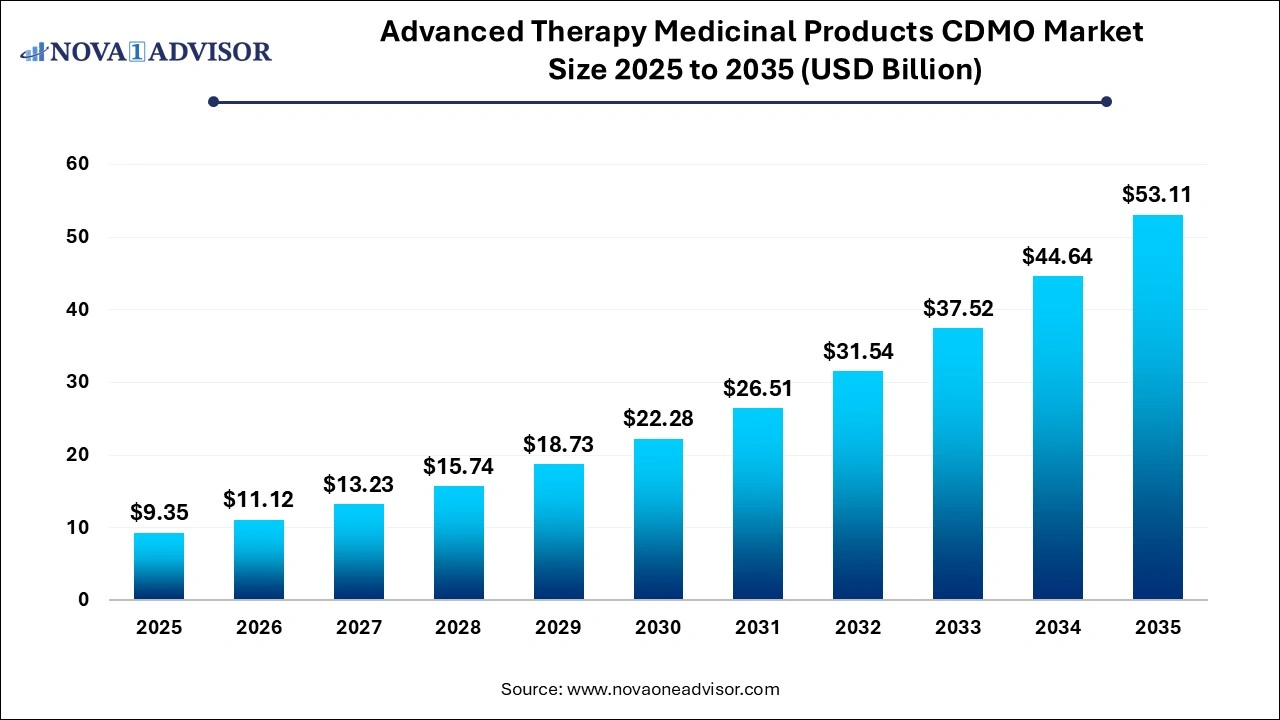

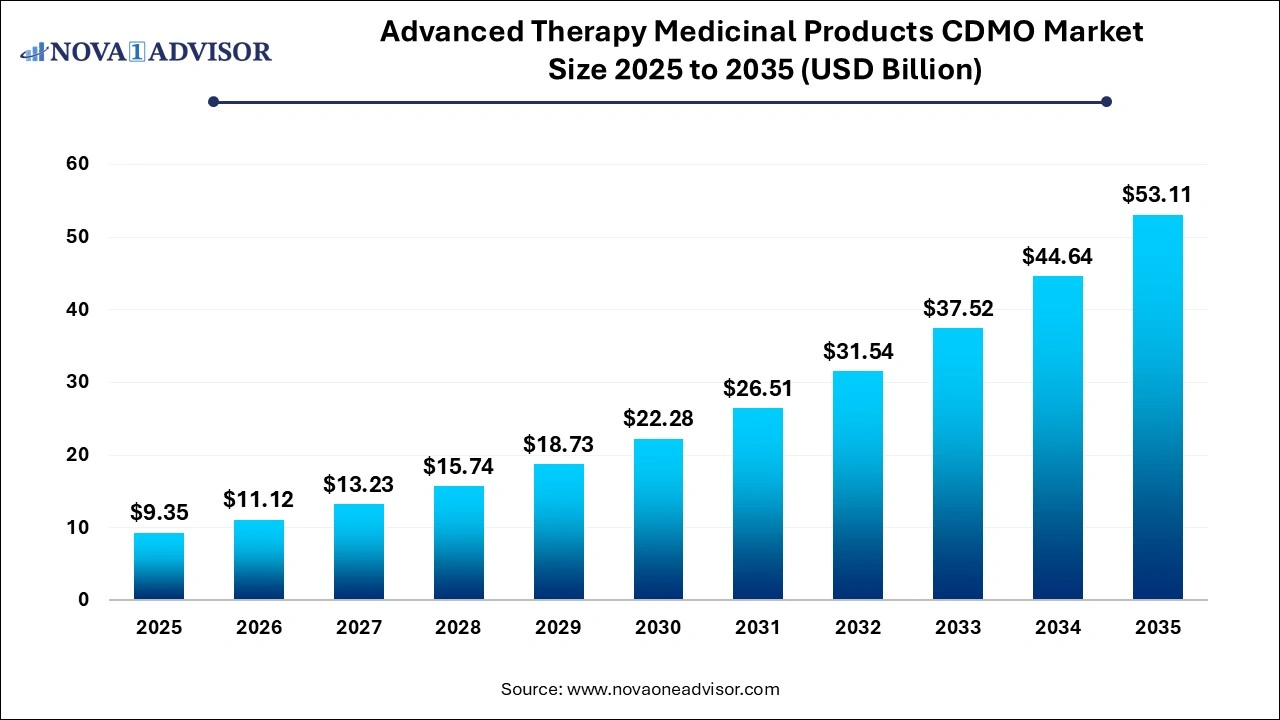

Advanced Therapy Medicinal Products CDMO Market Size and Growth 2026 to 2035

The global advanced therapy medicinal products CDMO market size was estimated at USD 9.35 billion in 2025 and is projected to hit around USD 53.11 billion by 2035, growing at a CAGR of 18.97% during the forecast period from 2026 to 2035.

Advanced Therapy Medicinal Products CDMO Market Key Takeaways

- By product, gene therapy dominated the market in 2025.

- By product, cell therapy is seen to be the fastest growing segment.

- By phase, the phase II segment led the market this year.

- By phase, the phase III segment is expected to have the fastest growth rate as of this year.

- By indication, oncology dominated the market this year in 2025.

- By indication, neurological and genetic disorders are expected to witness the fastest growth rate.

- By region, North America held the largest market share in 2025.

- By region, Asia-Pacific is expected to grow the fastest throughout the forecast period.

What is Advanced Therapy Medicinal Product CDMO?

The advanced therapy medicinal products CDMO Market is a dynamic sector within the broader biopharmaceutical landscape. ATMPs, which include gene therapies, tissue-engineered products, and somatic cell therapies are gaining traction due to their potential to treat complex and previously untreatable diseases.

Recent trends in the ATMP CDMO market include the adoption of innovative technologies such as artificial intelligence and machine learning in order to improve efficiency and precision in manufacturing processes. The market is also witnessing a shift towards integrated CDMO services, where providers are able to offer a comprehensive range of services from early-stage development to commercial manufacturing. Moreover, there is also a growing focus on patient-centricity, with CDMOs prioritizing the delivery of high-quality, personalized therapies.

