Lyophilized Injectable Drugs Market Size, Growth and Trends 2026 to 2035

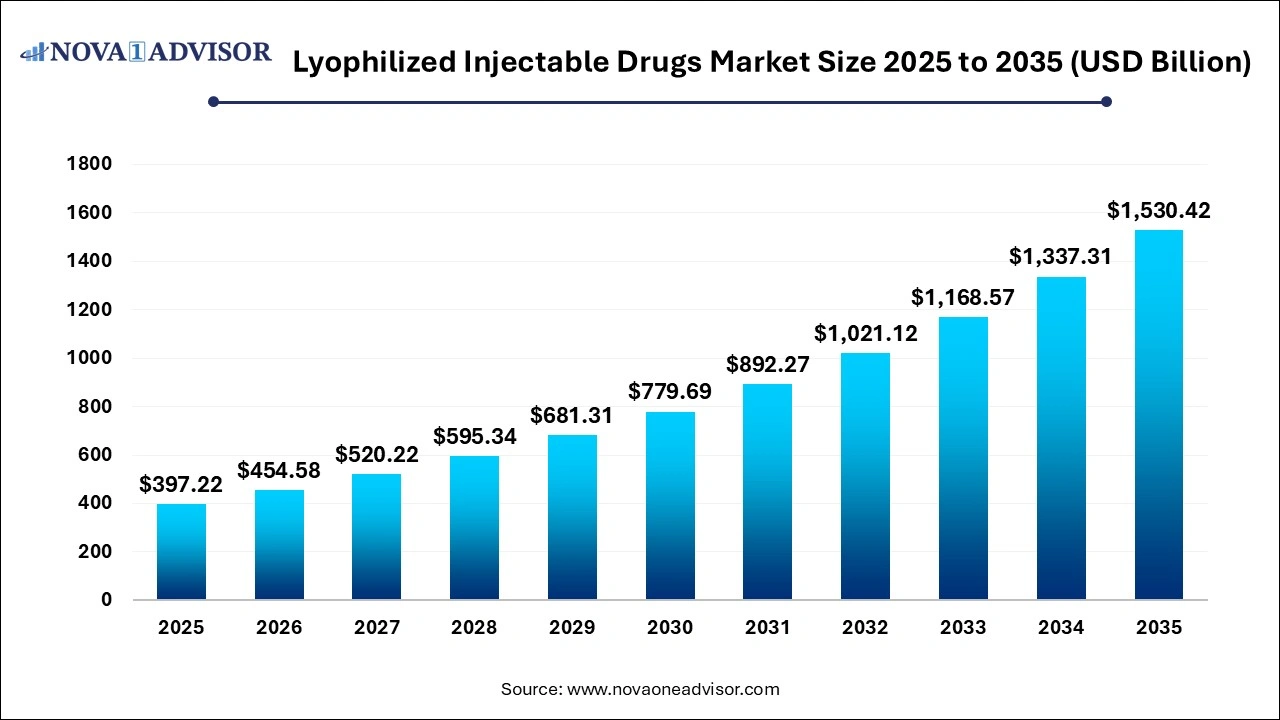

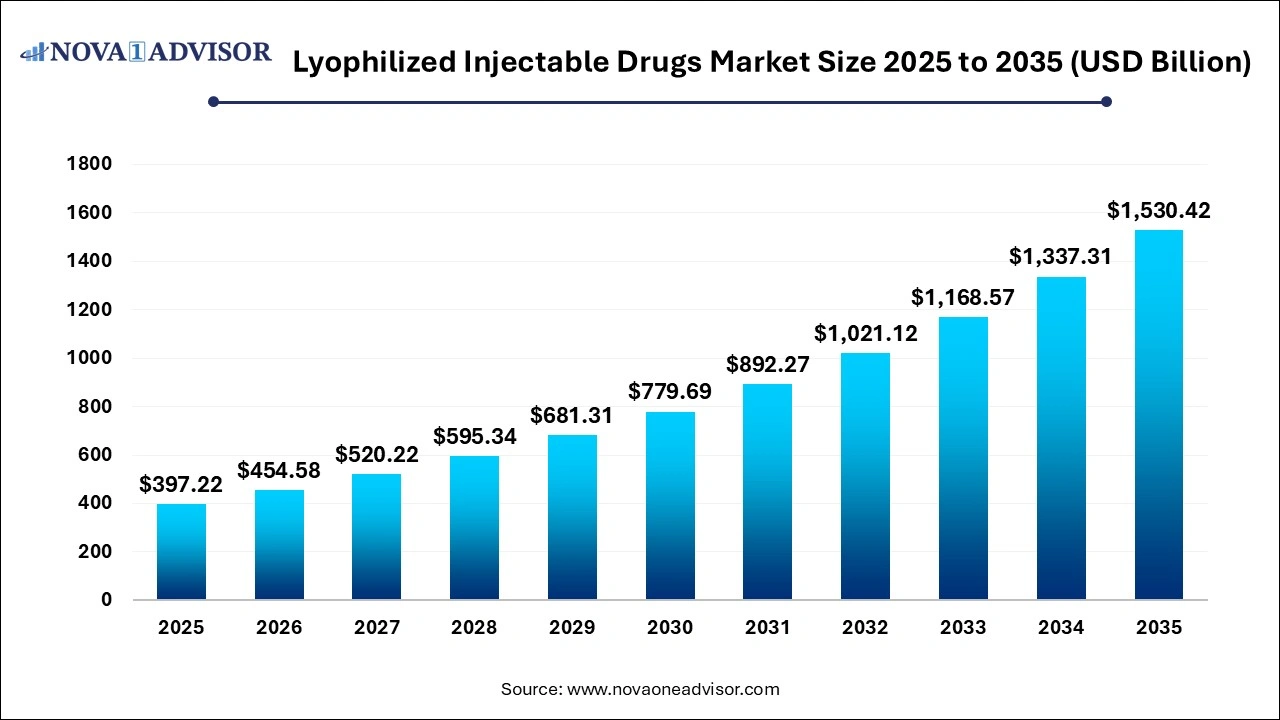

The global iyophilized injectable drugs market size was exhibited at USD 397.22 billion in 2025 and is projected to hit around USD 1,530.42 billion by 2035, growing at a CAGR of 14.44% during the forecast period 2026 to 2035.

Lyophilized Injectable Drugs Market Key Pointers:

