U.S. Tissue Diagnostics Market Size, Share, Growth, Report 2026 to 2035

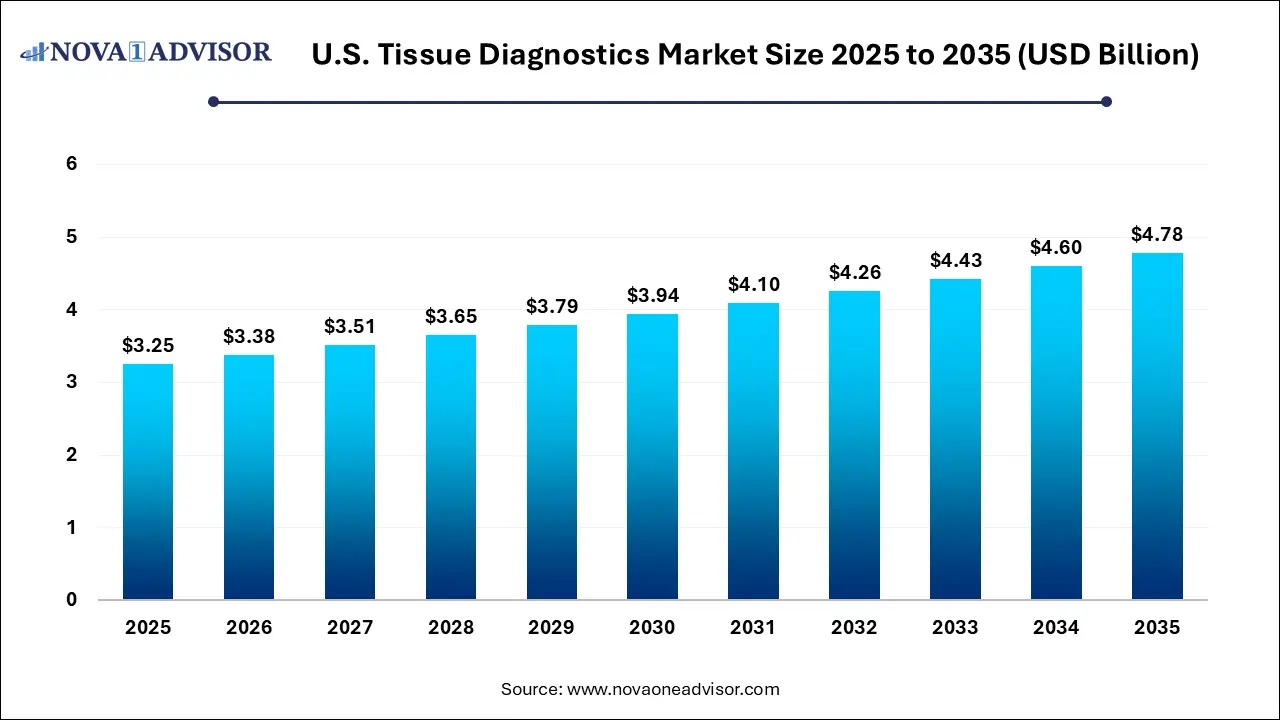

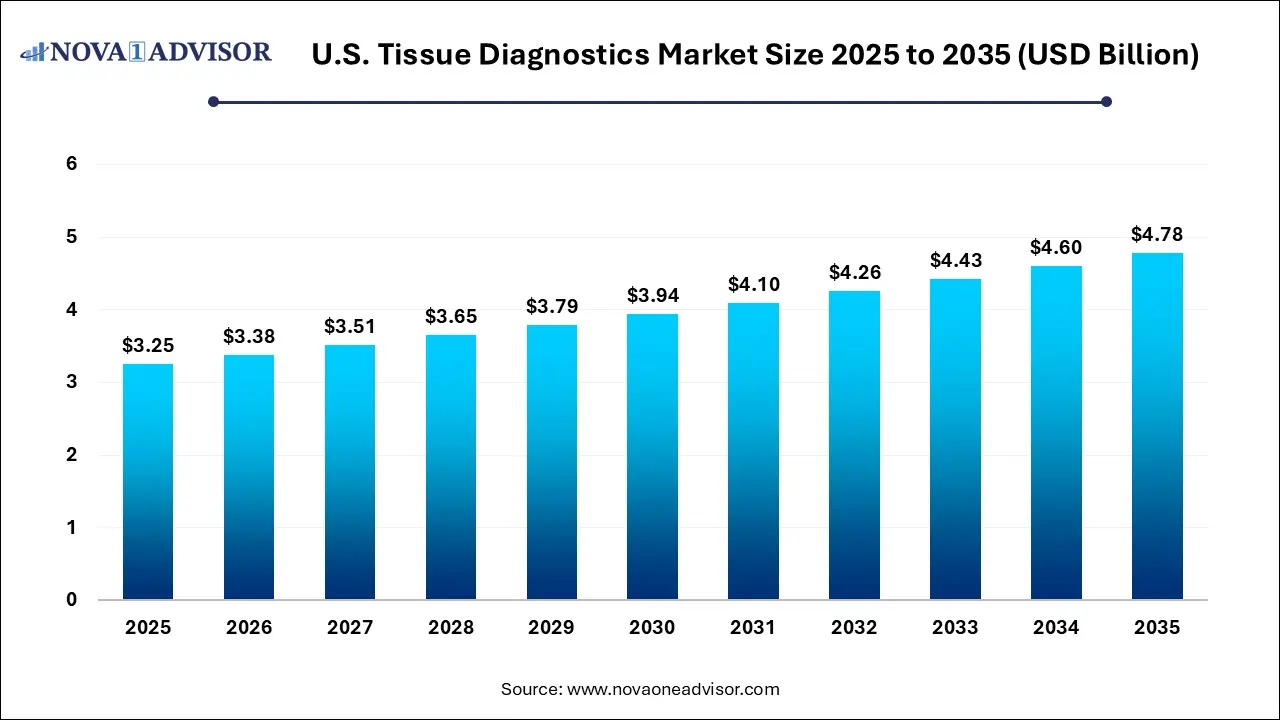

The U.S. tissue diagnostics market size was valued at USD 3.25 billion in 2025 and is projected to surpass around USD 4.78 billion by 2035, registering a CAGR of 3.94% over the forecast period of 2026 to 2035.

Key Takeaways:

- The Immunohistochemistry (IHC) segment dominated the market in 2025 accounting for a revenue share of 35.02%.

- The breast cancer application segment accounted for the highest revenue share of over 56.0% in 2025.

- The gastric cancer application segment is expected to grow at a CAGR of 4.03% from 2026 to 2035.

Market Overview

The U.S. tissue diagnostics market is a pivotal segment within the broader pathology and diagnostic landscape, driving advancements in early disease detection and therapeutic decision-making, particularly in oncology. With a focus on the molecular and cellular analysis of tissues, this market is at the forefront of personalized medicine and targeted therapies. Tissue diagnostics enable pathologists and clinicians to gain detailed insights into disease morphology, biomarker expression, and genetic alterations, facilitating accurate diagnosis and tailored treatments. The U.S., being a hub of healthcare innovation and home to some of the world's leading research institutions and biotechnology firms, continues to witness exponential advancements in tissue diagnostics technologies.