Key Trends in the Advanced Therapy Medicinal Product (ATMP) CDMO Market

- Rising Demand for Viral Vector Manufacturing: As gene therapies continue to expand, the need for viral vectors such as AAV and lentivirus has skyrocketed. CDMOs are rapidly scaling up their vector production capabilities to meet the growing demand from biotech and pharmaceutical companies developing next-generation therapies.

- Adoption of Modular and Closed-System Manufacturing: To improve flexibility, efficiency, and product safety, many CDMOs are moving toward modular cleanrooms and closed automated systems. These advanced setups make it easier to scale production, reduce contamination risks, and accelerate turnaround times for complex ATMPs.

- Shift Toward Allogeneic Therapies: While most current cell therapies are autologous, using a patient’s own cells—there’s growing momentum toward allogeneic or “off-the-shelf” products. These therapies can be produced in larger batches, making them more scalable, consistent, and cost-effective for broader patient access.

- Integration of Digital Manufacturing and Advanced Analytics: CDMOs are embracing digital transformation by incorporating artificial intelligence, real-time data monitoring, and digital twins into their manufacturing processes. These tools help optimize yields, improve batch quality, and shorten production timelines.

What is the Impact of AI in this field?

The integration of AI and ML within the ATMP CDMO Market has led to revolutionary changes, marking a significant advancement in maintaining product quality and consistency. AI algorithms have proven to be vital in real-time tracking and oversight, enabling the early detection of deviations and ensuring that each batch meets the stringent quality standards required. These types of systems integrate sensor data streams and employ multivariate models in order to analyze relationships between various parameters and product attributes. This real time analysis surpasses is better than periodic manual sampling as it allows for a more dynamic and responsive process control.

Advanced technologies like process analytical technology (PAT), continuous manufacturing, and AI present multiple opportunities to enhance hospital capabilities within ever-present constraints. Such technology and tools employ in-line monitoring and automated feedback control, thus optimizing manufacturing. By tracking parameters like pH, nutrients, metabolites and cell growth in real- time, bioreactors can be automatically controlled, reducing manual operations while ensuring consistency between batches.

This gives rise to continuous manufacturing in an uninterrupted flow, rather than individual batches, which simultaneously increases productivity. Altogether, we can see how the adoption of these technologies allows hospitals to boost productivity and quality within limited space, time, cost as well as staffing.

Advanced Therapy Medicinal Products CDMO Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 11.12 Billion |

| Market Size by 2035 |

USD 53.11 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 18.97% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, Phase, Indication, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Key Companies Profiled |

Celonic; Bio Elpida; CGT Catapult; Rentschler Biopharma SE; AGC Biologics; Catalent; Lonza; WuXi Advanced Therapies; BlueReg; Minaris Regenerative Medicine; Patheon |

Advanced Therapy Medicinal Products CDMO Market Dynamics

Driver

Rising Focus on Cell and Gene Therapies and Regulatory Support

The Global Advanced Therapy Medicinal Products CDMO Market is significantly influenced by the growing focus on cell and gene therapies. These innovative treatment modalities serve as key market drivers and offer potential cures for previously untreatable conditions, driving demand for specialized manufacturing capabilities. CDMOs are increasingly adapting and modifying their facilities and processes in order to accommodate the unique requirements of these therapies, which often involve complex production techniques.

Regulatory bodies worldwide are also driving the market forward by increasing the support of advanced therapies. Initiatives aimed at expediting the approval process for innovative treatments encourage investments in research and development and foster partnerships with various companies and institutions. This robust regulatory environment fosters collaboration and makes navigating complex compliance landscapes easy.

Restraint

High Costs

One of the biggest challenges faced by the ATMP CDMO market is the complexity and cost of manufacturing ATMPs. Unlike traditional biologics, ATMPs often involve living cells or viral vectors, requiring highly controlled environments and specialized skillsets. Each therapy needs unique workflow protocols for cell sourcing, expansion, gene editing and cryopreservation, which adds to logistical and operational complexity. Facilities are mandated to meet high biosafety standards, and equipment must support single-use processing to minimize contamination risk. This complex landscape makes it difficult for small scale and medium scale companies to keep up, thus slowing down market entry and growth.

