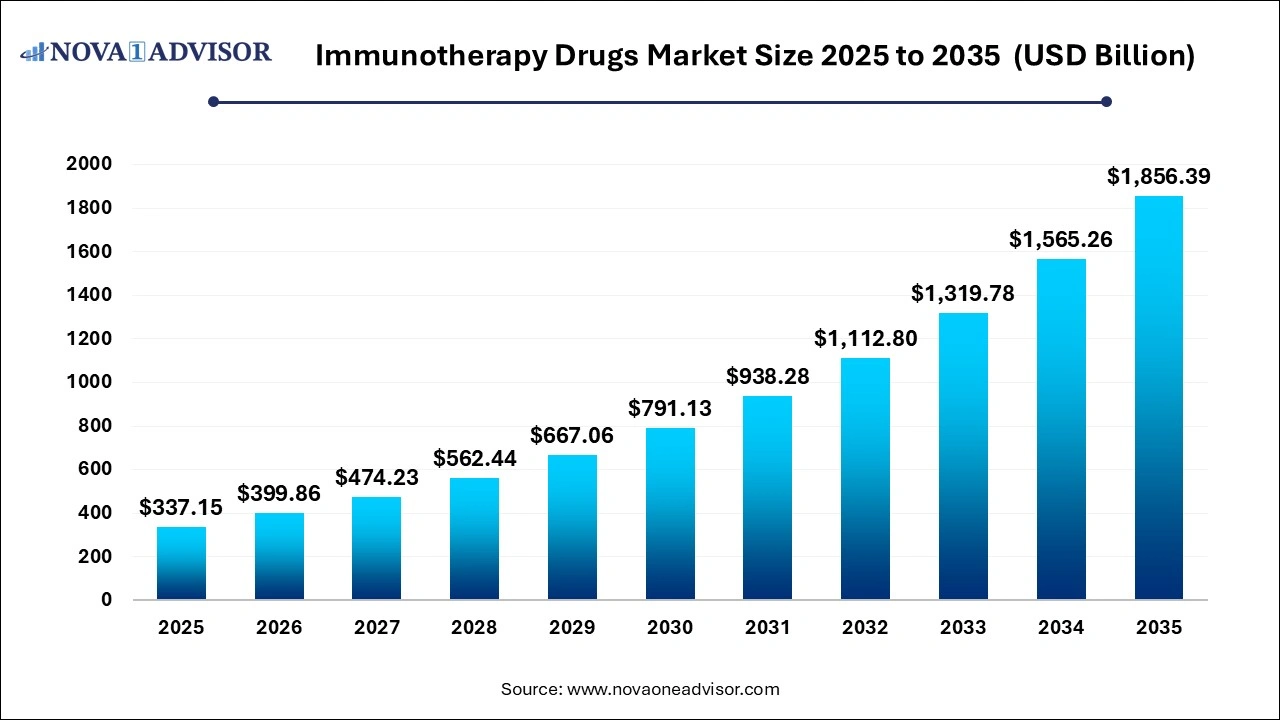

Immunotherapy Drugs Market Size and Growth 2026 to 2035

The global immunotherapy drugs market size was valued at USD 337.15 billion in 2025 and is projected to surpass around USD 1,856.39 billion by 2035, registering a CAGR of 18.4% over the forecast period of 2026 to 2035.

Immunotherapy Drugs Market Key Takeaways

- The cancer segment accounted for the largest revenue share of more than 94.10% in 2025.

- On the other hand, the autoimmune diseases segment is anticipated to register the fastest growth rate during the forecast period.

