U.S. Anatomic Pathology Market Size and Forecast 2026 to 2035

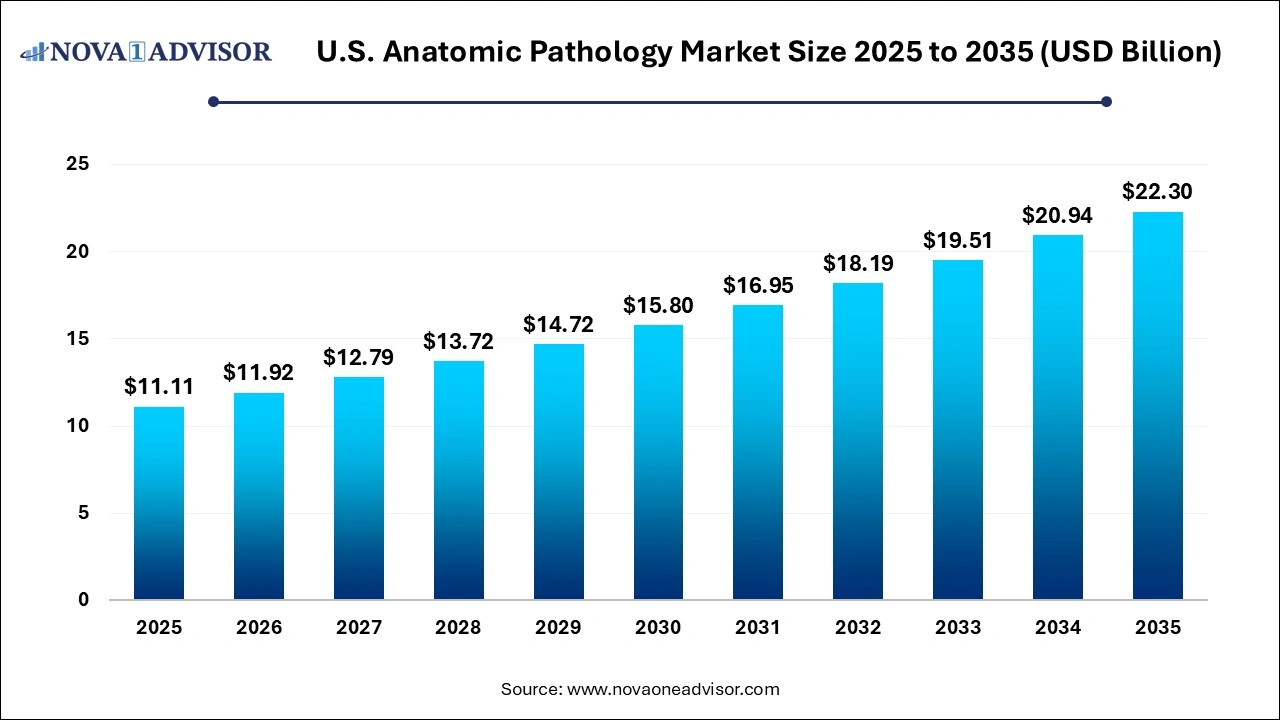

The U.S. anatomic pathology market size is calculated at USD 11.11 billion in 2025, grow to USD 11.92 billion in 2026, and is projected to reach around USD 22.30 billion by 2035, growing at a CAGR of 7.22% from 2026 to 2035. The market is growing due to rising cancer prevalence and increasing demand for early and accurate disease diagnosis. Technological advancements in diagnostic tools are further boosting market expansion.

U.S. Anatomic Pathology Market Key Takeaways

- By product & services, the consumables segment dominated the market with a revenue share in 2025.

- By product & services, the instruments segment is expected to grow at the fastest CAGR in the market during the studied years.

- By application, the disease diagnosis segment held the largest market share in 2025.

- By application, the drug discovery and development segment is expected to grow at the fastest CAGR in the market during the studied years.