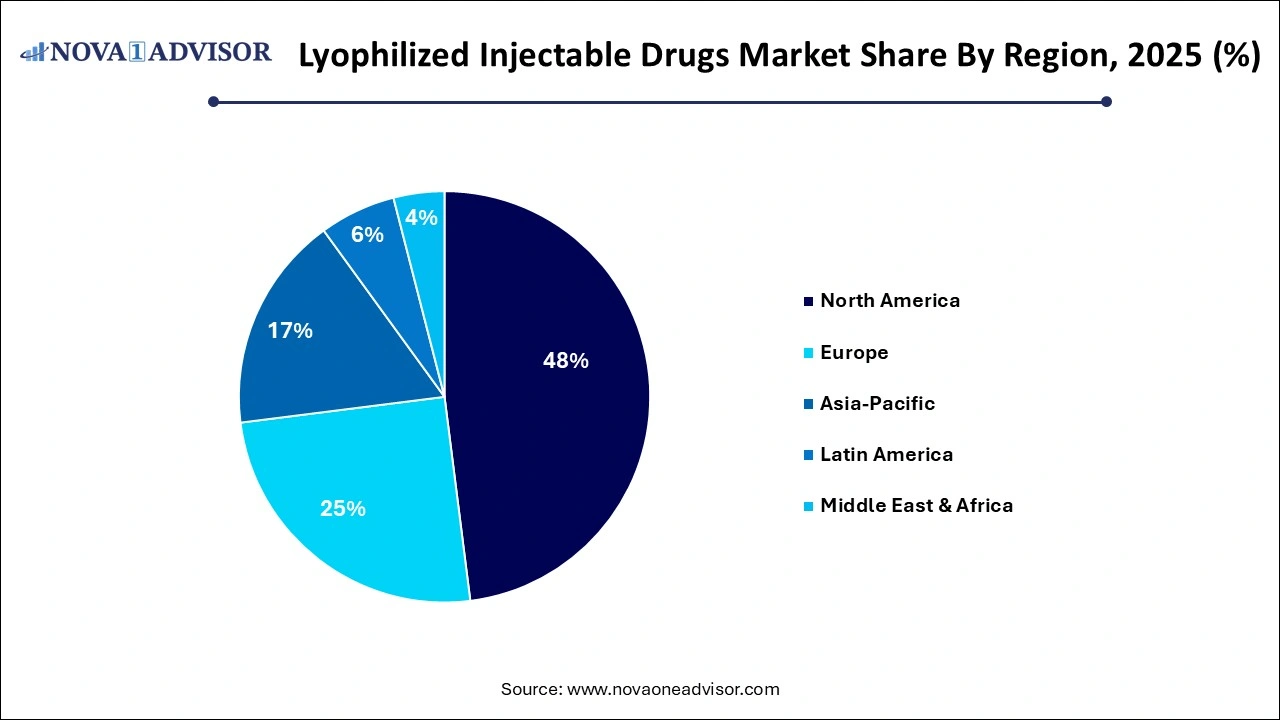

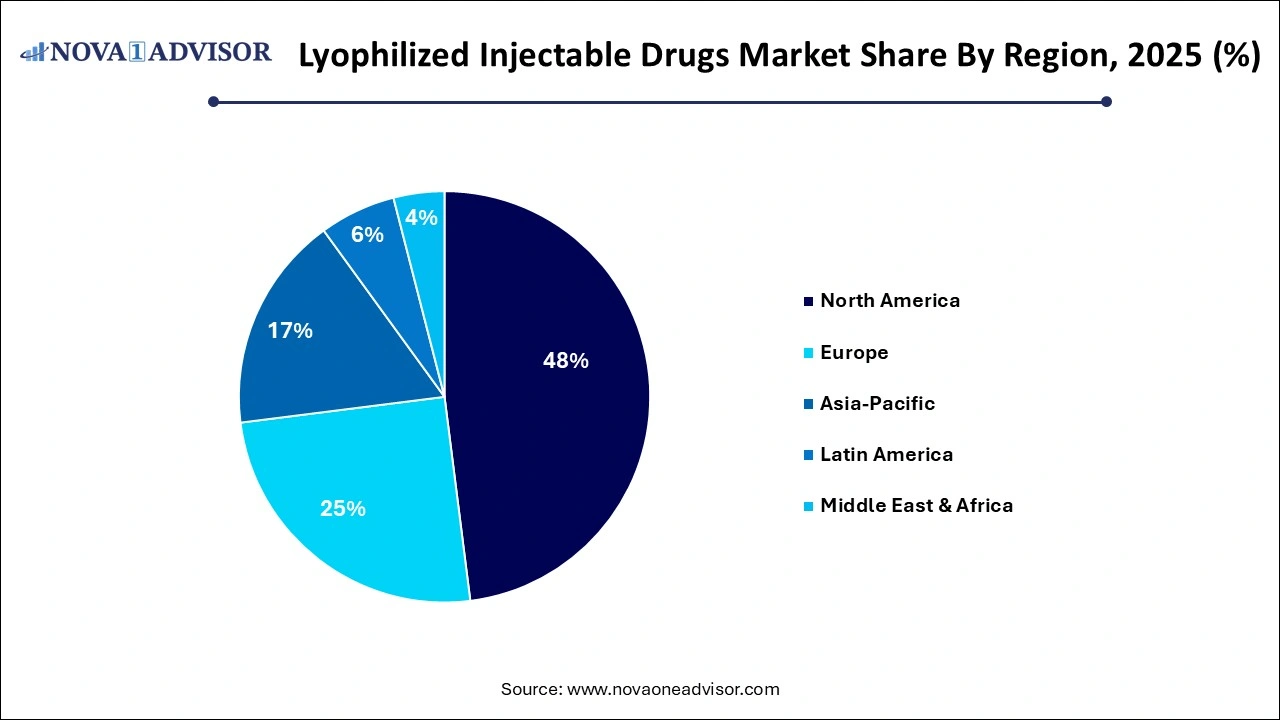

- North America dominated the highest market share in 48% in 2025.

- Lyophilized injectable drugs market from respiratory diseases indication is anticipated to witness 13% CAGR between 2026-20352

- Lyophilized injectable drugs market from prefilled diluent syringes segment held more than 30% business share in 2025.

- Online pharmacy segment was more than USD 35 billion in 2025.