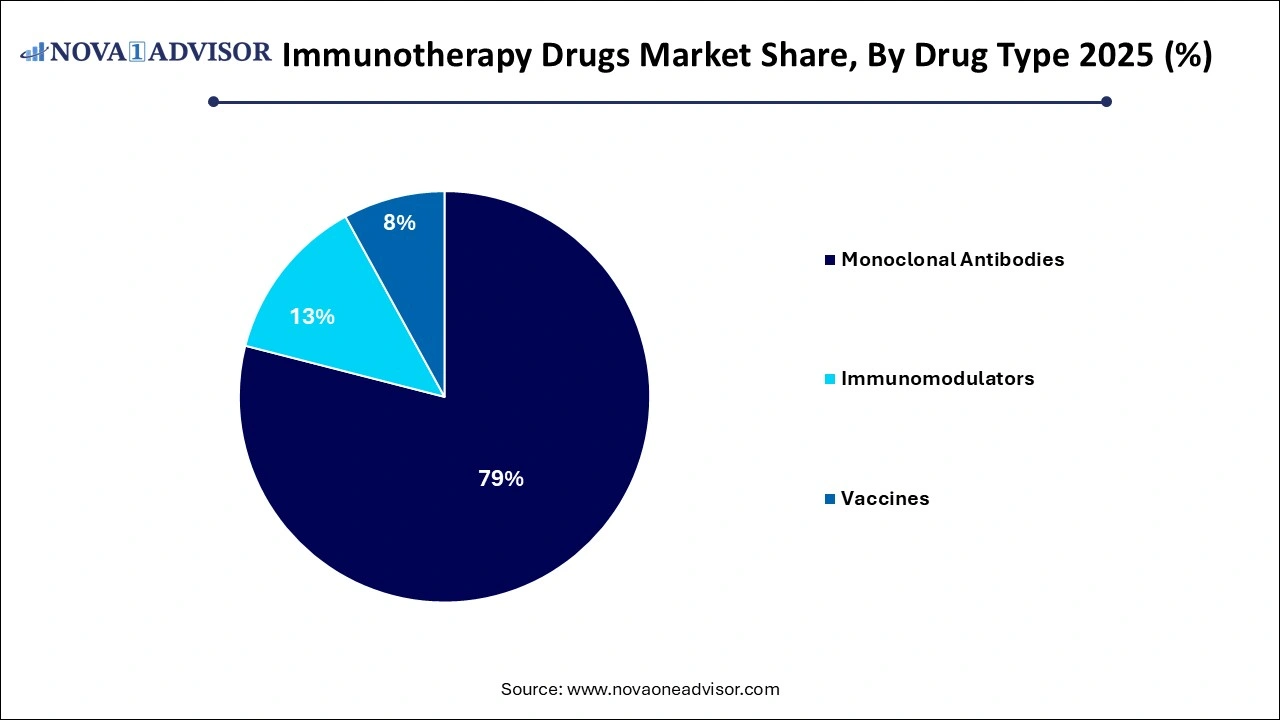

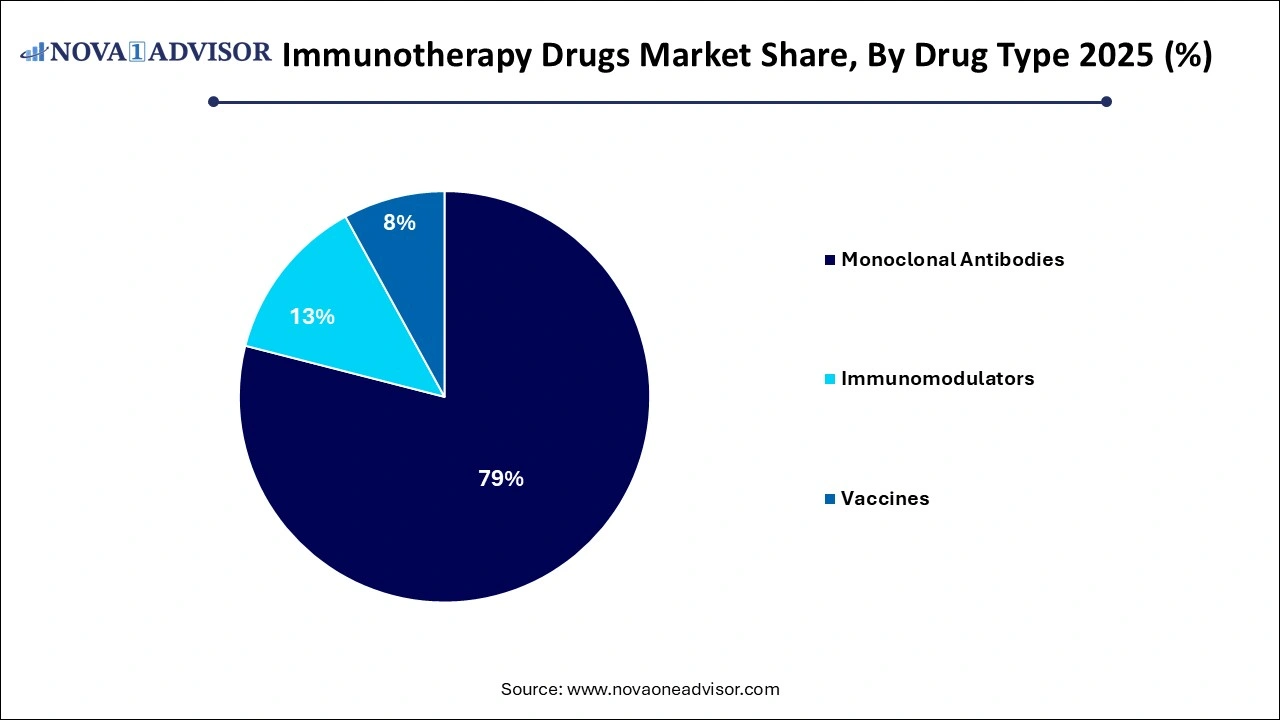

- The monoclonal antibodies segment accounted for the largest share of more than 79% in 2025.