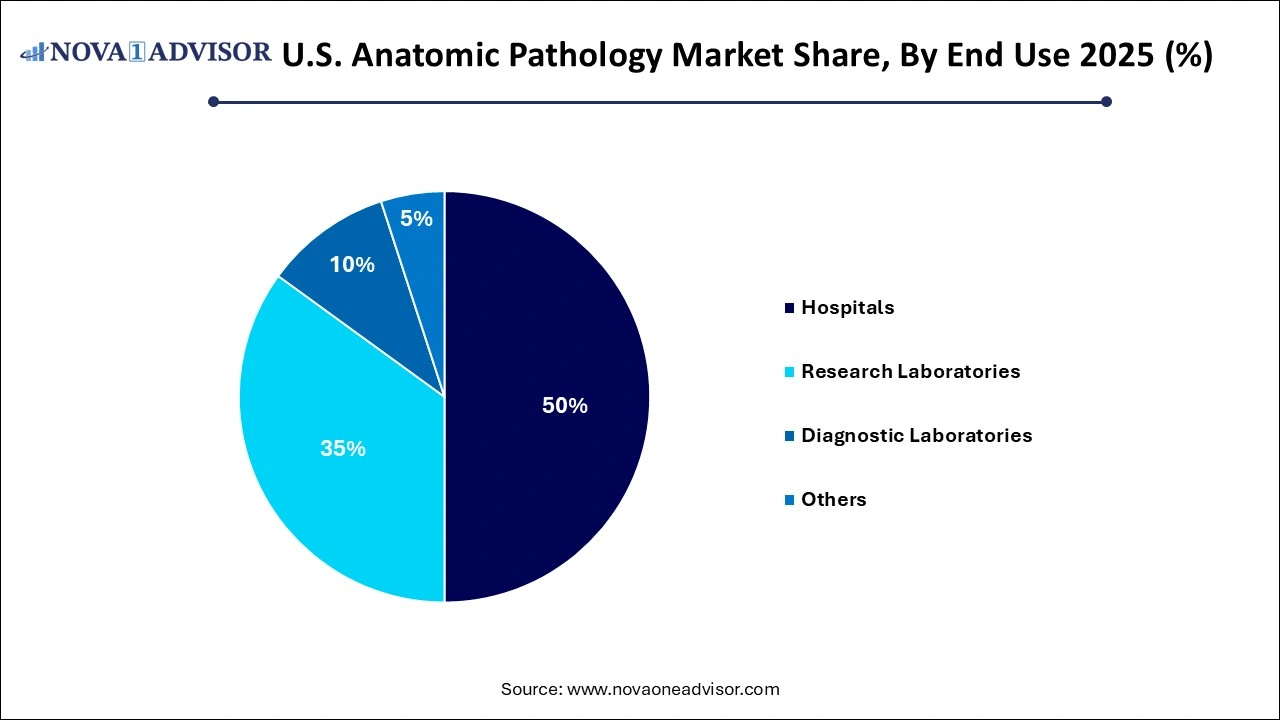

- By end use, the hospital segment led the market with the largest revenue share in 2025.

- By end use, the diagnostic laboratories segment is expected to grow at the fastest CAGR in the market during the studied years.

How U.S. Anatomic Pathology Market Evolving?

Anatomic pathology is s medical specialty focused on the diagnosis of diseases based on the examination of tissues, organs, and cells. It involves techniques like gross examination, histopathology, cytology, and immunohistochemistry to detect abnormalities, especially in cancer and other structural disorders. The U.S. anatomic pathology market is evolving due to the growing demand for early and precise disease diagnosis, especially in oncology. The integration of digital pathology, artificial intelligence, and automation is enhancing workflow efficiency and diagnostic accuracy. Additionally, increasing awareness about personalized medicine and the rising need for tissue-based diagnostic tests are further contributing to the market's steady transformation and technological advancements.