The market has experienced significant growth due to the rising burden of cancer, which remains the second leading cause of death in the U.S. Additionally, the increasing adoption of advanced diagnostics such as digital pathology and image analysis software, along with automation in histopathology laboratories, has propelled the adoption of sophisticated tissue diagnostic solutions. The U.S. Food and Drug Administration (FDA) continues to play a pivotal role by approving innovative companion diagnostics, further integrating tissue diagnostics into clinical decision-making.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI) in Digital Pathology: AI-powered image analysis tools are being increasingly used for automating routine tasks and improving diagnostic accuracy.

-

Rising Adoption of Companion Diagnostics: As precision medicine gains traction, there is growing integration of tissue diagnostics with targeted therapies.

-

Shift Towards Minimally Invasive Biopsy Techniques: Techniques such as fine needle aspiration and core needle biopsies are reducing patient discomfort and enhancing diagnostic yield.

-

Automation and Workflow Optimization in Laboratories: Automated slide scanners, staining systems, and data management tools are improving efficiency and consistency.

-

Expansion of Personalized Medicine: Molecular markers and immunohistochemistry (IHC) techniques are being increasingly used to identify patient-specific therapeutic responses.

-

Investment in Telepathology: Remote diagnostics and consultations are expanding access to specialized pathology expertise, particularly in underserved areas.