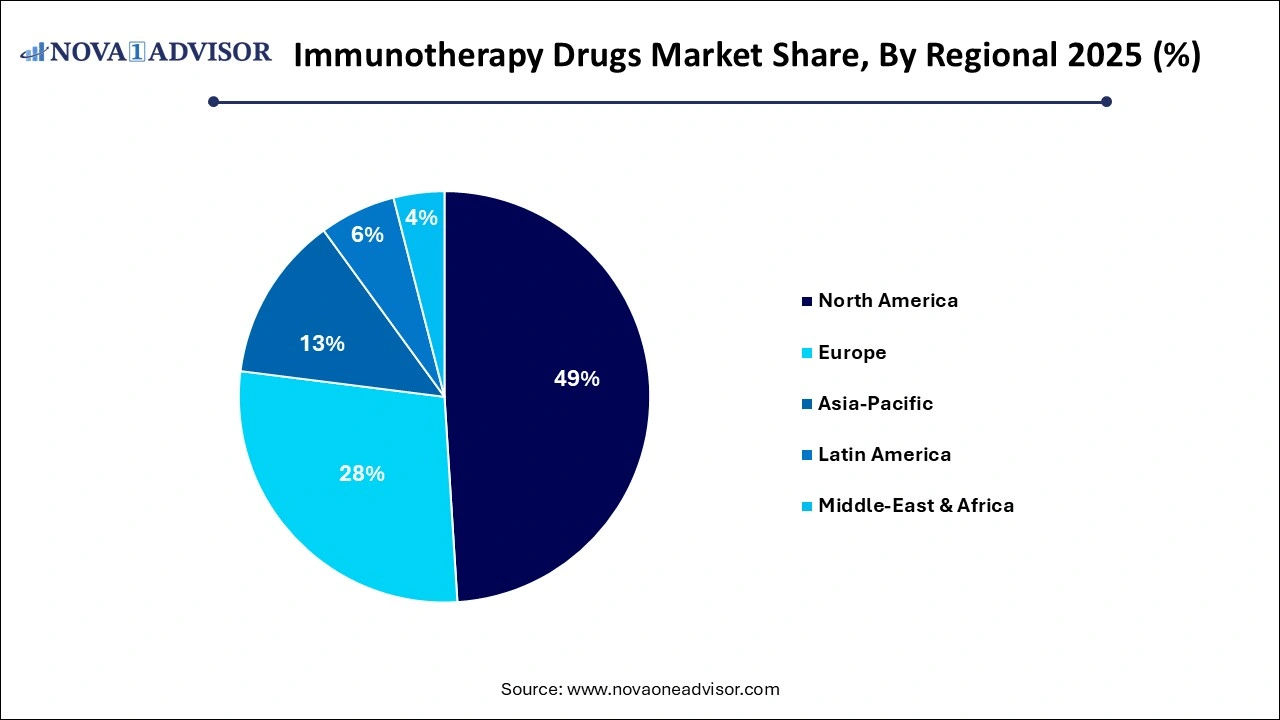

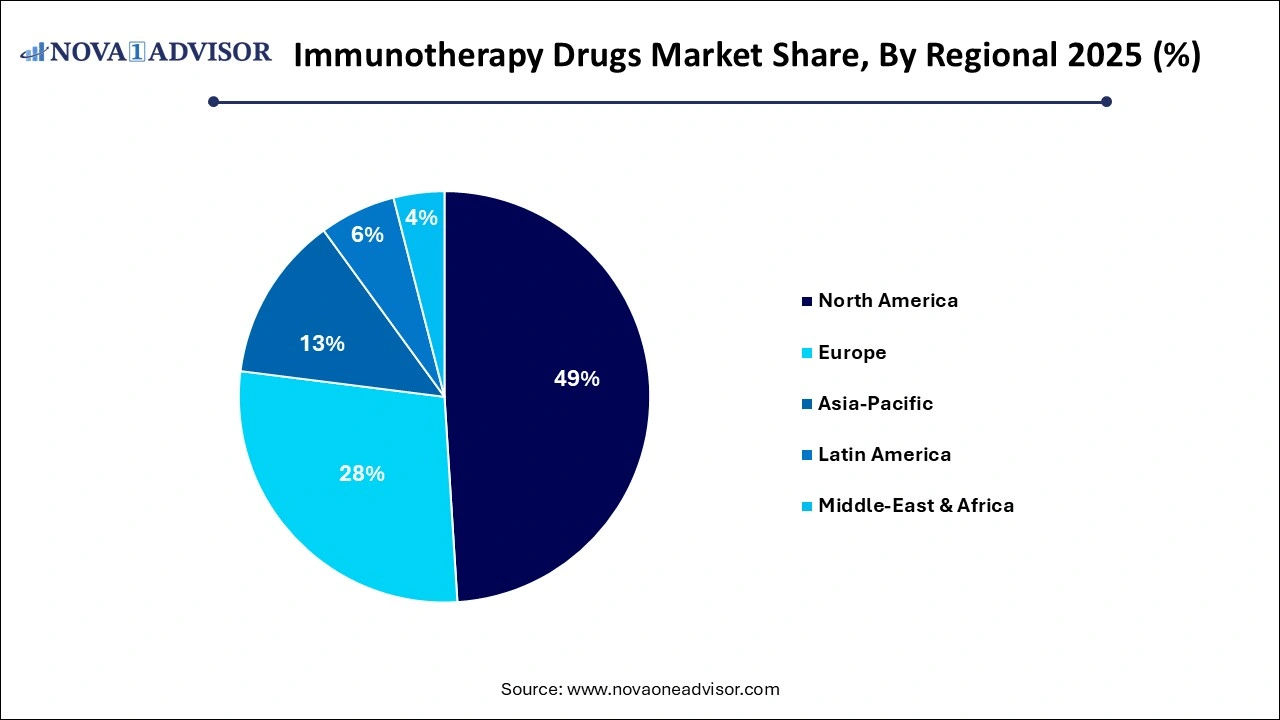

- North America dominated the global industry in 2023 and accounted for the largest share of more than 48.19% of the overall revenue.