- For Instance, In March 2023, PathAI, Inc. introduced the AISight digital pathology platform along with the AIM-PD-L1 NSCLC RUO algorithm. The launch involved collaboration with thirteen major institutions, including health systems, academic centers, pathology groups, and reference labs, through an Early Access Program designed to support the platform’s initial use and evaluation.

What are the Key trends in the U.S. Anatomic Pathology Market in 2024?

- In June 2025, Thermo Fisher Scientific announced its intention to sell segments of its diagnostics division for approximately USD 4 billion, indicating a strategic move to restructure and streamline its business portfolio.

- In May 2025, Roche introduced the Elecsys PRO-C3 test, which provides liver fibrosis results in just 18 minutes, offering a quicker and less invasive alternative to traditional liver biopsies.

How Can AI Affect the U.S. Anatomic Pathology Market?

Artificial intelligence is transforming the U.S. anatomic pathology market by enhancing diagnostic accuracy, streamlining workflows, and addressing the shortage of pathologists. AI-powered tools, such as digital slide analysis and predictive algorithms, enable faster and more consistent disease detection, particularly in oncology. These innovations not only improve patient outcomes but also reduce diagnostic turnaround times, making pathology services more efficient and accessible across healthcare systems.

Report Scope of U.S. Anatomic Pathology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 11.92 Billion |

| Market Size by 2035 |

USD 22.30 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 7.22% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product & Services, Application, End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Abbott, Astellas Pharma, Inc., Bayer AG, Enzon Pharmaceuticals, Inc., Glenmark, GSK plc, Merck & Co., Inc., Novartis AG, Pfizer, Inc., Sanofi |

U.S. Anatomic Pathology Market Dynamics

Driver

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic illness in the U.S. is fueling demand for detailed tissue analysis to guide clinical decisions. Conditions like cancer and liver diseases often require microscopic examination for accurate diagnosis, making anatomic pathology essential. As healthcare systems focus more on early detection and targeted therapies, the role of pathology expands, driving market growth through the need for precise, lab-based evaluations and advanced diagnostic technologies.

Restraint

High Cost of Diagnostic Equipment

The expensive nature of advanced diagnostic tools limits their accessibility, especially for smaller healthcare providers and rural facilities. These high-tech systems demand significant capital and specialized training, which not all institutions can afford. This financial barrier hinders the widespread adoption of modern pathology technologies, slows down digital transformation, and creates uneven access to efficient diagnostic services, ultimately restricting the overall progress of the anatomic pathology market in the U.S.

Opportunity

Advancements in Digital Pathology and AI

The growing use of digital pathology and AI is opening new possibilities in the U.S. anatomic pathology market by transforming how diagnoses are conducted. These innovations allow for faster image analysis, automated detection of disease markers, and easier data sharing among specialists. As the healthcare system shifts towards more data-driven, efficient practice, these technologies support better decision-making, reduce diagnostic delays, and offer scalable solutions for improving outcomes across diverse clinical settings.

U.S. Anatomic Pathology Market Segmental Insights

By Product & Services Insights

How will the Consumables Segment Dominate the U.S. Anatomic Pathology Market in 2025?

In 2025, the consumable segment led the market, and the dominance is attributed to the essential role of consumables such as reagents, staining solutions, and fixatives in routine diagnostic procedures. The consistent and high volume use of these materials in tissue processing and slide preparation underscores their critical importance in pathology laboratories, thereby driving substantial demand and market growth.

The instrument segment is anticipated to witness the fastest growth in the U.S. anatomic pathology market as laboratories increasingly invest in modernizing their diagnostic infrastructure. With growing demand for rapid and high-precision analysis, there’s a shift towards advanced equipment that supports seamless integration with digital platforms. These instruments not only enhance operational productivity but also enable better data management, making them essential for meeting evolving clinical needs and the rising complexity of diagnostic procedures.