Lyophilized Injectable Drugs Market Overview

The global lyophilized injectable drugs market has witnessed substantial growth in recent years, driven by the increasing demand for stable, long-shelf-life injectable formulations. Lyophilization, or freeze-drying, allows drugs particularly biologics, vaccines, and peptide-based therapeutics to maintain stability and efficacy during storage and transportation. With the rising prevalence of chronic diseases, infectious diseases, and cancer, healthcare providers are increasingly relying on these formulations to ensure precise dosing and patient safety.

What are the Trends in Lyophilized Injectable Drugs Market?

- Rising Adoption of Biologics and Biosimilars – Increasing use of biologics, vaccines, and biosimilar drugs is driving demand for lyophilized formulations, as they require enhanced stability and longer shelf life.

- Advanced Freeze-Drying Technologies – Automation, improved vial designs, and optimized lyophilization processes are being adopted to enhance production efficiency, reduce costs, and maintain drug potency.

- Expansion in Emerging Markets – Growing healthcare infrastructure, rising chronic disease prevalence, and increased access to injectable therapies are fueling market growth in regions like Asia-Pacific and Latin America.

Lyophilized Injectable Drugs Market Report Scope

| Report Coverage |

Details |

| Market Size in 2026 |

USD 454.58 Billion |

| Market Size by 2035 |

USD 1,530.42 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 14.44% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Drug, By Indication, By Delivery, By Packaging, By Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bristol Myers Squibb, Gilead Sciences, Inc., F. Hoffmann-La Roche Ltd, Novo Nordisk A/S, Sanofi, Aurobindo Pharmaceuticals, Fresenius SE & Co. KGaA (Fresenius Kabi), Merck & Co., Inc., Zydus Group, Vetter Pharma, Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, Cipla Ltd. |

Lyophilized Injectable Drugs Market Segmentation Insights

By Drug Insights

How did the antiarrhythmic segment dominate the Lyophilized Injectable Drugs market?

The antiarrhythmic segment is driven by the drugs that are essential in critical care for stabilizing ICU patients with atrial fibrillation. According to market analyses, the high prevalence of cardiac emergencies drives demand for these stable and potent formulations. While anti-infectives have a large share, the specialized nature of antiarrhythmic agents like beta-blockers and potassium channel blockers establishes them as a key, high-growth segment.

How did the anti-infective segment expect to hold the fastest-growing Lyophilized Injectable Drugs market in the coming years?

The anti-infective segment is driven by drug class, driven by the global need for stable, potent antimicrobial and vaccine formulations. Its dominance is sustained by rising infection rates, pandemic preparedness, and the technical necessity of freeze-drying to prevent contamination during transport. Meanwhile, anti-neoplastic agents for oncology represent the fastest-growing drug segment, fueled by the surge in complex cancer treatments.

By Indication

How did the oncology segment account for the largest share in the Lyophilized Injectable Drugs market?

The oncology segment is driven by the dominant indication for lyophilized injectables, as these complex treatments require freeze-drying to maintain potency. Biologics and targeted therapies, often administered in hospitals, rely on this technology to ensure structural integrity during storage and transport. While anti-infectives currently hold a large market share, anti-neoplastics are the fastest-growing drug class due to the increasing reliance on specialized oncology pipelines.

How did the autoimmune diseases segment expect to hold the fastest-growing Lyophilized Injectable Drugs market in the coming years?

The autoimmune diseases segment is driven by the technical necessity of freeze-drying for sensitive biologics. Market expansion is accelerated by pharmaceutical investments in targeted therapies and user-friendly prefilled pens, which simplify self-administration and improve adherence. While oncology currently dominates in total share, the autoimmune segment’s surge reflects a shift toward long-term, home-based management of chronic conditions using advanced delivery systems.

By Delivery Insights

How did the multi-step devices segment account for the largest share in the Lyophilized Injectable Drugs market?

The multi-step devices segment is driven by its critical role in ensuring the integrity of complex biologics that require precise, sequential reconstitution. While prefilled syringes are the fastest-growing segment for home use, multi-step systems remain the clinical standard in hospital settings for oncology and specialized care. Their ability to handle high-value, sensitive formulations ensures dosing accuracy and stability that simpler devices cannot yet match.