Immunotherapy Drugs Market Overview

The Immunotherapy Drugs Market is transforming the global pharmaceutical landscape, offering a new frontier in the treatment of chronic and life-threatening diseases. Immunotherapy, which involves leveraging the body’s immune system to fight illnesses, represents a paradigm shift from conventional treatments that often target the disease directly rather than modulating the immune response. This approach has emerged as one of the most powerful tools in the battle against cancer, autoimmune conditions, and infectious diseases.

Immunotherapy drugs include monoclonal antibodies, immune checkpoint inhibitors, cancer vaccines, cytokines, and immunomodulators. These biologic agents are designed to enhance or restore immune function, suppress overactive immune systems in autoimmune diseases, or train the immune system to recognize and neutralize pathogens or cancer cells. Unlike traditional chemotherapy or antiviral agents, immunotherapeutics often deliver targeted, durable, and sometimes curative outcomes, with reduced systemic toxicity.

The field gained widespread visibility with the approval of drugs like Keytruda (Merck) and Opdivo (Bristol-Myers Squibb) for treating a range of cancers. Since then, hundreds of immunotherapy drugs have entered pipelines and clinical trial phases, covering conditions from melanoma, lung cancer, and rheumatoid arthritis to multiple sclerosis and hepatitis. The accelerated pace of regulatory approvals, expansion of companion diagnostics, and integration of personalized medicine approaches have further reinforced immunotherapy's position as a core pillar of modern therapeutics.

The market is being shaped by a combination of academic breakthroughs, growing investments by biotech and pharmaceutical companies, and strong government support for oncology and immune disease research. Furthermore, the COVID-19 pandemic highlighted the relevance of immune-based interventions, boosting interest in vaccines and immune modulators beyond oncology.

Major Trends in the Immunotherapy Drugs Market

-

Expansion of Immune Checkpoint Inhibitors: Drugs targeting PD-1, PD-L1, and CTLA-4 are expanding across multiple cancer types, including head and neck, triple-negative breast cancer, and renal cell carcinoma.

-

Combination Therapy Strategies: Immunotherapy is increasingly being combined with chemotherapy, radiotherapy, and targeted drugs to enhance therapeutic efficacy.

-

Rise of Personalized Immunotherapy: Integration of genomics and biomarkers is enabling patient-specific immunotherapy regimens.

-

Growth in CAR-T and Cell-based Therapies: Cellular immunotherapies, including CAR-T and TIL therapies, are gaining traction with several approvals and a robust clinical pipeline.

-

Focus on Autoimmune Disorders: Immunomodulators and monoclonal antibodies are being expanded into diseases like psoriasis, lupus, and ulcerative colitis.

-

Shift Toward Biosimilars and Affordable Therapeutics: With blockbuster biologics going off-patent, biosimilar immunotherapies are entering the market to improve accessibility.

-

Emergence of Neoantigen Vaccines: Personalized cancer vaccines targeting tumor-specific mutations are becoming a promising innovation frontier.

Immunotherapy Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 399.86 Billion |

| Market Size by 2035 |

USD 1,856.39 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 18.6% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Drug type, indication, region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Amgen, Inc.; Novartis AG; AbbVie, Inc.; Pfizer, Inc.; F. Hoffmann-La Roche Ltd.; Johnson & Johnson Services, Inc.; AstraZeneca; GSK; Sanofi; Bayer AG |

Market Driver: Rising Cancer Prevalence and Clinical Success of Immuno-Oncology

One of the most powerful drivers of the immunotherapy drugs market is the global surge in cancer incidence and the clinical success of immune-oncology treatments. According to the World Health Organization (WHO), cancer is responsible for nearly 10 million deaths annually, with lung, colorectal, and breast cancers being the most prevalent. As the global population ages and environmental/lifestyle risk factors rise, cancer incidence is expected to increase substantially.