- For Instance, In January 2025, Solmedia Limited highlighted the increasing adoption of fully automatic microtomes in pathology labs globally. Once manually operated, these precision cutting tools are now offered in semi-automatic and fully automated models, enhancing efficiency and consistency in tissue sample preparation.

By Application Insights

How will the Disease Diagnosis Segment Dominate the U.S. Anatomic Pathology Market in 2025?

In 2025, the disease diagnosis segment dominated the market due to the growing demand for accurate, tissue-based evaluation in managing complex health conditions. As early detection becomes more critical in reducing disease burden, especially for cancers and organ-related disorders, clinicians rely heavily on anatomic pathology for confirmation and treatment planning. This increased reliance on precise diagnostics has made the market essential in routine clinical workflows, reinforcing its dominant market position.

The drug discovery and development segment is projected to grow rapidly in the U.S. anatomic pathology market as pharmaceutical companies increasingly depend on tissue-based research to validate therapeutic targets and monitor biological responses. Anatomic pathology plays a key role in identifying disease mechanisms and evaluating how new compounds interact with human tissues. As precision medicine and complex biologics advance, the demand for detailed pathological insights in drug development continues to rise, driving accelerated growth of the market.

By End Use Insights

How Does the Hospital Segment Dominate the U.S. Anatomic Pathology Market?

In 2025, hospitals held the largest share of the U, S anatomic pathology market, mainly due to their ability to handle large and complex diagnostic workloads. These facilities often serve as primary centers for surgeries, biopsies, and disease treatment, requiring frequent and detailed tissue evaluations. With access to advanced lab infrastructure and skilled pathologists, hospitals ensure timely and comprehensive diagnostic services, making them a central hub for pathology-based decision-making and driving their market leadership.

The diagnostic laboratories segment is expected to grow at the fastest rate in the U.S. anatomic pathology market as healthcare costs increase and efficiency improves. These labs offer specialized expertise, advanced equipment, and quicker turnaround times, making them a preferred choice for labs for high-volume testing, and the adoption of digital tools further contributes to their rapid expansion across the healthcare landscape.

- For Instance, As per the Pan American Health Organization’s 2025 report, non-communicable diseases led to 6 million deaths across the Americas in 2021, marking a significant rise of 43% compared to 4.2 million deaths recorded in 2000.

U.S. Anatomic Pathology Market Regional Insights

How is the U.S. approaching the U.S. Anatomic Pathology Market in 2025?

In 2024, the U.S. anatomic pathology market focused on integrating digital pathology and AI to enhance diagnostic precision and efficiency. Hospitals and laboratories adopted automated systems and molecular diagnostics to improve workflow and patient outcomes. The market also saw a shift towards decentralized services, with community-based labs expanding access to specialized diagnostics. These strategies, combined with investments in advanced technologies, positioned the U.S. market for sustained growth and innovation in anatomic pathology.

Top Companies in the U.S. Anatomic Pathology Market

Recent Developments in the U.S. Anatomic Pathology Market

- In May 2025, Labcorp revealed its plan to acquire specific assets from Incyte Diagnostics related to its clinical and anatomic pathology testing operations. This move aims to strengthen Labcorp’s diagnostic service offerings and expand its presence in the pathology sector.

- In March 2024, StatLab Medical Products completed the acquisition of Poly Scientific R&D, a U.S.-based company known for producing pathology stains, reagents, and tissue controls. This acquisition supports StatLab’s goal to expand its product portfolio and enhance its capabilities in pathology diagnostics.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the U.S. anatomic pathology market.

By Product & Services

-

- Microtomes & Cryostat microtomes

- Tissue processors

- Automatic strainers

- Whole Slide Imaging (WSI) Scanners

- Other products

-

- Reagents & Antibodies

- Probes & Kits

- Others

By Application

- Disease Diagnosis

- Drug Discovery and Development

- Others

By End Use

- Hospitals

- Research Laboratories

- Diagnostic Laboratories

- Others