Opportunity

Rise in Personalized Medicine and Technological Advancements

The Global Advanced Therapy Medicinal Products CDMO Market is experiencing a surge in demand for personalized medicine, driven by advancements in genomics and biotechnology. This has opened up new areas for opportunity. As healthcare shifts towards tailored or personalized therapies, CDMOs are increasingly pushed for developing and manufacturing apt treatments. The ability to produce individualized therapies not only enhances patient outcomes but also aligns with regulatory frameworks that favor innovative treatment modalities, thus pushing the ATMP CDMO market forward.

Technological innovations in manufacturing processes are another such opportunity propelling the market. Aspects like automation, artificial intelligence and advanced bioprocessing techniques are streamlining production, enhancing efficiency and reducing costs. These advancements enable CDMOs to scale up production while also maintaining compliance with stringent regulatory standards. The integration of cutting-edge technologies not only improves operational capabilities but also fosters collaboration between CDMOs and biopharmaceutical companies, leading to rapid development of the market.

Advanced Therapy Medicinal Products CDMO Market Segmental Analysis

By Product Analysis

Which product dominated the market in 2025?

Gene Therapy CDMO services dominated the product segment in 2025. These therapies require stringent production protocols for vector purification, plasmid preparation and contamination control. High-profile highlight the therapeutic potential and commercial viability of gene therapy, increasing the number of companies outsourcing their vector manufacturing.

Cell Therapy is the fastest-growing segment as of this year, driven by the success of CAR-T therapies. These therapies require individualized manufacturing workflows, cryopreservation and close coordination with clinical sites. As new cell therapies enter clinical trials for oncology, autoimmune diseases, and regenerative applications, CDMOs are seen scaling up capabilities in T-cell processing, ex vivo expansion, gene editing and cell banking. The shift toward allogeneic therapies is also driving demand for this segment.

Advanced Therapy Medicinal Products CDMO Market By Product, 2025-2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Gene Therapy |

3.35 |

3.97 |

4.67 |

5.53 |

6.52 |

7.71 |

9.11 |

10.76 |

12.73 |

15.02 |

17.75 |

| Cell Therapy |

2.98 |

3.55 |

4.24 |

5.05 |

6.03 |

7.19 |

8.57 |

10.22 |

12.18 |

14.53 |

17.32 |

| Tissue Engineered |

0.75 |

0.9 |

1.1 |

1.33 |

1.61 |

1.95 |

2.36 |

2.86 |

3.46 |

4.19 |

5.07 |

| Others |

0.37 |

0.44 |

0.53 |

0.63 |

0.75 |

0.89 |

1.06 |

1.26 |

1.49 |

1.78 |

2.11 |

By Phase Analysis

Which phase segment led the market in 2025?

Phase II services led the market as of this year in 2025. This is due to the transition from proof-of-concept to efficacy studies, which often marks the point where developers engage CDMOs for scale-up, process refinement and GMP-grade production. CDMOs offer invaluable support during this phase by establishing clinical supply chains, supporting IND submissions and managing pilot-scale manufacturing. The advantage of this segment lies in its flexibility and modular production approach, helping it maintain its market position.

Phase III is seen to be the fastest-growing phase segment, this is because more ATMPs advance into pivotal trials and prepare for commercialization. CDMOs are increasingly investing in large-scale viral vector production lines, modular cleanrooms for simultaneous batches, and high-throughput analytical platforms. Phase III CDMO services always ensure validated processes, quality assurance and risk mitigation strategies for product approval.