U.S. Tissue Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 3.38 Billion |

| Market Size by 2035 |

USD 4.78 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 3.94% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Technology & Product, Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Merck KGaA; Thermo Fisher Scientific, Inc; F. Hoffmann-La Roche Ltd; Abbott Laboratories; Siemens Healthineers AG; Danaher; bioMérieux SA; QIAGEN; Becton, Dickinson & Company (BD); Agilent Technologies, Inc.; General Electric Company (GE Healthcare); BioGenex; Cell Signaling Technology, Inc.; Bio SB; DiaGenic ASA; Sakura Finetek Japan CO., LTD; Abcam plc; Enzo Life Sciences, Inc.; VITRO SA (Master Diagnóstica); TissueGnostics GmbH |

Key Market Driver: Rising Cancer Incidence and the Need for Precision Diagnostics

One of the primary drivers of the U.S. tissue diagnostics market is the escalating incidence of cancer. According to the American Cancer Society, in 2024 alone, approximately 2 million new cancer cases are expected to be diagnosed in the United States. This alarming statistic underscores the urgent need for efficient, reliable, and advanced diagnostic solutions that can identify malignancies at an early stage. Tissue diagnostics play an indispensable role in histopathological confirmation, tumor grading, and staging. Moreover, innovations such as multiplex IHC and in situ hybridization are allowing for a comprehensive understanding of tumor biology, paving the way for precision oncology.

The increased utilization of tissue diagnostics in companion diagnostics has revolutionized how oncologists approach treatment planning. For instance, HER2 testing via IHC in breast cancer patients helps determine eligibility for trastuzumab therapy. Similarly, PD-L1 expression analysis is critical in immunotherapy eligibility for patients with NSCLC. These applications exemplify how tissue diagnostics are not only supporting disease detection but also enhancing therapeutic efficacy.

Market Restraint: High Cost of Advanced Diagnostic Equipment and Technologies

Despite the promising growth trajectory, the high cost associated with advanced tissue diagnostic tools and solutions poses a significant challenge. Instruments such as digital whole slide scanners, automated immunostainers, and image analysis software require substantial capital investment, making it difficult for smaller pathology labs and rural healthcare facilities to adopt these technologies. Furthermore, the recurring costs of reagents, antibodies, and maintenance add to the financial burden.

Additionally, the training requirements for operating sophisticated equipment and interpreting digital pathology outputs demand specialized skills and ongoing education. This skill gap often hampers the smooth transition from conventional microscopy to digital workflows. The combination of financial and operational constraints limits the widespread adoption of cutting-edge tissue diagnostics technologies, particularly in community hospitals and independent diagnostic labs.

Market Opportunity: Technological Advancements in Digital Pathology and AI Integration

The ongoing technological evolution in digital pathology presents a significant opportunity for the U.S. tissue diagnostics market. The convergence of high-resolution whole-slide imaging, cloud computing, and artificial intelligence has transformed traditional pathology workflows. AI algorithms can now identify and quantify biomarkers, detect tumor margins, and even predict disease outcomes with remarkable accuracy.

These advancements are particularly valuable in managing the rising volume of diagnostic cases, reducing turnaround times, and minimizing human error. Companies like Paige, PathAI, and Roche Diagnostics are at the forefront of this digital transformation, offering AI-powered pathology solutions that enhance diagnostic precision. As regulatory bodies begin to endorse AI-based tools, the opportunity to expand access and standardize pathology practices nationwide is expected to significantly contribute to market growth.

U.S. Tissue Diagnostics Market By Technology & Product Insights

Immunohistochemistry (IHC) dominated the technology & product segment due to its extensive application in cancer diagnosis and biomarker analysis. The IHC segment is bifurcated into instruments and consumables. Among instruments, slide staining systems and slide scanners are particularly favored for their role in automating routine processes and facilitating remote diagnostics. Slide scanners, when integrated with digital pathology software, allow pathologists to view high-resolution images from any location. Meanwhile, in the consumables sub-segment, antibodies and kits lead the market as they are crucial for antigen detection in tissues. For instance, monoclonal antibodies used in IHC help identify HER2 expression in breast cancer tissues, aiding in precise therapy selection.

Digital Pathology & Workflow is the fastest growing segment, driven by the increasing integration of AI and image analysis informatics. Sub-segments like whole slide imaging and image analysis informatics are seeing rapid adoption in research and clinical settings. These technologies enable seamless collaboration among pathologists, especially during multidisciplinary team meetings (MDTs). Additionally, the shift from analog to digital workflows reduces storage space requirements and enhances diagnostic turnaround times. As healthcare systems modernize, the demand for robust information management systems for data storage and communication is expected to surge.

