, and mixers. Sectors such as manufacturing, metallurgy, pulp and paper, and chemical processing rely on VFDs to improve throughput, extend equipment lifespan, and reduce operational costs. Industrial players benefit from VFD integration by gaining fine control over speed and torque, ensuring smoother operations and fewer mechanical failures.

The automotive sector is the fastest-growing end-use, particularly in the wake of expanding EV manufacturing capacity in the U.S. Automation-heavy environments such as body assembly, painting, stamping, and powertrain manufacturing are incorporating VFDs for precise motion control. With large-scale EV facilities being set up by Tesla, Ford, GM, and Rivian, the demand for VFD-driven systems such as robotic arms and material handling equipment is surging.

U.S. Variable Frequency Drive Market By Power Range Insights

The low power range (6-40 kW) segment dominated the market, finding use in medium-sized fans, compressors, and material handling systems. These drives are widely adopted in both commercial buildings and mid-sized industrial setups where moderate loads are present. Their energy-saving potential and ease of integration make them attractive for retrofit projects as well as greenfield installations.

The micro (0–5 kW) range is growing fastest, especially as small equipment like packaging machines, ventilation systems, and water booster pumps integrate VFDs to enhance performance. This segment is gaining traction among small and medium enterprises (SMEs), who are under pressure to optimize energy use and remain competitive. The affordability and compact size of these drives are making them viable in space-constrained applications.

U.S. Variable Frequency Drive Market By Application Insights

Pumps are the largest application segment, as they are ubiquitous in water treatment, irrigation, HVAC, and chemical processing systems. VFDs in pump applications allow pressure and flow to be controlled dynamically, reducing energy consumption, eliminating valve-based throttling, and minimizing pump wear. Municipal water systems and industrial fluid handling have adopted VFDs for optimizing pumping schedules and ensuring system longevity.

HVAC is the fastest-growing application, fueled by rising demand for sustainable building operations, regulatory pressure to lower emissions, and the integration of smart climate control systems. VFDs in HVAC systems allow fan speeds, compressors, and chiller systems to operate based on real-time demand. Their use is expanding in hospitals, data centers, universities, and LEED-certified buildings where climate control and energy efficiency are top priorities.

U.S. Variable Frequency Drive Market By Product Type Insights

AC drives dominate the U.S. variable frequency drive market, accounting for the largest market share. AC drives are used extensively in controlling induction motors across industries due to their compatibility, cost-effectiveness, and reliability. They are ideal for HVAC systems, water pumps, fans, and industrial compressors. The availability of a wide range of AC drives (from micro to high power) tailored for diverse applications has made them the preferred choice in both legacy and new installations.

Servo drives are the fastest-growing segment, largely due to their role in high-precision, high-speed applications such as robotics, CNC machinery, and semiconductor fabrication. These drives offer dynamic torque control, exceptional positioning accuracy, and fast response times—critical in industries transitioning toward automation. With the U.S. investing heavily in smart manufacturing and advanced assembly systems, servo drives are becoming indispensable in production lines requiring tight tolerances and repeatability.

Country-Level Analysis

Within the United States, market performance varies by regional industrial activity and infrastructure development:

-

The Midwest leads in demand due to its strong manufacturing base, with industries ranging from automotive in Michigan and Ohio to food processing in Illinois and dairy operations in Wisconsin.

-

The South is witnessing rapid adoption in sectors like petrochemicals, HVAC, and commercial buildings, particularly in states like Texas and Florida where climate control systems are essential.

-

The Northeast, home to financial hubs and aging infrastructure, is upgrading municipal utilities and building automation systems, boosting demand for VFDs in HVAC and water treatment.

-

The West, especially California, is driven by regulatory sustainability goals and the presence of advanced technology manufacturing, including semiconductors and clean energy projects.

The U.S. government’s emphasis on domestic manufacturing, energy efficiency programs, and infrastructure modernization further strengthens the nationwide outlook for VFD adoption.

U.S. Variable Frequency Drive Market Recent Developments

-

April 2025 – ABB announced its expansion of the ACS880 series in the U.S. with new models featuring regenerative capabilities and integrated IoT functionality, targeting industrial and infrastructure sectors seeking energy savings and remote monitoring.

-

February 2025 – Rockwell Automation launched its PowerFlex® 755TS VFD, a next-gen device equipped with TotalFORCE® technology, offering predictive diagnostics and adaptive control for critical industrial machinery.

-

January 2025 – Siemens USA introduced its SINAMICS G120X drive system at the AHR Expo in Chicago, specifically designed for HVAC, water, and wastewater applications, offering optimized harmonics and connectivity with building management systems.

-

November 2024 – Schneider Electric expanded its Altivar Process series with modular VFD systems for food & beverage and pharmaceutical industries, integrating cyber-secure communication and advanced torque control.

-

October 2024 – Yaskawa America launched the GA800 drive platform with expanded voltage range and mobile app configurability, aiming at small to mid-sized industrial applications requiring precise control.

Some of the prominent players in the U.S. variable frequency drive market include:

- ABB Ltd.

- General Electric

- Hitachi, Ltd.

- Schneider Electric

- SIEMENS AG

- Eaton

- Addison Electric, Inc.

- Rockwell Automation, Inc.

- Yaskawa Electric Corporation

- Johnson Controls International

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. variable frequency drive market

Product Type

- AC Drives

- DC Drives

- Servo Drives

Power Range

- Micro (0-5 kW)

- Low (6-40 kW)

- Medium (41-200 kW)

- High (>200 kW)

Application

- Pumps

- Electric Fans

- Conveyors

- HVAC

- Extruders

- Others

End-use

- Oil & Gas

- Power Generation

- Industrial

- Infrastructure

- Automotive

- Food & Beverages

- Others

Regional

- Northeast

- Midwest

- South

- West