Advanced Therapy Medicinal Products CDMO Market By Phase, 2025-2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Phase I |

1.64 |

1.89 |

2.17 |

2.5 |

2.86 |

3.28 |

3.76 |

4.29 |

4.9 |

5.58 |

6.34 |

| Phase II |

2.82 |

3.32 |

3.9 |

4.57 |

5.37 |

6.29 |

7.38 |

8.66 |

10.15 |

11.9 |

13.94 |

| Phase III |

2.24 |

2.7 |

3.27 |

3.95 |

4.77 |

5.77 |

6.96 |

8.41 |

10.15 |

12.25 |

14.79 |

| Phase IV |

0.75 |

0.95 |

1.2 |

1.52 |

1.91 |

2.4 |

3 |

3.74 |

4.66 |

5.79 |

7.18 |

By Indication Insights

Which Indication segment dominated the market this year?

Oncology segment held the largest market share in 2025. These therapies offer unique benefits in relapsed cancers and have demonstrated unprecedented remission rates in clinical trials. Given the urgent need for innovation in complex cancer treatment, oncology-focused ATMPs attract substantial investment, clinical activity and outsourcing demand. CDMOs that specialize in immunotherapy-related platforms, such as TILs, NK cells, and engineered T cells, are leading service providers in this segment.

Neurological and genetic disorders are expected to be the fastest-growing throughout the forecast period. Gene therapies for rare genetic diseases such as spinal muscular atrophy (SMA), Leber congenital amaurosis (LCA) and Duchenne muscular dystrophy (DMD) are gaining traction in today’s market. These conditions require highly targeted delivery vectors, long-term efficacy, and ultra-precise safety profiles, and CDMOs capable of custom vector design, capsid optimization and scalable purification, thus driving demand.

Advanced Therapy Medicinal Products CDMO Market By Indication, 2025-2035 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| Oncology |

2.61 |

3.08 |

3.63 |

4.28 |

5.05 |

5.95 |

7 |

8.25 |

9.74 |

11.45 |

13.53 |

| Cardiology |

0.52 |

0.62 |

0.74 |

0.88 |

1.04 |

1.24 |

1.48 |

1.76 |

2.09 |

2.49 |

2.96 |

| Central nervous system |

0.67 |

0.8 |

0.95 |

1.13 |

1.34 |

1.6 |

1.9 |

2.26 |

2.69 |

3.2 |

3.8 |

| Musculoskeletal |

0.45 |

0.53 |

0.63 |

0.75 |

0.89 |

1.06 |

1.27 |

1.51 |

1.79 |

2.13 |

2.53 |

| Infectious disease |

0.6 |

0.7 |

0.82 |

0.97 |

1.13 |

1.33 |

1.56 |

1.83 |

2.15 |

2.52 |

2.96 |

| Dermatology |

0.3 |

0.35 |

0.42 |

0.5 |

0.6 |

0.71 |

0.84 |

1 |

1.19 |

1.42 |

1.69 |

| Endocrine, metabolic, genetic |

0.52 |

0.64 |

0.78 |

0.95 |

1.16 |

1.42 |

1.73 |

2.11 |

2.57 |

3.13 |

3.8 |

| Immunology & inflammation |

0.52 |

0.64 |

0.78 |

0.95 |

1.16 |

1.42 |

1.73 |

2.11 |

2.57 |

3.13 |

3.8 |

| Ophthalmology |

0.45 |

0.54 |

0.65 |

0.79 |

0.95 |

1.15 |

1.39 |

1.68 |

2.03 |

2.45 |

2.96 |

| Hematology |

0.37 |

0.44 |

0.53 |

0.63 |

0.75 |

0.89 |

1.06 |

1.26 |

1.49 |

1.78 |

2.11 |

| Gastroenterology |

0.22 |

0.27 |

0.34 |

0.41 |

0.51 |

0.62 |

0.76 |

0.93 |

1.13 |

1.39 |

1.69 |

| Others |

0.22 |

0.25 |

0.27 |

0.3 |

0.33 |

0.35 |

0.38 |

0.4 |

0.42 |

0.43 |

0.42 |

By Regional Analysis

Why did North America Dominate the Market in 2025?