U.S. Tissue Diagnostics Market By Application Insights

Breast cancer was the leading application segment within the U.S. tissue diagnostics market due to its high prevalence and established screening guidelines. Tissue diagnostics, especially IHC and in situ hybridization (ISH), are pivotal in detecting estrogen receptor (ER), progesterone receptor (PR), and HER2 status. These biomarkers guide hormone therapy and targeted therapy decisions. Technologies like chromogenic in situ hybridization (CISH) are gaining popularity for HER2 testing as they offer better visual interpretation under a standard microscope. Additionally, high awareness and routine mammography screening contribute to a consistent demand for tissue diagnostic solutions in breast cancer care.

Non-Small Cell Lung Cancer (NSCLC) is the fastest growing application segment, attributed to the increasing adoption of molecular diagnostics and companion testing. Tissue diagnostics play a crucial role in identifying actionable mutations like EGFR, ALK, and ROS1, which inform targeted therapy decisions. Immunohistochemistry is also extensively used to assess PD-L1 expression, which determines eligibility for immunotherapy drugs such as pembrolizumab. The dynamic therapeutic landscape of NSCLC, coupled with the rise of biopsy and re-biopsy procedures, has propelled the need for accurate tissue-based diagnostics in this segment.

Country-Level Analysis: United States

The United States continues to lead the global tissue diagnostics market due to its sophisticated healthcare infrastructure, high R&D investment, and early adoption of innovative technologies. Major academic medical centers, cancer institutes, and pathology laboratories are leveraging cutting-edge diagnostics to improve patient outcomes. The presence of a favorable reimbursement framework for diagnostic tests, especially in oncology, has significantly contributed to market penetration.

Additionally, federal initiatives such as the Cancer Moonshot and funding from agencies like the National Cancer Institute (NCI) are fostering innovation in tissue-based research. The rise in hospital consolidation and the establishment of centralized pathology labs have further boosted the demand for automated and scalable diagnostic platforms. The U.S. is also home to leading tissue diagnostics firms and start-ups, creating a competitive ecosystem that continuously pushes technological boundaries.

U.S. Tissue Diagnostics Market Top Key Companies:

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Siemens Healthineers AG

- Danaher

- bioMérieux SA

- QIAGEN

- Becton, Dickinson & Company (BD)

- Agilent Technologies, Inc.

- General Electric Company (GE Healthcare)

- BioGenex

- Cell Signaling Technology, Inc.

- Bio SB

- DiaGenic ASA

- Sakura Finetek Japan Co., Ltd.

- Abcam plc

- Enzo Life Sciences, Inc.

- VITRO SA (Master Diagnóstica)

- TissueGnostics GmbH

Recent Developments

-

February 2025: Roche announced the FDA approval of its VENTANA MMR RxDx Panel, a companion diagnostic test for identifying patients eligible for anti-PD-1 therapies in endometrial cancer, showcasing the growing relevance of tissue diagnostics in immunotherapy.

-

January 2025: Agilent Technologies partnered with Akoya Biosciences to integrate multiplex immunofluorescence platforms with pathology workflows, aiming to provide spatial biomarker insights for translational research.

-

November 2024: Danaher Corporation’s Leica Biosystems unveiled a next-generation slide staining system with AI-enabled quality control features to enhance reproducibility in pathology labs.

-

October 2024: Philips Digital Pathology Solutions announced its collaboration with Mayo Clinic to scale AI-based diagnostic interpretation across multiple departments, indicating the shift toward digital and AI-assisted tissue diagnostics.

-

September 2024: Thermo Fisher Scientific launched a new range of chromogenic ISH probes designed for improved sensitivity and faster turnaround times in clinical diagnostics.

U.S. Tissue Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the U.S. Tissue Diagnostics market.

By Technology & Product

- Immunohistochemistry

- Instruments

- Slide Staining Systems

- Tissue Microarrays

- Tissue Processing Systems

- Slide Scanners

- Other Products

- Consumables

- Reagents

- Antibodies

- Kits

- In situ Hybridization

- Instruments

- Consumables

- Software

- Primary & Special Staining

- H&E Staining

- Special Staining

- Digital Pathology & Workflow

- Whole Slide Imaging

- Image Analysis Informatics

- Information Management System Storage & Communication

- Anatomic Pathology

- Instruments

- Microtomes & Cryostat Microtomes

- Tissue Processors

- Automatic Strainers

- Other Products

- Consumables

- Reagents & Antibodies

- Probes & Kits

- Others

By Application

- Breast Cancer

- Non-Small Cell Lung Cancer (NSCLC)

- Prostate Cancer

- Gastric Cancer

- Other Cancers