How did the prefilled diluent syringes segment expect to hold the fastest-growing Lyophilized Injectable Drugs market in the coming years?

The prefilled diluent syringes segment is driven by the shift toward home-based care and emergency efficiency. These devices minimize preparation time and human error by enabling rapid, sterile reconstitution of sensitive biologics and chronic disease treatments. Their expansion is fueled by technological transitions from traditional vials to dual-chamber systems, significantly improving patient safety and compliance in the surge of autoimmune and metabolic therapies.

By Packaging Insights

How did the vials segment account for the largest share in the Lyophilized Injectable Drugs market?

The vials segment is driven by there are highly compatible across drug classes and suitable for high-speed, cost-effective manufacturing, making them the preferred choice for global pharmaceutical leaders. The large volume of global demand for stable, long-shelf-life medications ensures vials maintain the largest market share despite the faster growth of prefilled devices for specialized uses.

How did the prefilled devices segment expect to hold the fastest-growing Lyophilized Injectable Drugs market in the coming years?

A shift toward self-administration and home-based care for chronic diseases drives the prefilled devices segment. Innovations like dual-chamber technology and smart injectors simplify the reconstitution of unstable biologics, significantly reducing dosing errors and contamination risks. This transition from traditional vials to ergonomic, single-step systems like BD’s prefilled solutions reflects a broader industry focus on patient safety and workflow efficiency in both clinical and domestic environments.

By Distribution Insights

How did the hospital pharmacy segment account for the largest share in the Lyophilized Injectable Drugs market?

The hospital pharmacy segment is driven by high procurement volumes of specialized oncology and biologic therapies. Their advanced infrastructure supports the strict cold chain requirements and sterile compounding needed for sensitive lyophilized injectables. This centralized model ensures maximum stability and efficacy for critical care, making hospitals the primary hub for managing chronic and infectious diseases globally through partners like Fresenius Kabi.

How did the online pharmacy segment expect to hold the fastest-growing Lyophilized Injectable Drugs market in the coming years?

The online pharmacy segment is driven by a rising number of chronic, autoimmune, and cancer diseases, which often require lyophilized drugs for stability, and has increased the need for accessible, easy-to-order options through digital channels. The growing expansion of smartphones usage and high-speed internet enables the offering of 24/7 access to medication, crucial for patients requiring regular medication, and integration of online pharmacies with virtual construction allows for seamless, end-to-end management of prescriptions for specialized.

Regional Insights

North America segment held the largest market share 48% in 2025. North America and Europe dominate the lyophilized injectable drugs market, driven by advanced healthcare infrastructure, strong pharmaceutical R&D, and widespread adoption of biologics, vaccines, and biosimilars. North America benefits from high chronic disease prevalence and robust regulatory support, while Europe’s growth is supported by a mature biopharmaceutical industry, government vaccination initiatives, and technological advancements in freeze-drying.

Asia-Pacific, Latin America, and the Middle East & Africa are emerging as high-growth regions. In Asia-Pacific, rising healthcare spending, expanding biotech sectors, and increasing access to biologics in countries like China, India, and Japan are fueling demand. Latin America and the Middle East & Africa are experiencing steady growth due to improved healthcare access, rising vaccine adoption, and strategic collaborations between local and global pharmaceutical companies.

Top Companies in the Lyophilized Injectable Drugs Market:

- Fresenius Kabi AG – Global leader in injectable drugs and infusion therapies, including lyophilized formulations.

- Pfizer Inc. – Major player in vaccines and biologics requiring lyophilization for stability.

- Sanofi S.A. – Offers a range of lyophilized vaccines and injectable therapies worldwide.

- Baxter International Inc. – Specializes in parenteral solutions and lyophilized injectable products.

- Dr. Reddy’s Laboratories Ltd. – Provides lyophilized injectables across oncology, antibiotics, and biologics.

- GlaxoSmithKline plc (GSK) – Strong presence in lyophilized vaccines and therapeutic injectables.

- Novartis AG – Focuses on lyophilized biologics and specialty injectable drugs.

- Teva Pharmaceutical Industries Ltd. – Produces lyophilized injectables for hospital and retail markets.

- AbbVie Inc. – Offers specialty lyophilized injectables in immunology and oncology.

- Boehringer Ingelheim GmbH – Known for lyophilized biologics and parenteral solutions.