North America dominated the Advanced therapy medicinal products CDMO market in 2025. This dominance can be attributed to increasing outsourcing activities and rising awareness about advanced therapy. The region has consistently been a leader in research and development for advanced treatments, and will most likely keep this position in the upcoming years. Recent approvals of products such as Kymriah and Yescarta have also propelled investments in the regional market.

United States Advanced Therapy Medicinal Products CDMO Market Analysis

The United States is emerging as the epicenter of growth in the Advanced Therapy Medicinal Products (ATMP) CDMO market, driven by a powerful convergence of scientific innovation, robust investment, and supportive regulatory frameworks. The country hosts a dense concentration of biotechnology firms, research institutions, and CDMOs specializing in cell and gene therapy development, positioning it at the forefront of the global ATMP ecosystem.

Favorable FDA initiatives, such as accelerated approval pathways for breakthrough and orphan therapies, have encouraged rapid clinical translation and commercialization. Additionally, the expanding pipeline of CAR-T, gene editing, and regenerative medicine programs has created a surge in demand for advanced manufacturing infrastructure and specialized CDMO partnerships.

What are the Advancements in Asia-Pacific?

Asia Pacific is expected to grow at the fastest rate over the forecast period. This growth is due to the increasing demand for novel ATMPs and rising research and development activities which helps to develop novel therapies. Moreover, the region’s market growth is driven by continuously expanding CDMO Cell Therapy. This is because a number of domestic players are increasingly collaborating with biotech companies from other countries involved in mesenchymal stem cell research and therapy development.

Advanced Therapy Medicinal Products CDMO Market By Region, 2026-2034 (USD Billion)

| Year |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

2035 |

| North America |

2.84 |

3.33 |

3.91 |

4.61 |

5.42 |

6.39 |

7.51 |

8.83 |

10.39 |

12.21 |

14.37 |

| Europe |

2.38 |

2.81 |

3.31 |

3.9 |

4.59 |

5.41 |

6.37 |

7.51 |

8.84 |

10.41 |

12.25 |

| Asia-Pacific |

1.64 |

2.02 |

2.49 |

3.06 |

3.76 |

4.61 |

5.66 |

6.93 |

8.48 |

10.37 |

12.67 |

| Latin America |

0.37 |

0.43 |

0.51 |

0.59 |

0.69 |

0.8 |

0.93 |

1.08 |

1.25 |

1.46 |

1.69 |

| Middle East & Africa (MEA) |

0.22 |

0.27 |

0.32 |

0.38 |

0.45 |

0.53 |

0.63 |

0.75 |

0.9 |

1.07 |

1.27 |

Top Key Players in Advanced Therapy Medicinal Products CDMO Market:

- Celonic GmbH – Provides end-to-end development and GMP manufacturing services for cell and gene therapies, with expertise in viral vector and biologics production.

- Bio Elpida – Specializes in small-batch GMP manufacturing for cell and gene therapies, focusing on process development and aseptic fill-finish for early clinical stages.

- Cell and Gene Therapy Catapult (CGT Catapult) – A UK-based innovation and manufacturing center supporting technology transfer, process optimization, and scale-up of advanced therapies.

- Rentschler Biopharma SE – Offers full-service biopharmaceutical development and GMP manufacturing, including viral vector and gene therapy production capabilities.

- AGC Biologics – Provides integrated development, manufacturing, and analytical services for viral vectors, plasmid DNA, and cell therapies, serving both clinical and commercial stages.

- Catalent, Inc. – A leading global CDMO offering viral vector manufacturing, plasmid DNA production, and advanced therapy fill-finish services through its Cell & Gene Therapy segment.

- Lonza Group Ltd. – Delivers comprehensive solutions for cell and gene therapy development and manufacturing, including viral vector platforms and commercial-scale production.