Immunotherapy has emerged as a game-changer in oncology. Unlike traditional treatments, immunotherapy can provide durable remission, even in late-stage cancers. Drugs like Keytruda (pembrolizumab) have demonstrated superior survival outcomes in melanoma, non-small cell lung cancer (NSCLC), and urothelial carcinoma. These breakthroughs have not only improved patient prognosis but have also incentivized heavy investment in research and clinical trials across pharma giants and biotech startups.

Moreover, the FDA and EMA have adopted expedited approval pathways for breakthrough immunotherapies, enabling faster market entry. The availability of predictive biomarkers such as PD-L1 expression and MSI-H status further aids in identifying patients who would benefit most from immunotherapy, leading to higher adoption and precision in treatment.

Market Restraint: High Cost of Immunotherapy Drugs

Despite their efficacy, the high cost of immunotherapy drugs remains a critical barrier to broader adoption. Most monoclonal antibodies and immune checkpoint inhibitors are biologics that require complex manufacturing, quality control, and regulatory compliance. These factors drive up development and production costs, translating into premium market prices.

For instance, the average annual cost of a single immunotherapy drug like nivolumab or pembrolizumab can exceed $100,000 per patient. While insurance and national health programs in developed countries often absorb part of the cost, in low- and middle-income countries, affordability is a major challenge. Even in advanced economies, patients may experience high co-pays, leading to delayed treatment initiation or non-compliance.

Moreover, the costs associated with monitoring side effects, managing immune-related adverse events, and integrating companion diagnostics add to the overall economic burden. Health systems are increasingly pushing back on pricing, prompting debates around value-based pricing models, biosimilar integration, and outcome-based reimbursement strategies.

Market Opportunity: Advancements in Cancer Vaccines and Preventive Immunotherapies

An emerging opportunity in the immunotherapy space lies in the development of cancer vaccines and preventive immunotherapies, especially those based on tumor-specific antigens and neoantigen discovery. Unlike traditional vaccines that prevent infectious diseases, cancer vaccines are designed to stimulate the immune system to recognize and eliminate cancer cells based on their unique genetic markers.

Several investigational vaccines—such as those for prostate cancer, glioblastoma, and melanoma—are in late-stage clinical trials. The rise of neoantigen-based vaccines, tailored to the specific mutations present in a patient’s tumor, has attracted significant interest from companies like Moderna and BioNTech. These platforms leverage mRNA technology and next-generation sequencing to create truly personalized therapeutic strategies.

Additionally, the success of HPV vaccines (e.g., Gardasil) in preventing cervical cancer highlights the potential of preventive immunotherapy. As R&D advances, new vaccines for viruses like Epstein-Barr (linked to nasopharyngeal cancer) and Hepatitis B (linked to liver cancer) are expected to enter the market, opening preventive avenues alongside therapeutic ones.

Immunotherapy Drugs Market Segmental Insights

By Indication Insights

Cancer is the dominant indication in the immunotherapy drugs market. The approval of checkpoint inhibitors, CAR-T therapies, and monoclonal antibodies for a variety of cancers including lung, breast, skin, blood, and bladder cancers has driven exponential growth in this segment. Immuno oncology continues to be the top investment focus for biopharma companies, with more than 4,000 trials underway globally. As combination therapies and tumor-agnostic indications grow in popularity, this segment is expected to maintain its leading role over the next decade.

However, infectious diseases are emerging as the fastest-growing segment, especially in the wake of the COVID-19 pandemic. mRNA-based vaccines, monoclonal antibodies, and antiviral immunomodulators have shown immense potential in reducing disease severity and mortality. Recent advances include monoclonal therapies for RSV, Ebola, HIV, and COVID-19 variants, as well as novel therapeutic vaccines under development for malaria and hepatitis B. As global awareness of infectious threats rises, the role of immunotherapy in both treatment and prevention is expected to expand rapidly.