- WuXi Advanced Therapies (WuXi AppTec Group) – Provides integrated cell and gene therapy CDMO services, including process development, testing, and GMP manufacturing for viral vectors and cell therapies.

- BlueReg Group – Offers specialized regulatory consulting and strategy support for ATMP developers, focusing on market access, compliance, and product lifecycle management.

- Minaris Regenerative Medicine – Focuses on global contract development and manufacturing of cell and gene therapies, with expertise in autologous and allogeneic manufacturing solutions.

Recent Developments

- In October 2025, BBG Advanced Therapies, a subsidiary of BioBridge Global and CELLforCURE, part of SEQENS Group, recently announced a partnership dedicated to supporting the development and large-scale production of Advanced Therapy Medicinal Products (ATMPs). This collaboration establishes a transatlantic connection enabling U.S. companies to leverage CELLforCURE's manufacturing capabilities in Europe, while European companies can benefit from BBG Advanced Therapies' production capacities in the United States.

- In October 2024, Recipharm, a leading global pharmaceutical contract development and manufacturing organisation (CDMO), is expanding its pharmaceutical development capabilities, through targeted investments and the integration of cutting-edge technologies. This investment bolsters its services for early- and late- stage product development, including clinical study supply at small and pilot scales and wide range of commercial technologies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Advanced Therapy Medicinal Products CDMO market.

By Product

- Gene Therapy

- Cell Therapy

- Tissue Engineered

- Others

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Indication

- Oncology

- Cardiology

- Central nervous system

- Musculoskeletal

- Infectious disease

- Dermatology

- Endocrine, metabolic, genetic

- Immunology & inflammation

- Ophthalmology

- Hematology

- Gastroenterology

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

- List of Figure

List of Tables

- Table 1: Global Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, 2026–2035

- Table 2: Global Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Phase, 2026–2035

- Table 3: Global Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Indication, 2026–2035

- Table 4: North America Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, 2026–2035

- Table 5: North America Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Phase, 2026–2035

- Table 6: North America Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Indication, 2026–2035

- Table 7: U.S. Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 8: Canada Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 9: Mexico Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 10: Europe Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, 2026–2035

- Table 11: Europe Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Phase, 2026–2035

- Table 12: Europe Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Indication, 2026–2035

- Table 13: Germany Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 14: France Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 15: UK Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

Table 16: Italy Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 17: Asia Pacific Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, 2026–2035

- Table 18: Asia Pacific Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Phase, 2026–2035

- Table 19: Asia Pacific Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Indication, 2026–2035

- Table 20: China Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 21: Japan Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 22: India Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 23: South Korea Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 24: Southeast Asia Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 25: Latin America Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 26: Brazil Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 27: Middle East & Africa Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 28: GCC Countries Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 29: Turkey Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

- Table 30: Africa Advanced Therapy Medicinal Products CDMO Market Size (USD Billion) by Product, Phase & Indication, 2026–2035

List of Figures

Figure 1: Global Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 2: Global Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 3: Global Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 4: North America Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 5: North America Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 6: North America Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 7: U.S. Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 8: U.S. Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 9: U.S. Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 10: Canada Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 11: Canada Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 12: Mexico Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 13: Europe Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 14: Europe Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 15: Europe Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 16: Germany Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 17: Germany Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 18: France Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 19: France Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 20: UK Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 21: Italy Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 22: Asia Pacific Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 23: Asia Pacific Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 24: Asia Pacific Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 25: China Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 26: China Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 27: Japan Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 28: Japan Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 29: India Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 30: South Korea Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 31: Latin America Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 32: Latin America Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 33: Brazil Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 34: Brazil Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 35: Middle East & Africa Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 36: Middle East & Africa Advanced Therapy Medicinal Products CDMO Market Share by Phase, 2025

Figure 37: GCC Countries Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 38: GCC Countries Advanced Therapy Medicinal Products CDMO Market Share by Indication, 2025

Figure 39: Turkey Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025

Figure 40: Africa Advanced Therapy Medicinal Products CDMO Market Share by Product, 2025