By Drug Type Insights

Monoclonal antibodies currently dominate the immunotherapy drugs market due to their broad application across cancer, autoimmune, and infectious diseases. These drugs target specific antigens on the surface of cancer or immune cells, enabling precise modulation of immune responses. Examples include rituximab for non-Hodgkin lymphoma, trastuzumab for HER2-positive breast cancer, and adalimumab for rheumatoid arthritis. Their established efficacy, wide clinical adoption, and inclusion in standard care protocols solidify their leading position in the market.

However, therapeutic vaccines represent the fastest-growing segment. Innovations in DNA, mRNA, peptide-based, and dendritic cell vaccines are enabling new treatment paradigms for both infectious diseases and cancer. The post-COVID era has proven the scalability and efficacy of mRNA platforms, leading companies to expand into oncology and chronic infections. Personalized cancer vaccines, in particular, are gaining attention due to their ability to train the immune system to recognize tumor-specific mutations, reducing off-target effects and improving long-term disease control.

Immunotherapy Drugs Market By Regional Insights

North America holds the largest share of the global immunotherapy drugs market, primarily due to the United States’ dominance in biotech innovation, R&D funding, and regulatory acceleration. The FDA’s priority review and breakthrough therapy designations have enabled rapid commercialization of novel immunotherapies. Major players like Merck & Co., Bristol-Myers Squibb, AbbVie, and Pfizer operate extensive pipelines and manufacturing capabilities in the region.

Furthermore, a favorable reimbursement environment, robust clinical trial infrastructure, and high healthcare spending support market penetration. The U.S. is also a leader in biomarker-based diagnostics, which enhance the precision and success rate of immunotherapy. Academic institutions, like MD Anderson and Dana-Farber, contribute significantly to translational research and trial design, further reinforcing regional leadership.

Asia-Pacific is the fastest-growing region in the immunotherapy market, driven by expanding healthcare access, increasing cancer incidence, and government initiatives supporting biotech innovation. Countries like China, Japan, South Korea, and India are making substantial investments in clinical trials, manufacturing, and biosimilar development. China, in particular, has seen a rise in domestic immunotherapy developers and the launch of PD-1 inhibitors like camrelizumab and toripalimab.

Japan’s aging population and preference for cutting-edge therapies, combined with fast-track approval pathways from the PMDA, make it an attractive market. Meanwhile, India is emerging as a hub for cost-effective clinical trials and biosimilar production, contributing to global supply chains. As infrastructure and affordability improve, immunotherapy is poised to become a central pillar of cancer and chronic disease treatment in this region.

Immunotherapy Drugs Market Top Key Companies:

Recent Developments

-

March 2025: Moderna announced early clinical success for its personalized cancer vaccine (mRNA-4157) in combination with Keytruda, showing reduced recurrence in melanoma patients.

-

January 2025: Bristol-Myers Squibb received FDA approval for Opdivo as adjuvant treatment in early-stage bladder cancer, expanding its label.

-

November 2024: AstraZeneca launched a new IL-33 monoclonal antibody for severe asthma under its biologics pipeline, reinforcing its autoimmune disease strategy.

-

September 2024: BioNTech and Regeneron entered a collaboration to co-develop next-gen bispecific antibodies targeting solid tumors.

-

July 2024: Merck & Co. signed a $3 billion partnership with Daiichi Sankyo to co-develop antibody-drug conjugates for HER2-positive breast cancer.

Immunotherapy Drugs Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Immunotherapy Drugs market.

By Drug Type

- Monoclonal Antibodies

- Immunomodulators

- Vaccines

By Indication

- Cancer

- Autoimmune Diseases

- Infectious Diseases

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)